Disclaimer:

With 11+ years of experience & expertise in the real estate industry, Homebazaar provides end-to-end property-buying solutions. Hundreds of 100% verified RERA-registered residential & commercial properties are listed on our website. We provide facilities like Zero brokerage, 360° virtual street view, effortless site visit services, end-to-end property buying agreements & documentation guidance, and low-interest home loan assistance. This helped us gain the trust of 55,000+ clients across India & sold 6,500+ homes of top reputed developers.

Page Contents

- Meaning Of Mutation Of Property

- Is A Mutation Of Property Necessary?

- Mutation Certificate Of Property

- Application For Mutation Of Property

- How To Apply For Mutation Of Property Online

- When To Do A Mutation Of Property?

- Difference Between Property Mutation And Property Registration

- What Happens If A Mutation Of Property Is Not Done?

- Affidavit For Mutation Of Property

- FAQs

Meaning Of Mutation Of Property

The mutation of property is a process through which the old owner can include the name of another owner in the revenue records.

The mutation of property is a process through which the old owner can include the name of another owner in the revenue records.

This is done for an existing property that is maintained at the local level by the State government.

However, this does not transfer the title of the ownership from the old owner to the new one.

It only makes any individual eligible to pay revenue or property tax.

The mutation of property helps the local authority of the state to levy property tax on the owner and charge accordingly.

Different states have assigned different names for the mutation of Property. For eg: in Bihar, this process is known as Dakhil Khariz.

The individual whose name is recorded in the revenue or municipal records will be liable to pay the property taxes, etc.

Note:

Homebazaar serves homebuyers searching for flats in India with end-to-end services like site visits, and lower-interest home loans to property registration guidance. We provide the best price options & offers for 1 to 4 BHK RERA-registered flats, villas & penthouse properties in India. To begin a smooth homebuying journey with us, fill out the form mentioned below or on the right side.

Is A Mutation Of Property Necessary?

The Mutation of property is necessary because it updates the ownership rights in the government registers.

The Mutation of property is necessary because it updates the ownership rights in the government registers.

Therefore, the property owner gets legal ownership of the property.

Moreover, the mutation certificate can further be produced as legal proof for property-related disputes.

The mutation of property can be used as a legal document along with other relevant documents to decide the ownership of the property.

Mutation of property is important because the new owner requires a mutation certificate to apply for a water or electricity connection.

The municipal authority can assess the individual as the new owner in the revenue records. The person whose name is recorded in the list is only eligible to pay revenue tax on the property. For title transfer, the Supreme Court has confirmed to proceed with separate legal action.

Property mutation is only required as it guarantees that every record which is relevant to the property is available and updated with the local authorities.

There are two kinds of mutation of the property done mutation of agricultural land and mutation of non-agriculture land.

The mutation is important for agricultural land as it transfers the title. If government acquires the agricultural land then the compensation will be paid to the land owner.

For non-agriculture land, the mutation is important only for payment of electricity bills, water connections, and property tax.

Importance Of Property Mutation For A Buyer

The buyers need to get the property mutation done because it of the following:

- The local authorities/ Government check the name in the revenue records to analyze the actual owner who will pay the property taxes and is eligible for compensation

- The mutation process helps the buyer to ensure that the property does not have any hindrance

- Property mutation helps in the future sale of property

- Property mutation helps buyers to prevent any act of fraudulence by the seller

- Property mutation shows the possession of the property

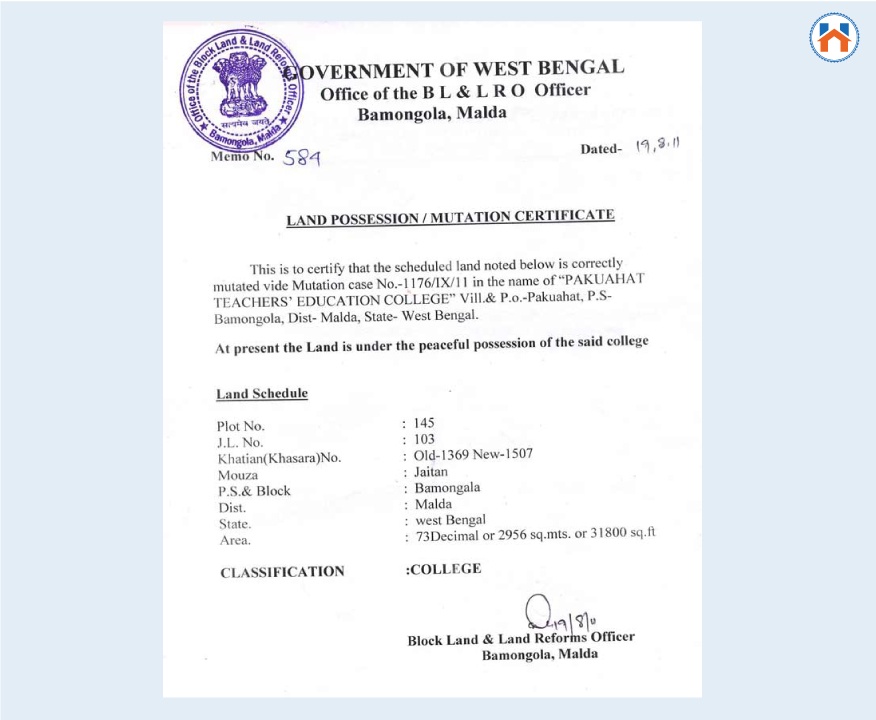

Mutation Certificate Of Property

The Supreme Court has stated that the individual whose name is listed in the mutation of the property will not hold the ownership or title of the property. The transfer of ownership requires different legal proceedings and actions.

The mutation of the property will act as one of the supportive documents while proceeding with the legal action of transfer of ownership. Property mutation is just an acknowledgment for the title along with other legal title documents.

Format Of Mutation Certificate

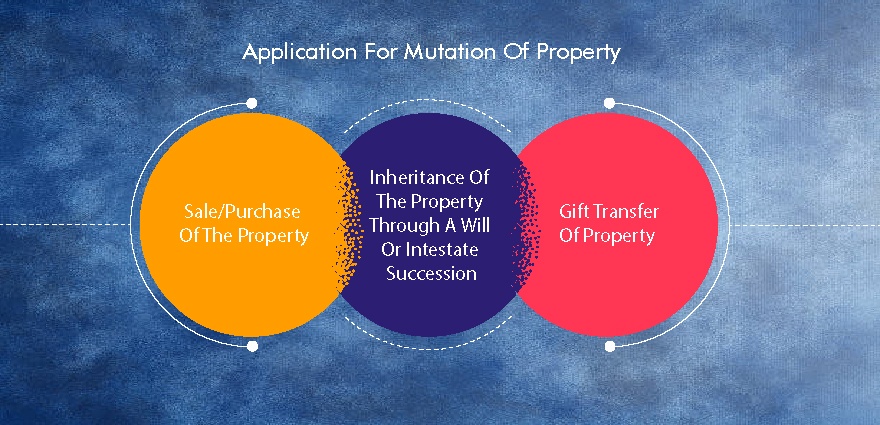

Application For Mutation Of Property

Property mutation process to substitute the existing property owner with another new owner to list their name in the revenue department.

The application of property mutation is necessary whenever there is:

- Sale/Purchase of the property

- Inheritance of the property through a will or intestate succession

- Gift transfer of property

During the application process, the individual will have to pay the court fee stamp affixed to the document. The fee and requirement of documentation will be different for different states.

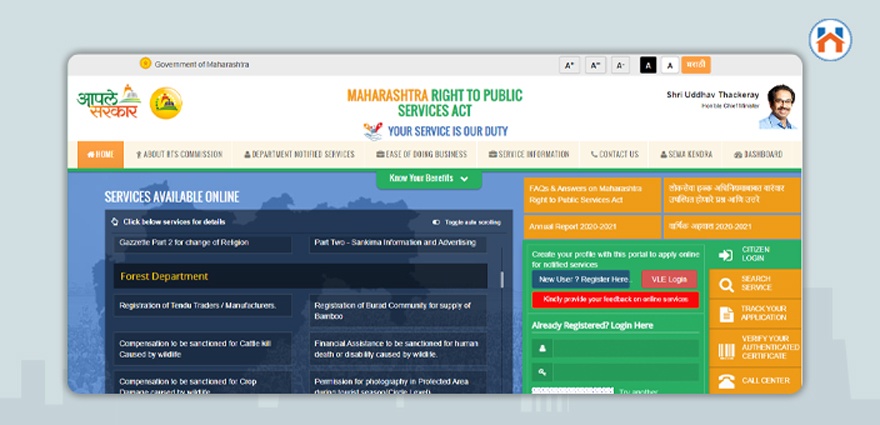

How To Apply For Mutation Of Property Online

The property mutation process will be governed by the municipal authority of the district. The state governments have introduced an online mutation process for the citizens.

However, in some states, it is done offline by visiting the concerned municipal authority.

The individual has to visit the official website of the state government and proceed with the application. You have to fill in all the relevant details.

It is ensured that the application process of property mutation is free of any data manipulation and corruption.

After submitting all the required documents, the new owner will be provided with a mutation certificate within 15-30 days.

For eg: If you want Mutation Entry (un-disputed) then you can follow the below steps:

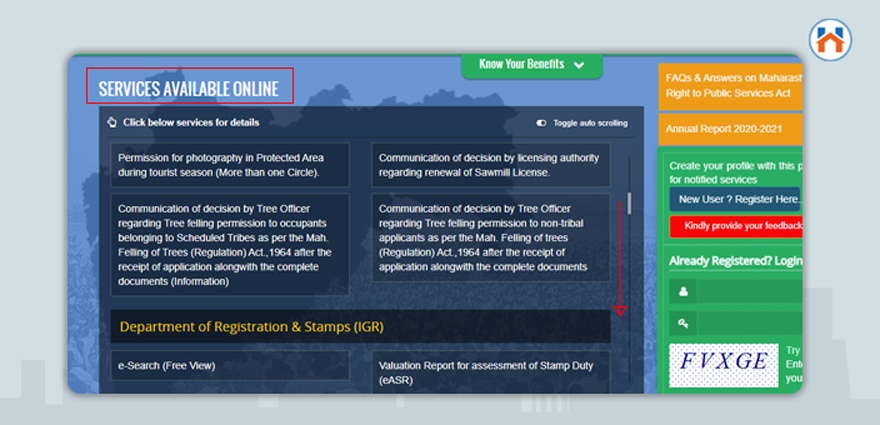

Step 1: Visit the official website of the Maharashtra Right to Public Service Act @aaplesarkar.mahaonline.gov.in

Step 2: Scroll down the ‘Services Available Online’ Section

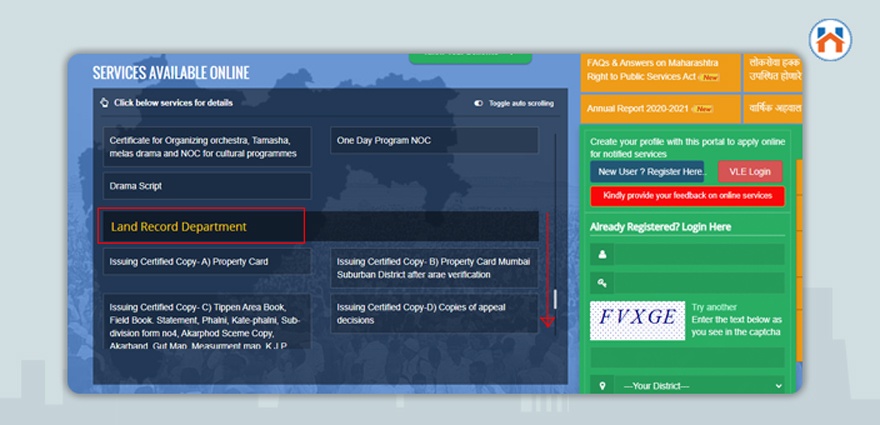

Step 3: Look for ‘Mutation Entry A) Mutation Entry (un-disputed)’ under the Land Record Department

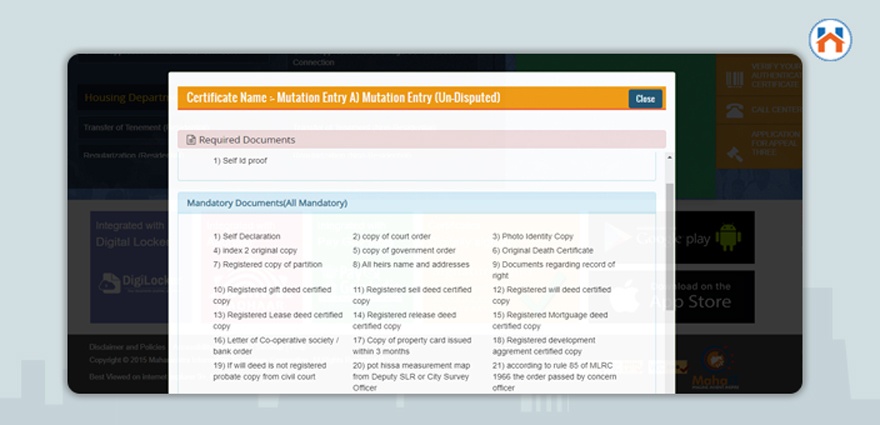

Step 4: This will redirect you to a new page where the list of required documents will be provided

Step 5: Click on the apply button to apply for the same

Step 6: Provide relevant documents and details like district, village, and other details. Click on Submit

Documents Required For Mutation Of Property

Documents Required For Mutation Of Property

During the process of property mutation, different documents are required to support the details provided.

- ID Card

- Copy of will (if applicable)

- Copy of sale/gift/exchange/partition deed/transfer

- Copy of succession certificate (if applicable)

- Copy of PoA (Power of Attorney) (if applicable)

- Updated property tax payment receipt

- No objection certificate from the society

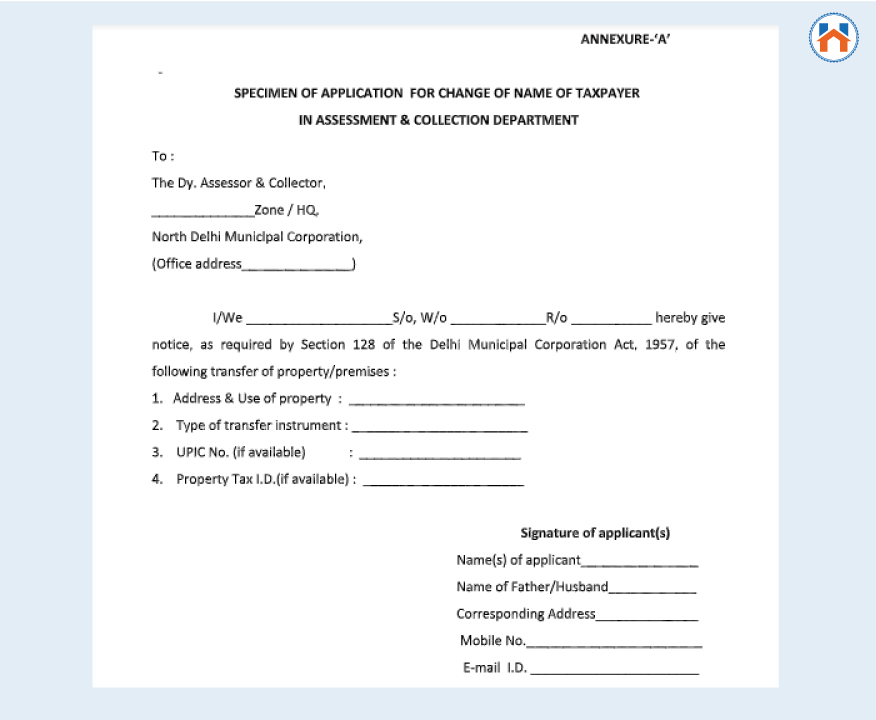

- Rs 3 court stamp fee affixed with the application for change of name.

- Submit indemnity bond on stamp paper which will explain that if there is any legal dispute after the property mutation is done, then the owner will indemnify the Municipal Corporation. It is important to record the bond on Rs 100 stamp paper which is attested by the notary.

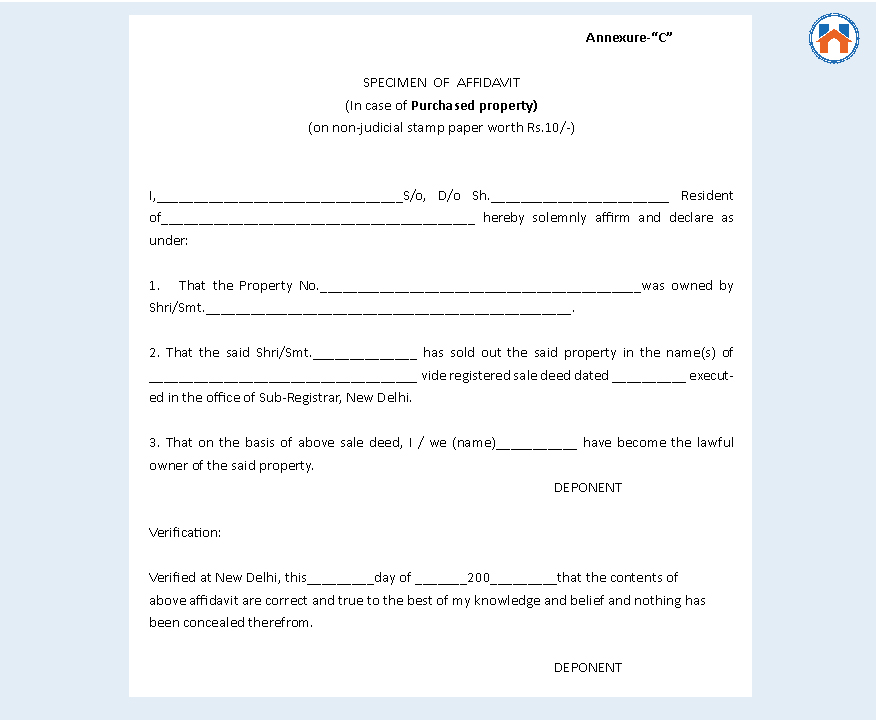

- Affidavit document mentioning the names of all the previous owners of the property and also the new owners in question on Rs 10 stamp paper. This must be attested by the notary.

When To Do A Mutation Of Property?

The buyers are suggested to do mutation of the property as soon as the sale transaction is complete. The process will include self-attesting all the relevant documents.

The property mutation certificate should ideally be obtained every six months to ensure that there are no fraudulent transactions or mortgages on the property.

Difference Between Property Mutation And Property Registration

Even if the meaning of property mutation and property registration seem similar, there are still some changes which are explained in the below table for better understanding.

| Property Mutation | Property Registration | |

| Meaning | Property mutation is the process through which the change of the owner’s name is done in the records of the municipal corporation | Property registration is the process of transferring the ownership of the property from one person to another |

| Importance | The property mutation is important as it allows to change the name in government records so that they are liable for property tax, electricity bill, water bill and etc | The property registration is important to transfer the ownership of the property from the seller to the buyer with both the parties agreement |

| Execution | The property mutation is done only after the property registration is complete | The property registration can be done only after execution of sale deed |

| Documents Required | ID Card

Copy of will (if applicable) Copy of sale/gift/exchange/partition deed/transfer Copy of succession certificate (if applicable) Copy of PoA (Power of Attorney) (if applicable) Updated property tax payment receipt No objection certificate from the society Rs 3 court stamp fee affixed with the application for change of name Indemnity Bond Affidavit document mentioning the names of all the previous owners of the property and also the new owners in question on Rs 10 stamp paper. This must be attested by the notary. |

Copy of Municipal tax bill

Construction completion certificate Recorded agreement between the builder and original purchaser of the building initially Aadhar Card Passprot size photo of both the parties Copy of updated property register card Verified copy of original ols sale deed No objection certificate copy under the Land Ceiling Act |

What Happens If A Mutation Of Property Is Not Done?

Property registration and stamp duty payment are completed only after the property mutation is done. It is however noted that many times the buyers only go for property the register and neglect property mutation.

The penalty for not doing property mutation has encouraged buyers to complete the process of mutation. If the property mutation is not done then it would become tough to sell the property in the future or provide any supportive document while transferring the ownership.

If the property mutation is not accepted in the first request, then the person can reapply for the same within 30 days of rejection.

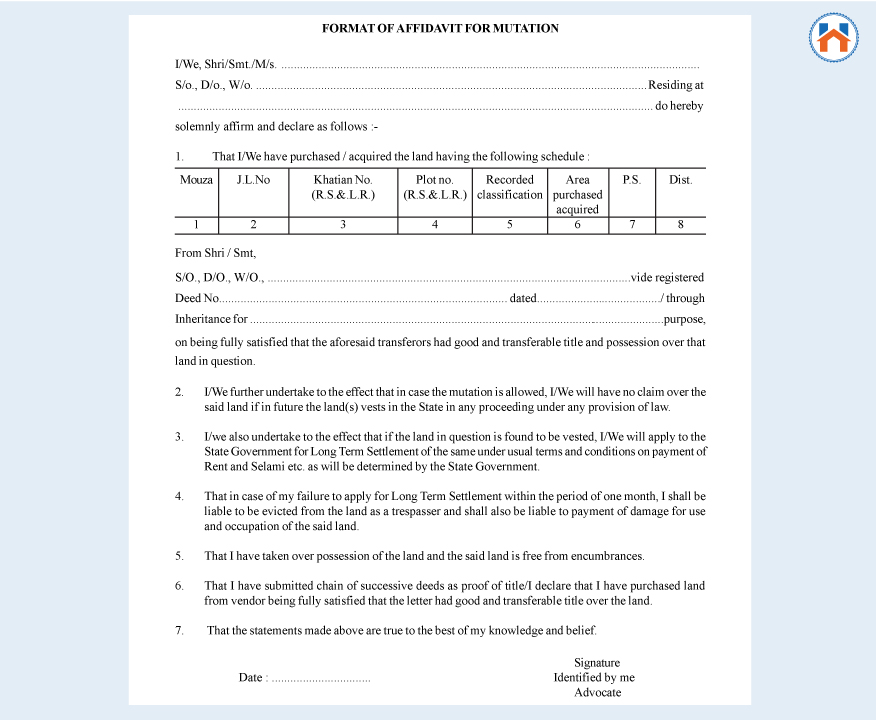

Affidavit For Mutation Of Property

The affidavit for mutation of property includes the process of mutating the name of the current owner into the records of the government.

The person will have to sign the mutation of property along with the details of the proof. The person will have to agree with the arrears and documents which should be paid by him.

Format Of Mutation Of Property

Indemnity Bond For Mutation Of Property

Indemnity Bond For Mutation Of Property

An indemnity bond is required for the process of property mutation because it states that the executant will pay the Municipal Corporation if any dispute arrives from the mutation.

The indemnification bond will be valid only when the application was done by the owner. It is critical to register the bond on Rs 100 stamp paper that has been attested by a notary.

Format Of Indemnity Bond

Here is the link for format of Indemnity Bond

FAQs

| Q1: Can the mutation of property be completed online?

Ans: Yes, some states have made it easier to complete the mutation of property online. |

| Q2: What are the benefits of property mutation?

Ans: The local authorities can easily levy property tax on the person whose name is recorded in the property mutation. It becomes easier to sell the property. |

| Q3: When should I apply for a land mutation?

Ans: It is ideal to apply for land mutation during the time of its purchase. If the property mutation is not done then the owner will not be able to sell the property. |

| Q4: How many types of land mutations are there?

Ans: There are two types of land mutations which are agricultural land mutation and non-agricultural land mutation. |