Disclaimer:

With 11+ years of experience & expertise in the real estate industry, Homebazaar provides end-to-end property-buying solutions. Hundreds of 100% verified RERA-registered residential & commercial properties are listed on our website. We provide facilities like Zero brokerage, 360° virtual street view, quick site visit services, end-to-end property buying agreements & documentation guidance and low-interest home loan assistance. This helped us gain the trust of 55,000+ clients across India & sold 6,500+ homes of top reputed developers.

Page Contents

PF Withdrawal For Home Purchase

A salaried person can withdraw the provident fund amount for paying the down payment of a home purchase.

It is a dream of all to have their own house, and PF withdrawal can help you finance this dream. It acts as an additional avenue for funding your home purchase decision.

You can withdraw up to 90% of the closing balance in your PF account. You can avail of this amount only once in a lifetime.

Withdrawal eligibility

As per the EPF laws, if you have completed 5 years of working and contributing to EPF, then you are eligible for withdrawing the PF amount.

At the time of raising the request for the downpayment of the house, your account should have a minimum of Rs 20,000 balance.

If you have a joint account then it is mandatory that both of your accounts altogether should consist of a minimum balance of Rs 20,000 for raising a request.

Step Wise Online Process For PF Withdrawal For Home Purchase

To apply for PF withdrawal, you can follow the below online steps to raise a request for home loan purposes.

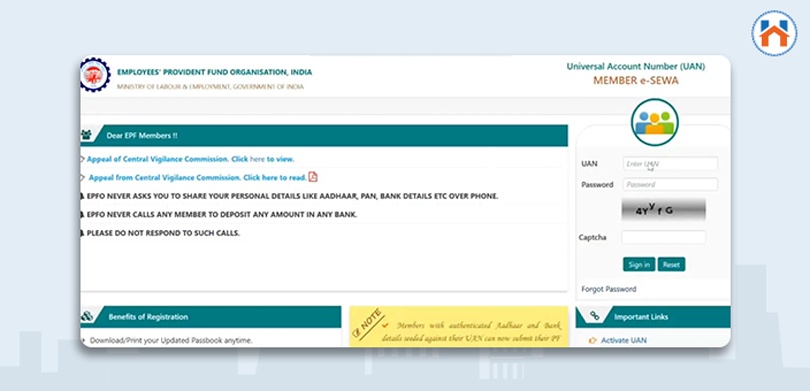

Step 1: Visit the official website @unifiedportal-mem.epfindia.gov.in

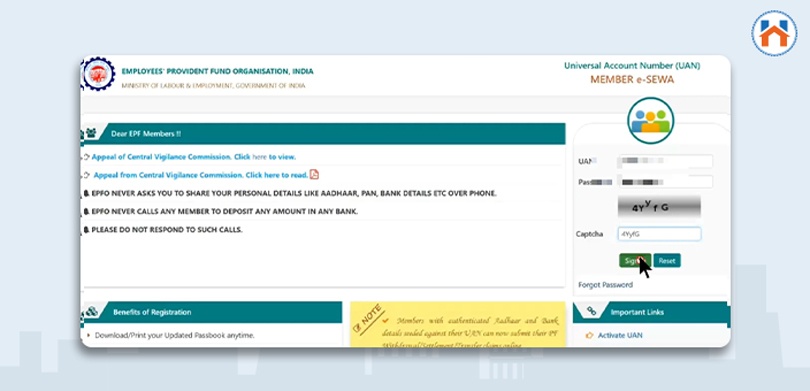

Step 2: Provide your UAN number and password to sign in

Step 3: Provide the Captcha shown and click on the sign-in button

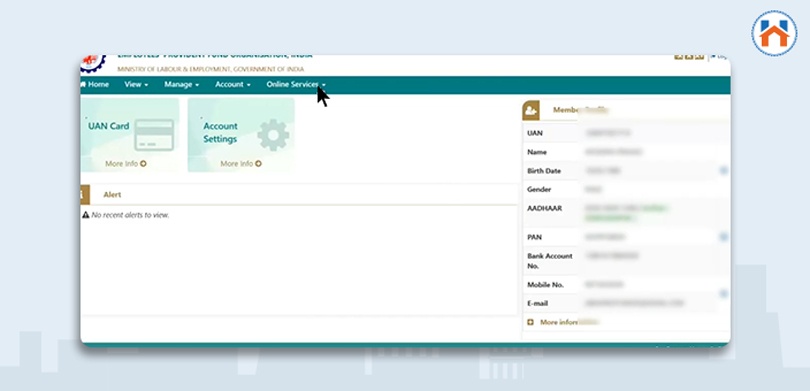

Step 4: Click on the ‘Online Services’ option from the page

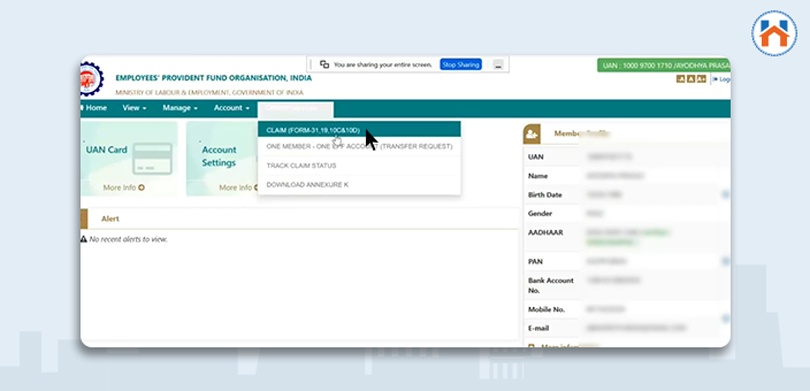

Step 5: Then, click on ‘Claim Form 31, 19, 10C & 10D’. A new tab will appear

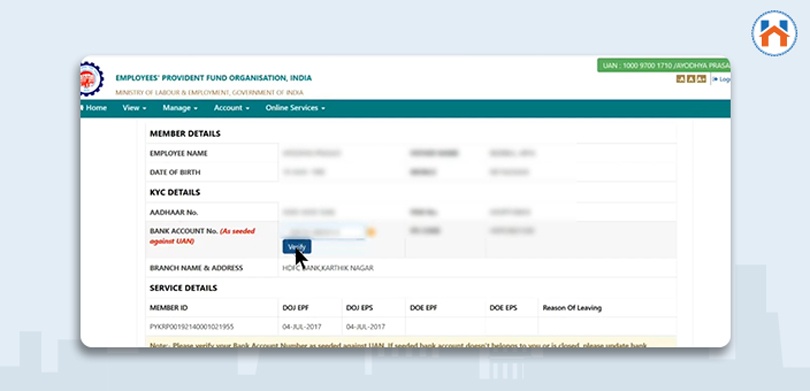

Step 6: Provide your bank account number and click on Verify

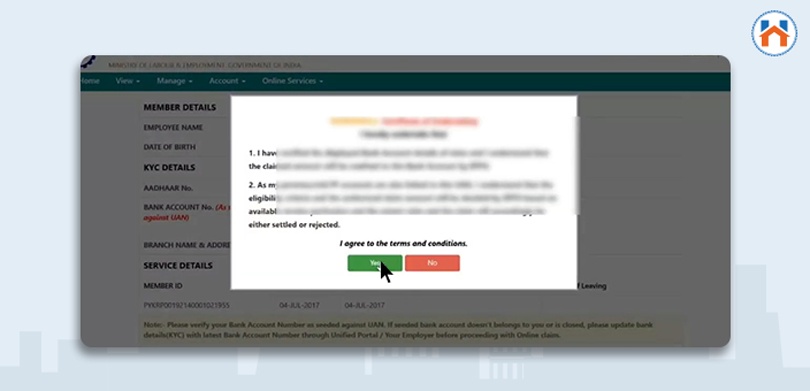

Step 7: A pop-up will appear, click on the Yes button to verify your bank information

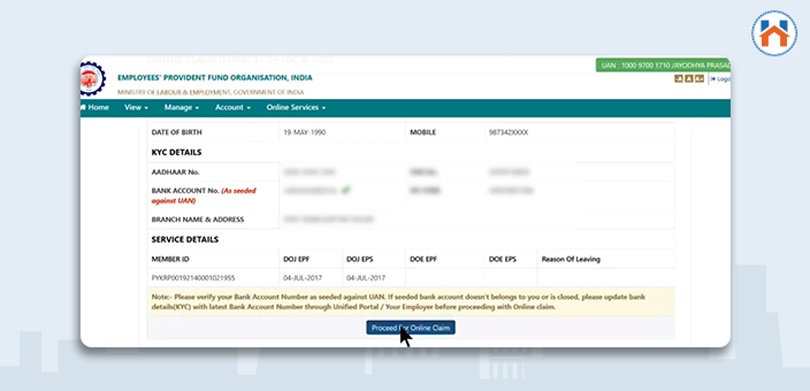

Step 8: Then click on ‘Proceed For Online Claim’

Step 9: A new page will appear showing your PF withdrawal details

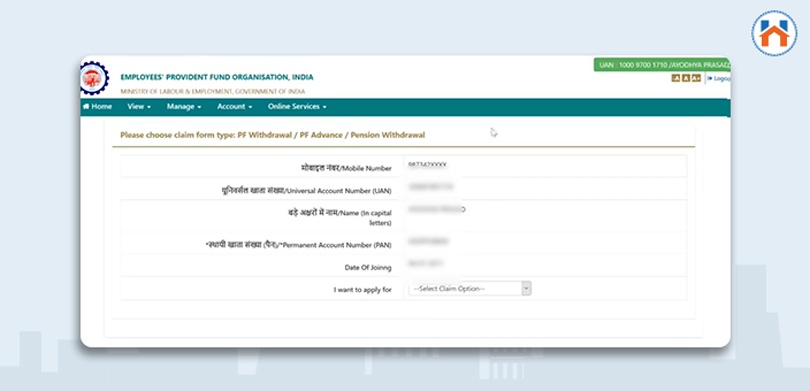

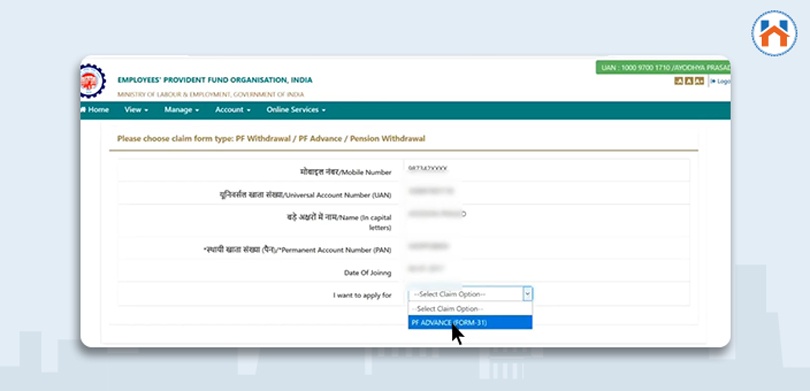

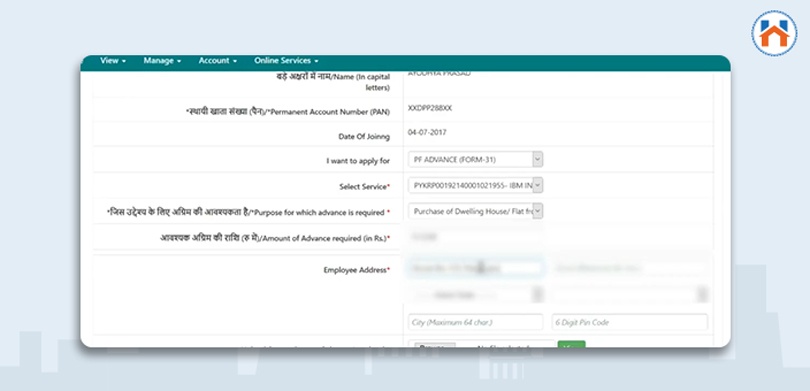

Step 10: Select ‘PF Advance (Form 31)’ from the drop-down of the ‘I want to apply for’ option

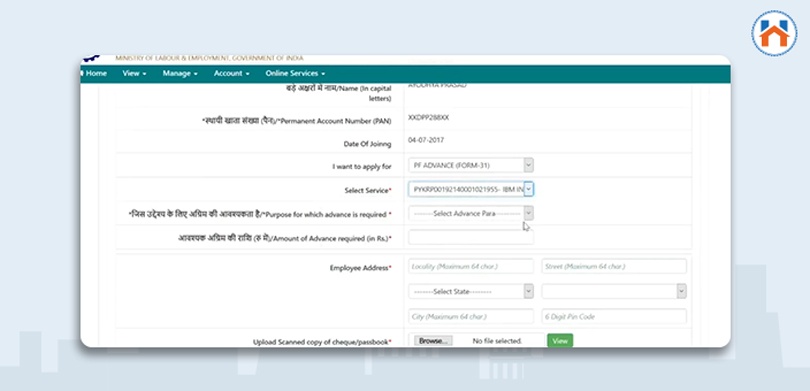

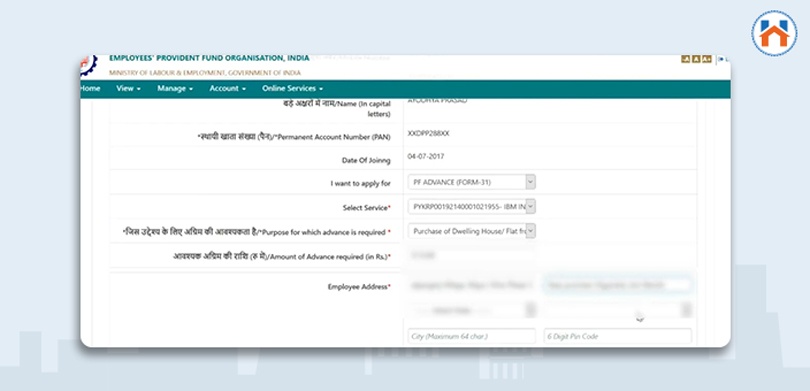

Step 11: Select your preferred PF account from the drop-down of ‘Select Service’

Step 12: Select the reason for withdrawing the PF balance from the drop-down of ‘Purpose for which advance is required’

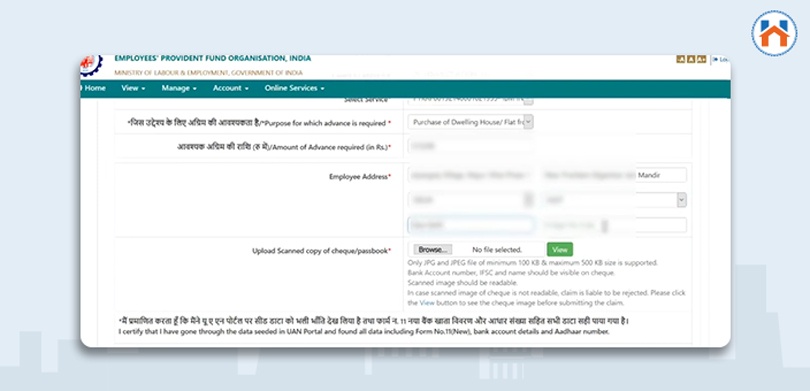

Step 13: Calculate the 90% of your PF balance and type the amount on ‘Amount of advance required (in Rs)’

Step 14: Provide your residential address on the ‘Employee Address’ option

Step 15: Provide a scanned copy of your bank account’s passbook or chequebook

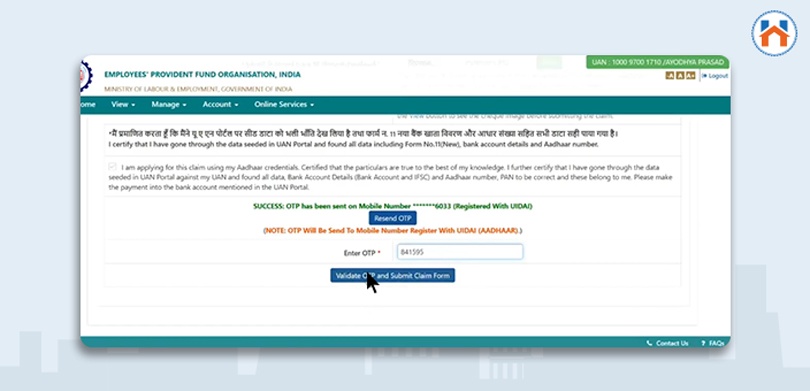

Step 16: An OTP will be sent to your registered mobile number. Enter the OTP

Step 17: Click on ‘Validate OTP and Submit Claim Form’

PF Withdrawal For Home Renovation

You can withdraw your PF amount for the purpose of repairs and renovation work of your house. However, it is to be ensured that this withdrawal request can be availed only when no other withdrawal request was taken.

Only after 10 years from 1st withdrawal, it is allowed to request for 2nd withdrawal of PF. The PF withdrawal for the home renovation can be applied only once in a lifetime.

If you are renovating your house, then the minimum of the following point will be allowed as withdrawal of the PF amount:

- 12 months basic salary + DA or,

- Employees share + interest or,

- Cost of renovation

PF Withdraw For Paying Home Loan

Similar to home renovation, the withdrawal of PF for payment of a home loan also can be availed under some circumstances.

You should have completed a minimum of 10 years of service for being eligible to raise a request. The withdrawal request will be done through Form 31. However, you should note that you can avail of this request only once in a lifetime.

If you are taking a home loan, then the minimum of the following point will be allowed as withdrawal of the PF amount:

- 36 months basic salary + DA or,

- Employees share + interest or,

- Cost of renovation

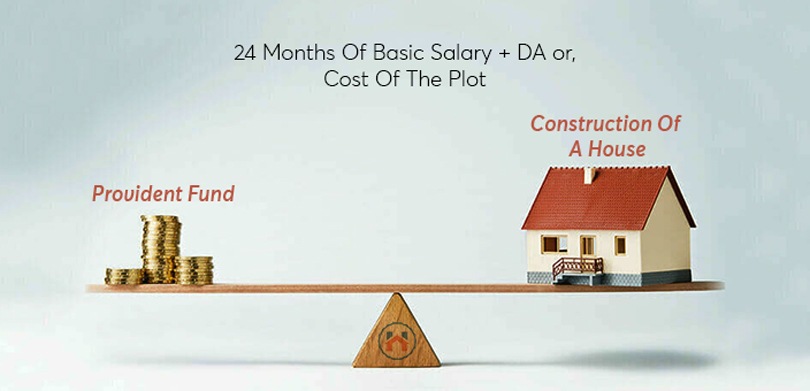

PF Withdrawal For Construction Of A House

If you are buying a plot for constructing a house, then the minimum of the following point will be allowed as withdrawal of the PF amount:

- 24 months of basic salary + DA or,

- Cost of the plot

However, you should remember that you can avail this amount only once in a lifetime.

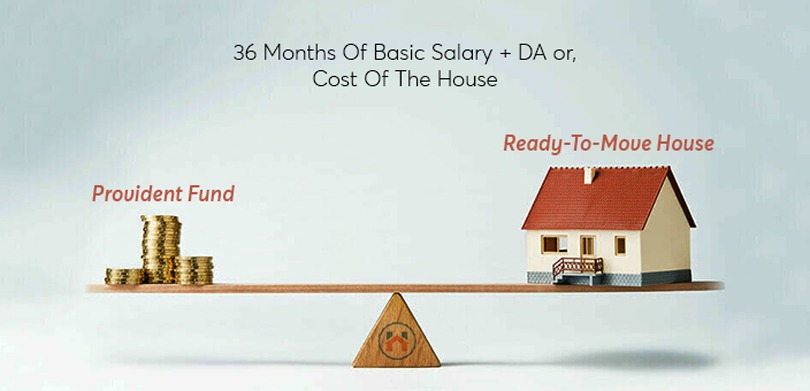

PF Withdrawal For A Ready-To-Move House

If you are buying a ready-to-move house, then the minimum of the following point will be allowed as withdrawal of the PF amount:

- 36 months of basic salary + DA or,

- Cost of the house

You can avail this requested amount only once in a lifetime.

FAQs

| Q1: How can I use my provident fund to finance a house?

Ans: Yes, you can withdraw your provident fund for financing a house if your PF account has a minimum balance of rs. 20,000. However, there are some conditions under which a specific amount will be provided. You can utilise the amount for any purpose. |

| Q2: Which documents are required for the withdrawal of PF for buying a house?

Ans: The EPFO (Employee Provident Fund Organisation) demands the housing agreement, sanction letter, and other relevant documents as proof. |

| Q3: Can I get a loan against my PF account?

Ans: Yes, you can get a loan against your PF account by providing relevant documents to the office for a specific amount. |

| Q4: How many times can I take a home loan against my PF account?

Ans: You can take a home loan against your PF account only once in a lifetime. One of the conditions is to have a minimum of rs 20,000 in your PF account. |

| Q5: Is it better to withdraw PF or transfer the amount?

Ans: It is always better to transfer the PF amount so that you can get interested in it. Withdrawal of the money can cause losing the principal money and also attract tax in case you are withdrawing the amount before 5 years of service completion. |