Page Contents

- What Are Stamp Duty Registration Charges in Chennai, Tamil Nadu

- Why Stamp Duty And Registration Charges in Tamil Nadu Are Important

- Factors Deciding Stamp Duty and Registration Charges in Tamil Nadu

- How To Pay The Stamp Duty And Registration Charges Online in Tamil Nadu

- Stamp Duty and Registration Calculation in Tamilnadu

- How to Pay Stamp Duty and Registration Charges in Tamil Nadu in an offline Mode.

- FAQs

What Are Stamp Duty Registration Charges in Chennai, Tamil Nadu

| Stamp Duty | Registration Charges | |

| Male | 7 % of the agreement value of the property | 1% of the agreement value of the property |

| Female | 7 % of the agreement value of the property | 1% of the agreement value of the property |

| Joint Male Female | 7 % of the agreement value of the property | 1% of the agreement value of the property |

Why Stamp Duty And Registration Charges in Tamil Nadu Are Important

According to the Tamil Nadu Stamp Act 2019, it is mandatory to pay the applicable stamp duty and registration charges in Tamil Nadu on buying the property.

The following are the main reasons why stamp duty and registration in Tamil Nadu are important.

- To be a legal owner of the property you need to register the sales deed by paying the applicable stamp duty and registration charges.

- During litigations or disputes, the proof of stamp duty and registration charges are considered valid proof.

- Only after the property registration by paying the stamp duty and registration charges in Tamil Nadu does the property get reflected in the register

- Only after the payment of the Stamp Duty and Registration Charges, do the property rights get transferred.

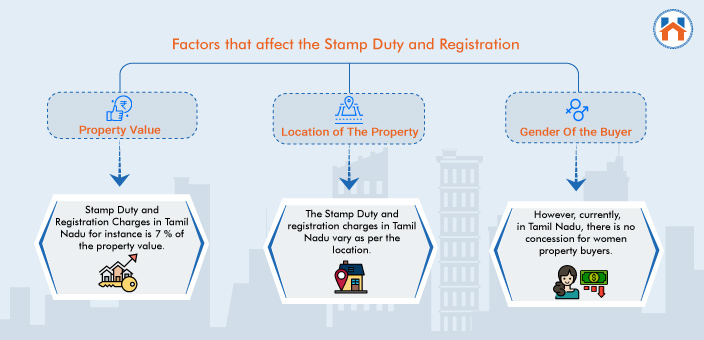

Factors Deciding Stamp Duty and Registration Charges in Tamil Nadu

The stamp duty and registration charges in Tamil Nadu are based on several parameters.

So following are the important factors that decide the Stamp Duty and the registration Charges in Tamil Nadu.

Gender Of the Buyer

The state government announces the concession on the stamp duty and registration charges for the women property buyers. However, currently, in Tamil Nadu, there is no concession for women property buyers.

The government generally gives concessions to the women property buyers to promote and encourage the women property buyers.

Property Value

The stamp duty and registration charges are calculated against the total property value. The Stamp Duty and Registration Charges in Tamil Nadu for instance is 7 % of the property value.

The stamp duty and registration charges in Tamilnadu are lower if the total value of the property is low. You can calculate the stamp duty and the registration charges online in Tamil Nadu if you know the exact amount of the property value.

Location of The Property

The Stamp Duty and registration charges also depend on the location of the property. The stamp duty and the registration charges are applied depending on whether the property is located in urban or rural areas.

For urban areas, the stamp duty ansd registration charges are slightly higher than the stamp duty and registration charges applied in the rural areas.

Type Of The Property

The stamp duty and the registration charges vary depending on the type of property. For commercial and residential properties there are different stamp duty rates. Generally, the stamp duty and registration for the commercial properties are more than that of the residential properties.

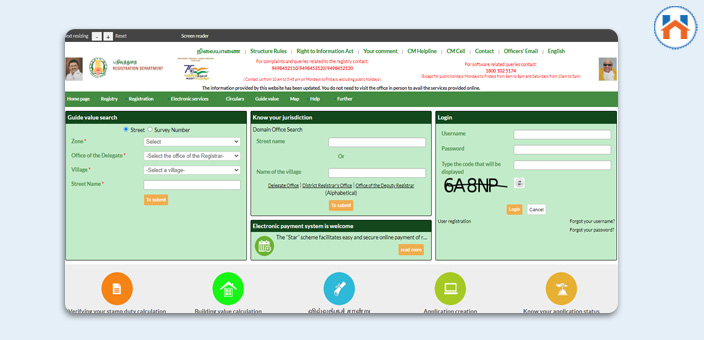

How To Pay The Stamp Duty And Registration Charges Online in Tamil Nadu

To facilitate the online payment of the stamp duty and registration charges in Tamil Nadu, the e-payment option is provided.

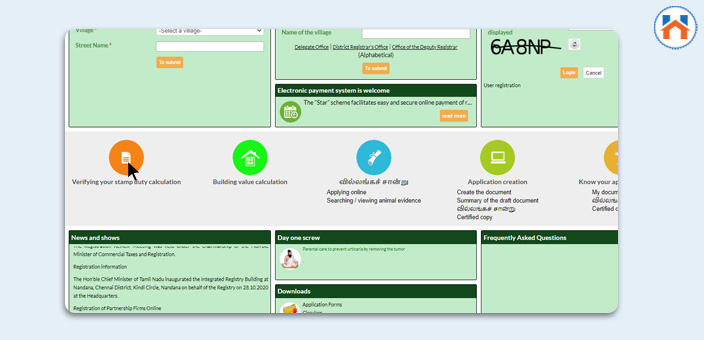

Following is the step-wise process for the stamp duty and registration charges in Tamil Nadu.

Step 1: Visit the official website of the Tamil Nadu Registration Department at www.tnreginet.net

Step 2: Then choose the citizen login from the Home Page.

Step 3: Signup into the Citizen Login Page by filling in all the details.

Step 4: Then click on the entry form and choose the appropriate Sub Registrar office.

Step5: Fill in the following important information-

- Applicant Name

- Address

- Phone Number

- Registration Details etc

Step 6: Choose the applicable service type.

Step 7: Then the Fee details will be displayed, then select the necessary fees and enter the amount.

Step 8: Then select the PayNow option. You can also select the Pay Later option to make the payment later

Step 9: Select the Online Payment Gateway and Choose the Appropriate Payment Option.

Stamp Duty and Registration Calculation in Tamilnadu

You can calculate the Stamp Duty and the registration charges in Tamilnadu online. For this, you need to visit the official website of the Registration Department of the Tamil Nadu Government.

After visiting the official website of the Registration Department of the Tamil Nadu colic on the Calculate stamp duty and registration charges tab from the home page.

To calculate the stamp duty and registration charges in Tamil Nadu online you need the total value of the property, locality details, and ther property-related details.

How to Pay Stamp Duty and Registration Charges in Tamil Nadu in an offline Mode.

You can also pay the unrefined stamp duty offline. For this, while generating the challan select the offline mode option.

Here is the stepwise process to Pay the stamp duty and registration charges in an offline mode.

Step1: Select The Offline Mode and click on the submit button

Step2: Click On The Print Now button and take the two copies

Step3: Visit the nearest bank to make the applicable payment

FAQs

| What are the Stamp Duty And The Registration Charges In Tamil Nadu?

The Stamp Duty and Registration charges in Tamil Nadu are 7% of the agreement value of the property. Whereas the registration charges are 1% of the property value. |

| What are the stamp duty and registration charges for females in Tamil Nadu?

The Stamp Duty charges In Tamil Nadu for female property owners are also 7% of the total property value and registration charges are 1% of the property value. |

| How to pay the Stamp Duty and Registration Charges Online in Tamil Nadu?

The stamp duty and registration charges online In Tamil Nadu can be paid by visiting the official tnreginet portal. |