Disclaimer:

With 11+ years of experience & expertise in the real estate industry, Homebazaar provides end-to-end property-buying solutions. Hundreds of 100% verified RERA-registered residential & commercial properties are listed on our website. We provide facilities like Zero brokerage, 360° virtual street view, effortless site visit services, end-to-end property buying agreements & documentation guidance, and low-interest home loan assistance. This helped us gain the trust of 55,000+ clients across India & sold 6,500+ homes of top reputed developers.

Page Contents

- What is a Release Deed?

- What is the Purpose Of Deed Of Release

- Release Deed Registration

- Stamp Duty and Registration Charges on Release Deed

- Release Deed of Ancestral Property Format

- Release Deed Format For Flat

- Release Deed Format For The Land Property

- Why is a Release Deed Important In Home Buying?

- Difference Between Release Deed & Gift Deed

- FAQs

What is a Release Deed?

A Release Deed is used when one co-owner of the property wants to release their ownership and transfer the property rights to the other co-owners.

A Release deed is generally done for the property owned by multiple owners.

The release deed facilitates seamless transfer and other vital property transactions.

For example, if the property is owned by all the family members, and they want to transfer all the property rights to one member of the family, then they have to execute the Release Deed.

A release deed can also be executed for ending the liabilities of the personal guarantees, the bank’s legal hold after repayment of the home loan, and for the settlement of the disputes between the parties.

In short, the release deed is used when one party needs to release the ownership of something to another party.

The release deed may or may not involve the monetary transaction between the two parties.

What is the Purpose Of Deed Of Release

A Deed of release is also used between the two parties for clear settlement.

Where both the parties release each other from certain obligations.

Once the Release Deed is signed, the parties cannot legally challenge each other based on the agreed terms and conditions mentioned in the Release Deed.

Release Deed Registration

According to section 17 of the Registration Act 1908, the release deed is considered valid only when the release deed is registered at the sub-registrar office.

According to section 17 of the Registration Act 1908, the release deed is considered valid only when the release deed is registered at the sub-registrar office.

Therefore, it is necessary to register the Release Deed at the sub-registrar office by paying the applicable release deed stamp duty.

You can register the release deed at the sub-registrar office in online and offline modes.

Also, to register the release deed you need to pay the applicable Stamp Duty on the Release Deed.

Note:

Homebazaar serves homebuyers searching for flats in India with end-to-end services like site visits, and lower-interest home loans to property registration guidance. We provide the best price options & offers for 1 to 4 BHK RERA-registered flats, villas & penthouse properties in India. To begin a smooth homebuying journey with us, fill out the form mentioned below or on the right side.

Stamp Duty and Registration Charges on Release Deed

By paying the applicable Stamp Duty and Registration charges on the release deed, you can have it registered at the sub-registrar office.

Here are the release deed stamp duty and registration charges in Mumbai.

| Stamp Duty | Registration Charges | |

| Release Deed by Legal Heirs for ancestral property | Rs. 200/- | 1% of the Market/Agreement Value

or Rs. 30,000/- (Whichever is less) |

| Release Deed for Any Other Cases | 6% of the market/ agreement value of the property. | 1% of the Market/Agreement Value

or Rs. 30,000/- (Whichever is less) |

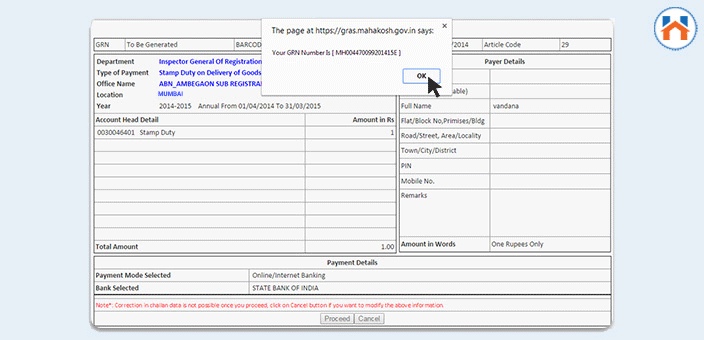

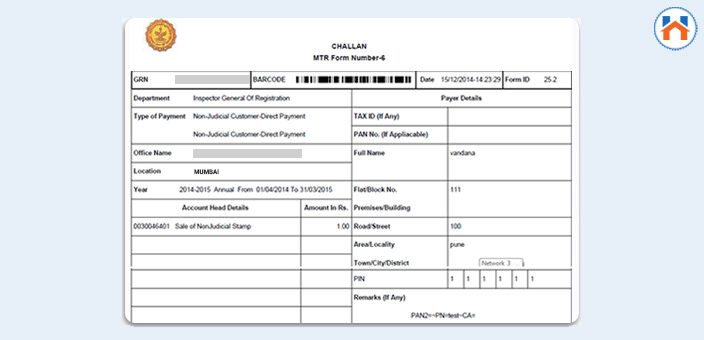

Release-Deed Registration Online

Here is how you can register the Release Deed Online in Mumbai.

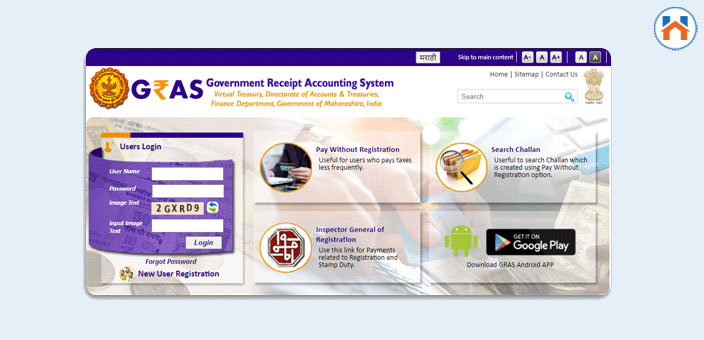

Step 1: Visit the Official GRAS Portal at gras.mahakosh.gov.in

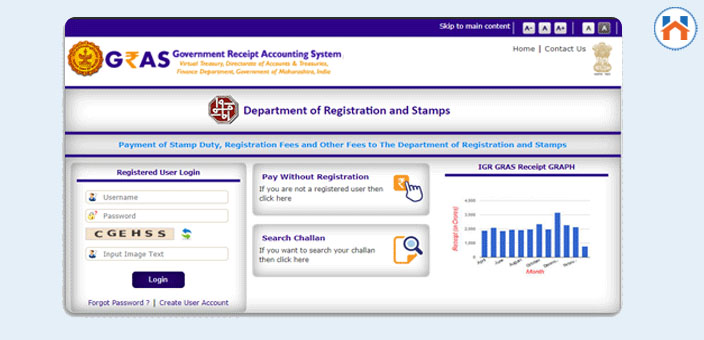

Step 2: Then Click On Pay Without Registration

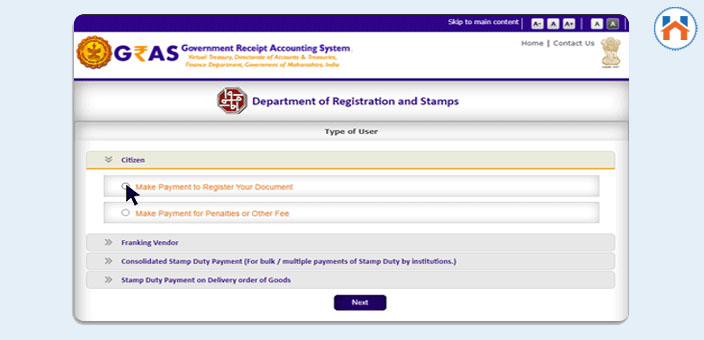

Step 3: Then, From the Citizen Section, Select The Applicable Option

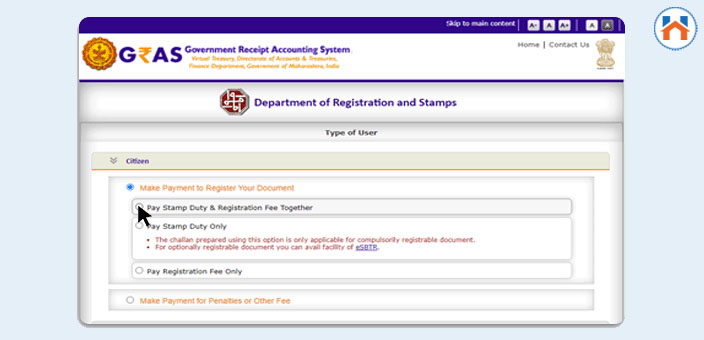

Step 4: Select the Suitable Payment Option and then Click On Proceed.

Step 5: Check The Generated Chalan

Step6: Make Payment and Get the Receipt of the Release Deed Registration  Where Release Deed is Used?

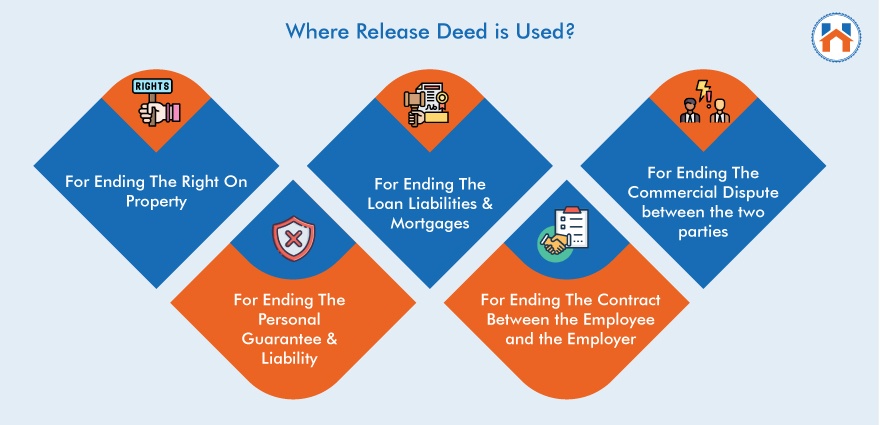

Where Release Deed is Used?

The release deed is used in the following cases.

- For Ending The Right On Property

- For Ending The Personal Guarantee & Liability

- For Ending The Loan Liabilities & Mortgages

- For Ending The Contract Between the Employee and the Employer

- For Ending The Commercial Dispute between the two parties

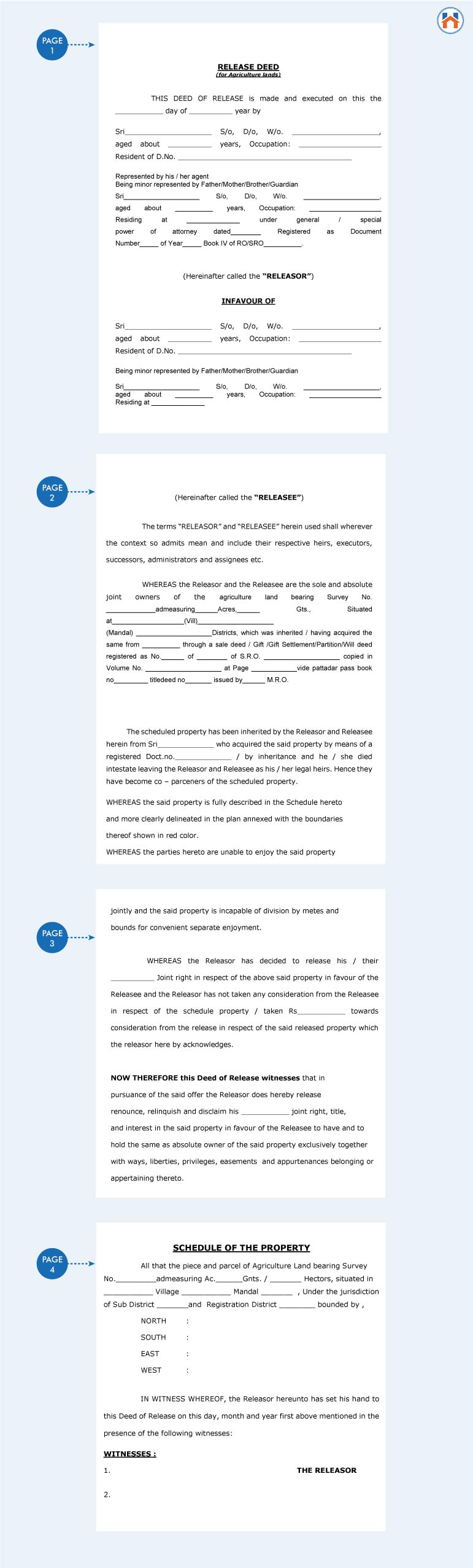

Release Deed of Ancestral Property Format

Release Deed of Ancestral Property Format

The Release Deed Format consists of the basic details of the property co-owners

Following are the basic details required in the Release Deed-

- Name of The Property Co-owners

- Professional Details

- Residential Details

- Property Details

- Property Registration Details

- Terms and Conditions

- Witness Details

Release Deed Format For Flat

Release Deed Format For The Land Property

Why is a Release Deed Important In Home Buying?

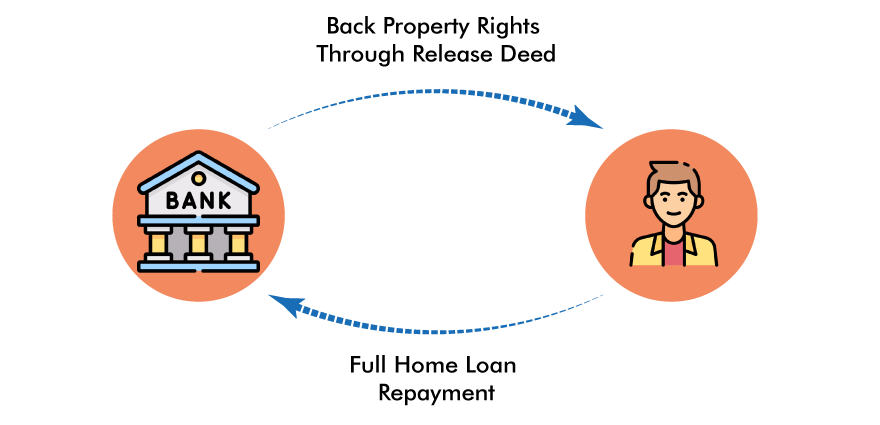

When you take a Home Loan to buy a new property, the bank holds the legal right on the property.

When you completely repay your Home Loan to the bank, the bank releases its property right.

Therefore, after repaying the home loan amount, the bank or financial institution can execute a release deed with you.

This ends the bank’s legal hold on the property & makes you the complete owner of the property.

Difference Between Release Deed & Gift Deed

Here is a key difference between Release Deed and Gift Deed.

The difference between the release deed and gift deed is important to understand especially when transferring the rights of the inherited property.

When one family member needs to transfer the property rights to the other, either a Release Deed or Gift Deed can be executed.

Release Deed and Gift Deed may have different applicable stamp duty charges.

| Release Deed | Gift Deed |

| Release Deed can be executed by one property Co-Owner to the other Property Co-Owner. | A gift Deed can be executed by any type of property owner to anyone. |

| In the case of a release deed, the monetary transaction may or may not take place between the parties | In the case of a Gift Deed, the monetary transaction does not take place. |

| A release Deed can be done only for the inherited properties | A gift deed can be done for any kind of property |

FAQs

| Why is the Release Deed important?

Release Deed is executed to give the complete property rights to the other property co-owner. |

| Why is Release Deed registration important?

As per section 17 of the Registration Act 1908, the release deed is valid only when registered at the sub-registrar office by paying the applicable Stamp Duty and Registration Charges. |

| What are Release Deed Stamp Duty Charges?

If the Release Deed by Legal Heirs for ancestral property, the Stamp Duty of Rs 200/- is applicable. |

| What is Release Deed in Home Loan?

Bank holds the legal rights of the property till you repay the complete loan amount. When you repay the home loan amount, the bank releases its property right by executing the release deed. |