Disclaimer:

With 10+ years of experience & expertise in the real estate industry, Homebazaar provides end-to-end property-buying solutions. Hundreds of 100% verified RERA-registered residential & commercial properties are listed on our website. We provide facilities like Zero brokerage, 360° virtual street view, quick site visit services, end-to-end property buying agreements & documentation guidance and low-interest home loan assistance. This helped us gain the trust of 55,000+ clients across India & sold 6,500+ homes of top reputed developers.

Page Contents

- Rectification Deed: Meaning

- Use of Rectification Deed

- Rectification Deed Format

- How To Apply Online For Rectification Deed

- What Kind of Mistakes Can Be Corrected With Rectification Deed

- Important Information Required in Rectification Deed

- Cost of Rectification Deed

- Stamp Duty for Rectification Deed in Maharashtra

- Rectification Deed Charges in Karnataka

- Rectification Deed Time Limit

- Rectification Deed Without Seller

- FAQs

Rectification Deed: Meaning

Many essential details carry into documentation while selling or purchasing a property. However, you should quickly address any small inaccuracies in this paperwork, such as typographical or numerical errors. A rectification deed is used for these corrections.

Any faults or errors in any formal agreement could be revoked with the use of a legal procedure known as a Rectification deed. It is used during property deals to correct the mistakes in the sale deed.

With the help of a rectification deed, you can also add details or delete irrelevant information. It is necessary to check all the details in the documentation in presence of involved parties.

A rectification deed is an entirely legitimate method of fixing mistakes in official documentation. For the deed to be legally binding, it must be registered.

Use of Rectification Deed

The most common use Rectification deed is to correct the errors in legal documentation. These mistakes can be spelling mistakes, numerical mistakes, typing mistakes or errors in the property description.

A supplementary deed could be prepared to add or remove provisions from the original deed. If you try to change the original nature of the deed then the rectification deed application can be rejected by the court.

Furthermore, the sub-registrar will only approve your request for the rectification deed registration only if he is satisfied that the error in the actual document was unintentional.

The proposed amendments must be accepted by all parties to the agreement, and they must all be present in person at the sub-office registrars for the rectification deed’s registration.

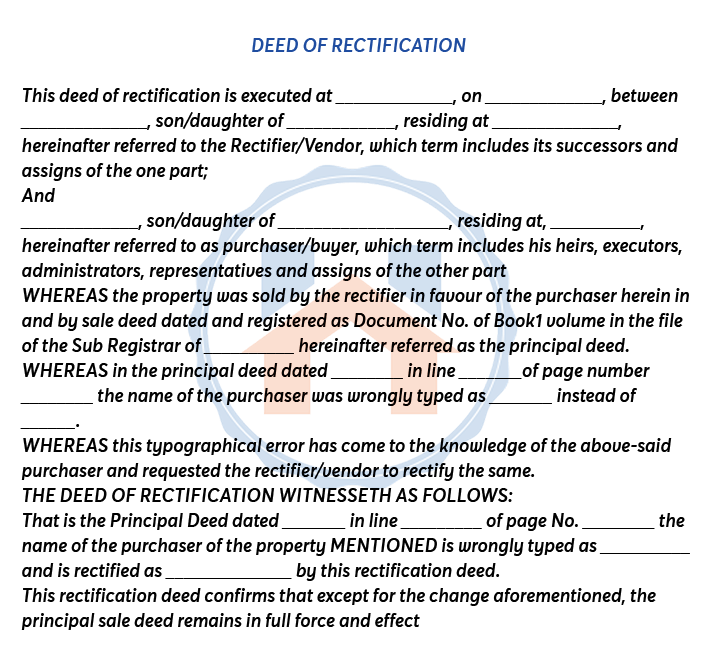

Rectification Deed Format

You can use this rectification deed format as a guide. It is simple to implement and appropriate for a variety of situations.

You can download a sample Rectification Deed PDF from here.

How To Apply Online For Rectification Deed

For the initial procedure of a rectification deed to put in action, you can apply online by visiting the official state portals.

- Maharashtra: gras.mahakosh.gov.in/igr

- Karnataka: https://kaverionline.karnataka.gov.in

- Tamil Nadu: https://tnreginet.gov.in

- Delhi: http://revenue.delhi.gov.in

- West Bengal: https://wbregistration.gov.in

- Bihar: http://bhumijankari.bihar.gov.in

What Kind of Mistakes Can Be Corrected With Rectification Deed

A rectification deed is a legal correction document which is used most of the time in real estate transactions. The following types of mistakes can be corrected by rectification deed.

Important Information Required in Rectification Deed

- In the rectification deed, the personal information of both parties must be mentioned.

- All the details about the original deed must be mentioned.

- Both concerned parties should give a written undertaking stating that there are no changes made in the original nature of the deed.

Cost of Rectification Deed

Rectification deed registration generally costs RS.100. This can vary if the error in the documentation is about the change of area, rectification deed registration changes differ along with the stamp duty charges.

Stamp Duty for Rectification Deed in Maharashtra

An individual must obtain the rectification deed if the original deed has already been registered and pay the necessary stamp duty plus registration fees following the State’s current rules.

The stamp duty and registration fees for rectification deeds in Maharashtra are each Rs 100 for typographical and other general errors. Other than that if the mistakes are about area change, the identities of the parties or the size of the estate then conveyance cost is applied with it.

Rectification Deed Charges in Karnataka

The nominal charges of rectification deed registration in Karnataka are Rs. 100. This can differ from the errors in the documentation of property transactions.

Rectification Deed Time Limit

According to law, there is no time limit for the corrections in the deed. As it is the legal proof of your property or the ownership you must get it rectified if there is some error in the deed.

Once the individual notice any mistake in the original deed, he can apply for rectification in the presence of the involved party. Mistakes that go unfixed could endanger your status as owner.

Rectification Deed Without Seller

It is necessary to sign the rectification deed in the presence of both involved parties. If one party is not agreeing on corrections then another party is allowed to file a legal suit against it with proper documentation and proof.

Between the buyer and seller, if the individual is no more then another party must contact his heir for the rectification deed process. But if in a few cases there is no trace of an heir then in such cases rectification of deed without a seller is possible. With the supporting paperwork, you can request a correction.

FAQs

| What can be rectified by a rectification deed?

You can correct any flaws or mistakes in legal documents like sale deeds and title deeds by using a rectification deed. |

| .How do you correct a mistake in the sale deed?

If the original deed is already registered, the rectification deed should also be recorded and pay the necessary stamp duty and registration fees in accordance with the State’s current rules. The stamp duty and registration fees are each Rs 100 for typographical and other general errors. |

| Can the rectification deed be Cancelled?

It is a correction deed, not a cancellation, and must be signed by the vendor or, in his absence, by his legal agents. You might execute a fresh correction deed or file a cancellation of the previously mentioned rectification deed. |

| What is a rectification transfer?

Rectification Transferring is made to fix registration mistakes, like when a property was unintentionally left off of a deed of transfer. Correction of inaccuracies in registered deeds, such as misspelt owner names or wrong identity numbers, through the application |

| Can a sale deed be challenged?

Only when there are solid legal justifications can a sale deed be contested. If it was carried out through fraud, coercion, etc., it can be contested, but the challenger must provide the court with evidence to support their claims. |

.