It is important to know whether the value of the property you are buying will increase over time. Property price appreciation is a key metric to evaluate the property for better returns. Also, knowing the factors that affect the property value can help you choose income-generating property. So, read on to know 5 important things about property price appreciation with detailed topic analysis and examples from the real estate market.

Page Contents

What is Property Price Appreciation?

When the property value increases over the period, we call it a property price appreciation. Higher property price appreciation gives you more profits when you resale the property.

So, what exactly triggers the property price appreciation? And what are the hints that suggest to you that the value of the property that you buy will increase over time?

Let’s start by understanding the simple supply-demand mechanism in real estate.

Any property that has higher demand will get a higher value. Now, what increases the demand for the specific property?

To answer this, we need to consider a broader perspective since there are many factors into play. These factors include the locality growth where property belongs, social infrastructure, connectivity, quality of the property, and so on.

These factors collectively increase livability and therefore triggers the demand for the property. We will look into these factors that influence property price appreciation in detail in this article.

Along with these, different types of properties viz commercial, residential, and plots may have different property price appreciation. We will also dive deeper into why these properties increase at a different rate and what are the chief factors.

Important Factors That Influence Property Price Appreciation

Here are the top factors that influence property price appreciation. Each factor has its own significance in increasing the value of the property.

Infrastructure Projects

Infrastructure projects have a huge impact on property price appreciation. The infrastructure projects that help increase the property value include metro projects, construction of bridges, expansion of railway network, an airport, and so on.

Such infrastructure projects act as building blocks for economic development. Additionally, these projects ensure comfort and ease of living for the population. Further, it triggers the higher demand for the properties in the region and results in increases in property price appreciation.

Why Infrastructure projects Are Crucial for Property Price Appreciation

- Improve accessibility to the essential services

- Ensure hassle-free connectivity

- Spur the economic growth in the entire belt

- Reduce the traveling time to the employment hubs

- Adds comfort and overall ease of living

Example:

The upcoming Mumbai Metro Project has accelerated growth and economic activities in some underdeveloped Mumbai suburbs. Ultimately, the property prices in the entire belt covered by metro projects have shown unprecedented property price appreciation. Properties in Mulund, Goregaon, Malad, Kandivali, Andheri, etc. are showing an upward property trend.

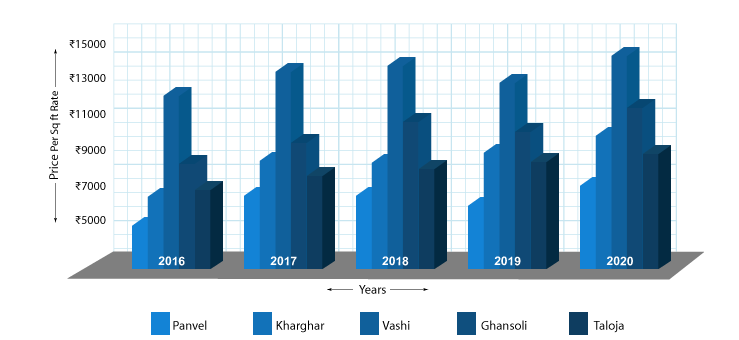

Similarly, The Navi Mumbai International Airport has boosted the property prices in Navi Mumbai. New Panvel, Kharghar, Vashi, Ghansoli, Taloja have increased property prices in Navi Mumbai.

Impact of Navi Mumbai International Airport on property values in Navi Mumbai

Commercial Development

Commercial development stimulates demand for residential and commercial properties. When commercial activities increase in a particular locality, it creates employment opportunities. And this triggers more requirements for residential properties as people settle in the region.

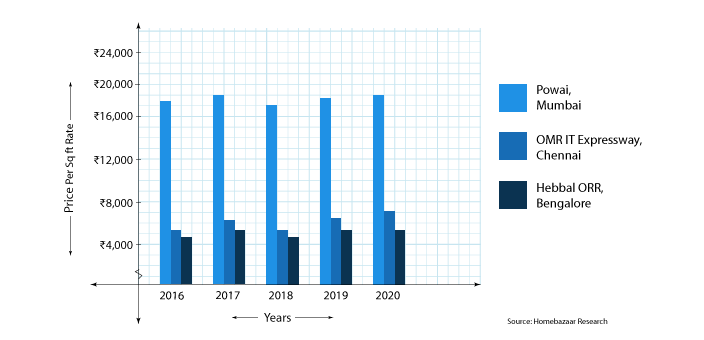

For example, the establishment of IT companies has increased the demand for residential properties in Powai. And ultimately, Powai has emerged as one of the best places to live in Mumbai.

The same trend is followed in the Outer Ring Road (ORR) IT corridor in Bangalore and Old Mahabalipuram Road in Chennai.

Here is how the property prices in these commercially active regions have increased over time.

How commercial development results in property price appreciation

- Employment hubs increase the demand for commercial and residential properties.

- The proximity to the corporate offices becomes an important factor.

- Commercial growth brings a strong physical infrastructure which raises the property value.

Connectivity

Connectivity is one of the main factors that affect property value. The solid connectivity network allows easy access to employment hubs, education, and healthcare facilities.

Road connectivity is linked directly with the quality of life. The robust road network reduces the traveling time to the essential services and workspaces. Also, it facilitates transportation for commercial activities.

So the connectivity boosts the residential and commercial real estate market. As demand goes up because of the improved livability, the value of the property increases.

Example-

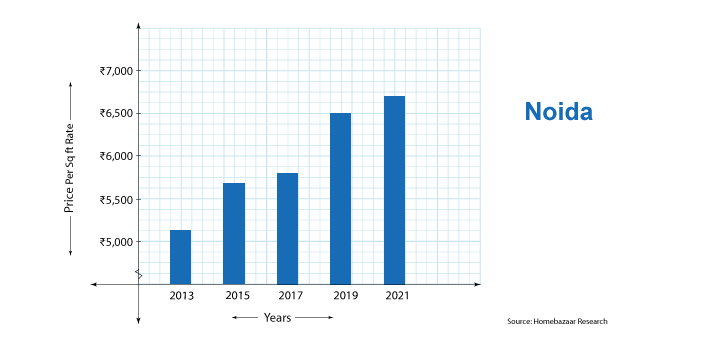

The growth of Gurgaon and Noida is the best example can have connectivity that can have a positive influence on property price appreciation. The connectivity to the already established market of Delhi pushed the growth of the Gurgaon and Noida region significantly. And the properties in Noida and Gurgaon witnessed an increase in the property values in these areas.

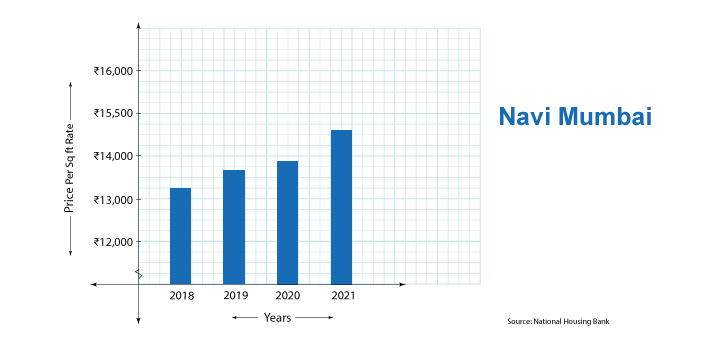

Similarly, the upcoming Metro Line in Mumbai and Navi Mumbai region will boost the connectivity and benefit the properties in its operational belt. There is an upward property price trend in Navi Mumbai due to the solid connectivity network.

Social Infrastructure

The properties with easy access to quality social infrastructure get higher property price appreciation. There is always a higher demand for properties close to quality healthcare, education, and entertainment facilities.

Therefore while buying property, the nearby social infrastructure facilities are considered. As it impacts considerably on the property price appreciation in the future.

Example

Shivajinagar, Erandwane, Kothrud, Model Colony localities have witnessed an upward trend in property prices due to the presence of prominent schools and colleges.

The same trend can be seen in Mumbai and other major metro cities. There is high property price appreciation in the locations with easy access to quality infrastructure.

Quality & Features of Property

The property price appreciation also depends on the quality and the features of the property. The properties in good condition and have quality facilities are always preferred.

If the property is too old and lacks the basic requirements, then such properties may not get the price appreciation even for the perfect location.

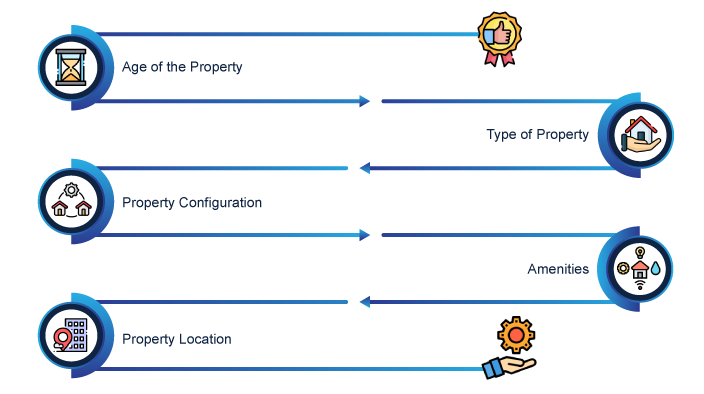

Here are the property quality-related factors that impact the value of the property.

- Age of the Property: Older properties get less attraction from the buyers. And therefore, the properties that are too old get fewer returns in the resale market.

- Type of Property: There might be a different rate of appreciation for different properties types. The villas, multistory apartments, independent houses can grow differently depending on the supply and demand mechanism. Also, in the case of land property, price appreciation is completely different.

- Property Configuration: Better property price configuration gets good demand and hence the higher value in the market. Therefore, While buying property, choose the configuration that will benefit you for the reselling.

- Amenities: Properties with essential amenities such as gyms, play areas, Gardens, Clubhouses get the higher property price appreciation.

- Property Location: Properties that are at a good location in the building appraise better. For example, the properties facing the Sea and Green open areas get the higher values. Also, the properties with natural lights, airflow, serene views, always show good property price appreciation.

Tips that can help you to increase the value of your property

- Keep the property well-maintained

- Paints and other design changes

- Do frequent upgrades and renovations

- Emphasize the security aspects

- Design for good ventilation & lights

Economic Factors

The economic condition affects property prices significantly. When the economy becomes sluggish, it directly impacts the real estate market. For instance, the great recession that began in 2007 plummeted the real estate market in India and all around the world.

The economic slowdowns reduce the demand for the properties. Because of the reduced buying capacities of people. Moreover, the developers spend more on resources and raw materials to develop the properties.

Also, the construction of the new infrastructure projects and facilities slows down. And it ultimately reduces the value of the properties.

Following are the key economic factors that govern the property prices-

- Inflation Rate- Higher inflation rate increases the cost of the development. And hurt the property prices.

- Supply and Demand- Higher property demand increases property prices. Conversely, higher supply or low demand reduces property prices.

- Real Estate Inventory-Higher real estate inventory means a higher supply of properties and hence reduced prices.

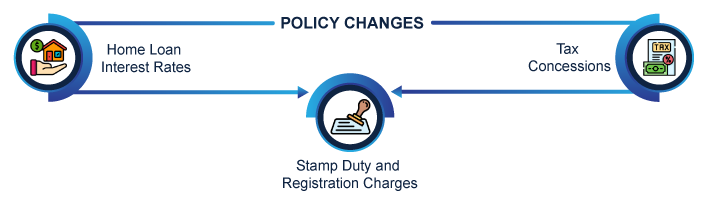

Policy Changes

Government policy changes impact real estate property prices. These policies could be tax concessions, home loan interest rates, GST cuts, or reductions in Stamp Duty and registration charges.

For example, the Pradhan Mantri Awas Yojana PMAY policy had a positive impact positively in real estate. This policy allows homebuyers to save upto 2.67 lakh on the home loan amount. This encouraged buyers and hence pushed the demand up resulting in the appreciation of the properties.

Also, the RERA (Real Estate Regulatory Authority) Act 2016, brought more transparency and streamlined the real estate industry. It had a positive impact on the buyer’s sentiment.

Following are the policy changes that directly affect the property price appreciation In India.

Home Loan Interest Rates

In India, RBI controls the repo rate. And according to the repo rate, banks set the home loan interest rates for the homebuyers. If the home loan interest rates are low, then the demand for the property increases. Which ultimately increases the value of the property.

Tax Concessions

The government announces the tax concessions to give relief to the property buyers. These tax concessions trigger the demand for the properties and hence play a role in property price appreciation.

For example, the concessions Section 80 C allows homebuyers to save upto Rs 1.5 Lakh on the principal portion of EMI. Whereas, upto Rs 2 lakh can be saved on the interest component of the EMI under section 26.

Under section 80C, first-time homebuyers in India can get the concession upto Rs 1.5 Lakh on the principal portions of the EMI. Rs 2 Lakh on the interest component can be saved under section 26.

Stamp Duty and Registration Charges

Stamp Duty and Registration cuts trigger higher property sales. Therefore, when the government announced the stamp duty and registration charges, the demand and the property price appreciated.

In 2020, the Maharashtra government had reduced stamp duty and registration charges by 3%. This policy change boosted the real estate sales in Mumbai and other key areas in Maharashtra. In Mumbai, Housing sales were increased by 50% in the last quarter of 2020 compared to the earlier one.

How to calculate property price appreciation

The property price appreciation is calculated in percentage and expressed against the number of years. For eg. 15% over the last 5 Years.

To calculate the property price appreciation, you need-

- The Purchase Value of the Property

- The current price of the property/ Selling Price of the Property

Here is the formula to calculate the property price appreciation.

Eg. If you purchase the property in 2017 at 60 lakh and the value of the property becomes 70 Lakh in 2022, then the total property price appreciation will be-

(70 lakhs – 60 lakh) / 60 lakh = 0.1667

0.1667 X 100 = 16.67%

Here as you can see the property price has increased by 20 Lakh i.e by 16.67%.

Commercial & Land Property Price Appreciation

commercial properties and land properties may have a different price appreciation. Here is the general overview of how the property price for commercial and land property increases.

Commercial Property Price Appreciation

Commercial properties give more returns than Residential properties.

The property price appreciation for the commercial property depends on the factors that boost the economic activities in the locality. It includes the establishment of the new corporate hubs, connectivity, and physical infrastructure.

Following are the key points to increase the value of the Commercial properties.

- Keep the Commercial properties well-maintained

- Choose a rapidly growing locality for buying commercial properties

- Proximity to the residential properties is important for better ROI.

- Connectivity and access to the surrounding micro markets are important.

Land Property Price Appreciation

Land property prices tend to appreciate more faster. It is because there is no depreciation cost associated with the land properties. Moreover, the supply of the land is considerably lower. And the demand for land properties becomes higher with an increase in population and industrial growth.

While buying land, you should consider the following key points for better land property price appreciation.

- Economic growth of the locality

- Upcoming infrastructure projects

- Connectivity and ease of transportation

- Essential facilities- Water and electricity supply

- Proximity to the commercial and residential hubs

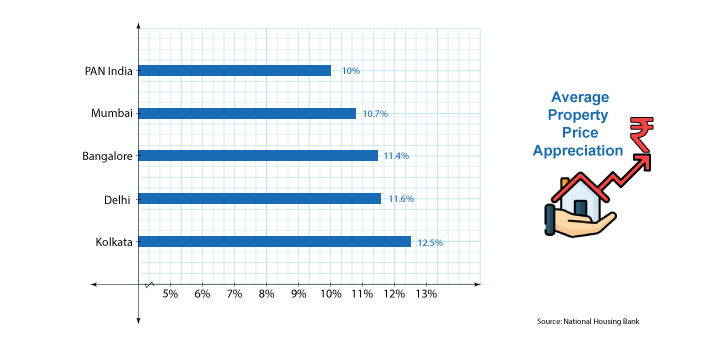

Average Property Price Appreciation in India

In India, the average property price appreciation in a year is 3-5%. However, the best cities for real estate investment in India have shown rapid property price appreciation.

According to the National Housing Bank, property prices in India have increased by 10% between 2011-2021.

Here is the property price appreciation in the major cities in India according to the National Housing Bank.

FAQs

| Why property price appreciation is Important?

Property price appreciation decides the returns on real estate properties. Therefore, while buying a new property it is crucial to consider property price appreciation prospects. |

| What are the factors affecting property price appreciation?

The factors that decide the property price appreciation are The infrastructure project Commercial Development, Connectivity, Social Infrastructure, Quality & Features of Property, Economic Factors And Policy Changes. |

| What is the real estate appreciation rate in India?

The real estate properties in India have grown with an average of 3-5%. Between 2011-2021, the properties have an average appreciation of 10% |