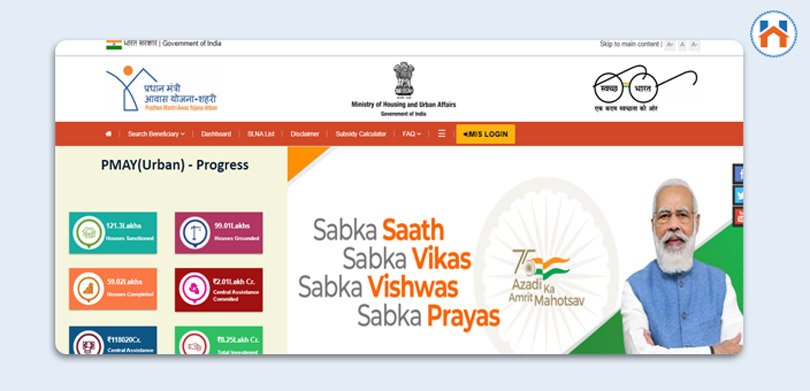

The PMAY (Pradhan Mantri Awas Yojana) was created in 2015 by the Government of India. The mission was to provide the urban poor people with affordable housing. The target assigned by the government was to construct around 2 crore affordable houses.

Page Contents

Beneficiary List of PMAY Urban

The beneficiary list of PMAY Urban includes the name of individuals according to different categories depending on their earnings and eligibility for the PMAY program.

The categories which are considered for the beneficiary list are the following:

- Economically Weaker Section (EWS) with earning up to 3 lakhs pa

- Scheduled Caste and Scheduled Tribes

- Low Income Group with earnings between 3 lakhs to 6 lakhs pa

- Middle Income Group – 1 (MIG-1) with earnings between 6 lakhs to 12 lakhs pa and Middle Income Group – 2 (MIG-2) with earnings between 12 lakhs to 18 lakhs.

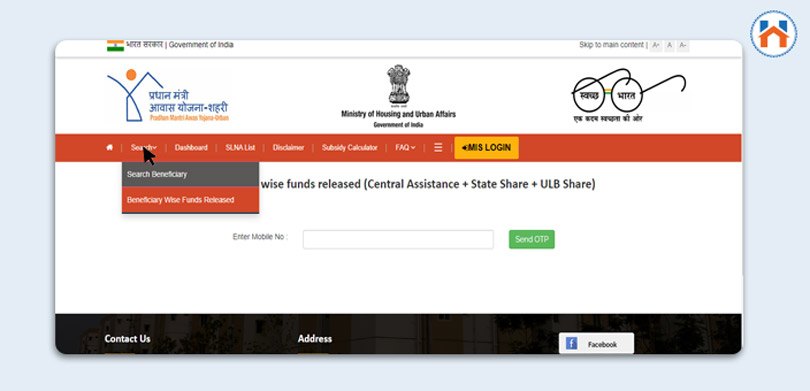

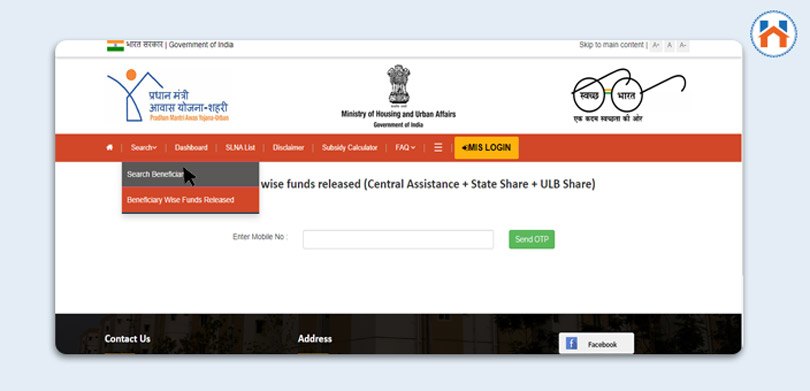

Steps To Check Beneficiary List

You can check the beneficiary list of PMAY Urban from the official government website. You can follow the below steps to check the beneficiary list of PMAY Urban.

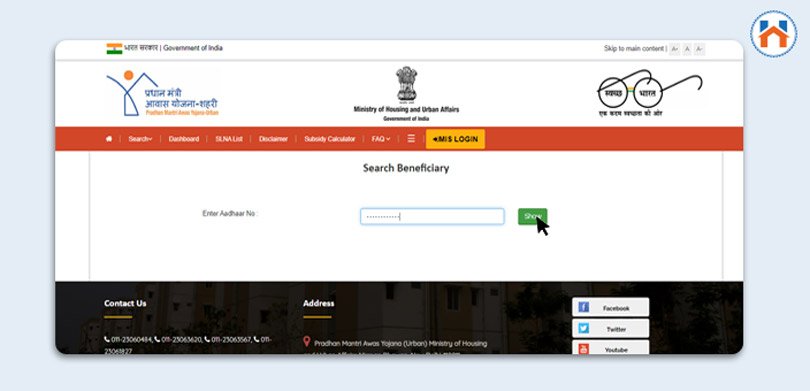

Step 1: Visit the official website pmaymis.gov.in

Step 2: Click on the ‘Search’ button

Step 3: Select ‘Search Beneficiary’ from the dropdown

Step 4: Enter your Aadhar Card number and click on Show

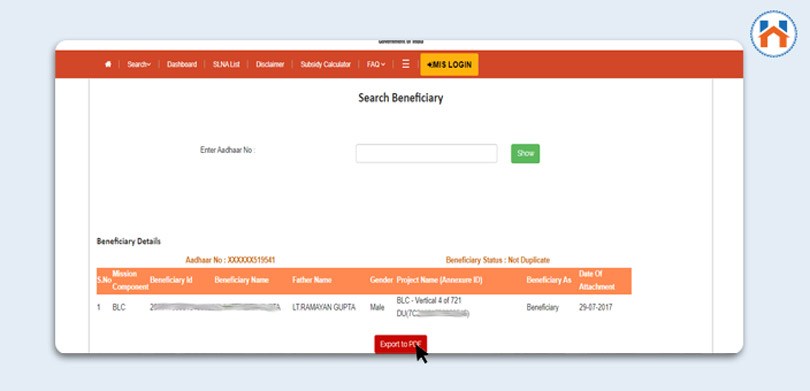

Step 5: A list will appear on your screen. If your Aadhar card is present in the database then your name will be on the list.

Features of PMAY Urban

Under the PMAY Urban program, the government has sanctioned 122.69 lakhs of house projects, 61.04 lakhs house projects are completed, Rs 2.03 lakh crore amount was Central Assistance Committed, and Rs 8.31 lakh crore amount was in total investment.

Due to the progressive features of PMAY Urban, the government has been able to reach its objective. The features of PMAY Urban are provided in the following:

- The beneficiaries will receive a loan tenure of up to 20 years

- The loans must be taken for house construction work or for purchasing the resale house

- The beneficiaries will receive a subsidy on the interest rate of 6.5% depending on their income slab

- Only organic and eco-friendly technologies will be used for buildings

- The ground floor will be designed for senior citizens and disabled people.

- It will be ensured that all the houses have basic facilities available like water, electricity, and gas.

List Of Documents Required For PMAY Urban

A person should provide a few important documents to register for PMAY Urban. The required documents for a self-employed and salaried employee will mostly be similar.

The requirements are stated below:

- A person who is a salaried employee:

| Income Certificate (necessary only if the income is taxable) | |||||||||||||||||||||||

| Aadhar Card | |||||||||||||||||||||||

| EWS/LIG Income Certificate | |||||||||||||||||||||||

| Pan Card | |||||||||||||||||||||||

| MNREGA Number | |||||||||||||||||||||||

| Driving License | |||||||||||||||||||||||

| Copy of address proof | |||||||||||||||||||||||

| Voter ID Card | |||||||||||||||||||||||

| Nationality ID Proof | |||||||||||||||||||||||

| Caste Certificate (SC/ST/OBC/Minority etc.) | |||||||||||||||||||||||

| Certificate of architects which confirms the expected life, | |||||||||||||||||||||||

| During the time of purchase of the flat/house, an architect’s certificate stating the estimated life, fitness, and future of the house is required. | |||||||||||||||||||||||

| Income proof (original salary slip/ salary certificate/other income) | |||||||||||||||||||||||

| Latest Income Tax Return/ Income Tax Assessment Order/ Form no 16 (If applicable) | |||||||||||||||||||||||

| Last six months’ bank statement | |||||||||||||||||||||||

| If not approved before, then a valuation certificate from the qualified valuer is also required | |||||||||||||||||||||||

| Agreement for the construction with the builder or the developer | |||||||||||||||||||||||

| The certificate of the approved plan of the construction | |||||||||||||||||||||||

| The certificates of architects/engineers should confirm the cost of the construction/cost of repairs/cost of improvement/ cost of extension | |||||||||||||||||||||||

| NOC from the housing society/component authority | |||||||||||||||||||||||

| Affidavit-cum-undertaking stating that the construction is done in an authorized area. The construction should be strictly according to the sanctioned plan/building and those should amend by the law as well. The loan will be sanctioned only for acquiring the house for residential purposes only. | |||||||||||||||||||||||

| The letter of allotment of the property/ or agreement to sale, title deed/ lease deed/ mutation in respect of the pre-owned property, which requires to get extended according to where the property or resale property is proposed to be purchased from the builder. | |||||||||||||||||||||||

| An affidavit from the beneficiary should also be submitted stating that either he/she or any of the other family members do not own any pucca house in any part of the country. | |||||||||||||||||||||||

If there is any receipt of advance payment made to the builder or seller, then that should also be submitted.

|

FAQ

| Q1: What is the benefit of PMAY Urban?

Ans: Under the PMAY Urban Scheme, the Urban poor people can avail of loans for buying a resale house or constructing their own house. There will be a deduction from the interest amount. |

| Q2: Who is eligible for PMAY Urban?

Ans: People who are under Economically Weaker Section (EWS) with earning up to 3 lakhs pa, Scheduled Caste and Scheduled Tribes, Low Income Group with earning between 3 lakhs to 6 lakhs pa, Middle Income Group – 1 (MIG-1) with earning between 6 lakhs to 12 lakhs pa, and Middle Income Group – 2 (MIG-2) with earning between 12 lakhs to 18 lakhs. |

| Q3: Which banks are providing PMAY loans?

Ans: Around 38 banks are providing PMAY loans, however, name of 10 banks among them are Indian Overseas Bank, Bank of Baroda, Indian Bank, State Bank of India, Dena Bank, IDBI Bank, Axis Bank Ltd, DCB Bank Ltd, IDFC Bank Ltd, and Yes Bank. |

| Q4: How much subsidy is provided under PMAY Urban program?

Ans: The maximum subsidy provided under the PMAY Urban program is different for different sections. For EWS it is 6.5%, for LIG it is 6.5%, for MG I it is 4%, and for MG II it is 3%. |