Page Contents

MCGM Property Tax in Mumbai

The property owners in Mumbai need to pay the MCGM property tax annually. The amount of the MCGM property tax depends on various factors such as the type of the property, location of the property, the total area of the property, etc.

The property owners in Mumbai are liable to pay the MCGM property tax in Mumbai as per the Mumbai Municipal Corporation Act, 1888. Not paying the MCGM Property Tax makes the property owner liable to pay the additional fines.

The property owners have to pay the MCGM property tax in June. If the property owner fails to do so, a fine of 2% is applicable to the total property tax amount every month.

The PCMC property tax amount, various additional cesses are also applicable. These cesses include the Street Tax, Municipal Education Cess, Water Tax, Water Benefit Tax, Sewage Tax, and tree cess.

Let’s look at how exactly the MCGM property taxes are calculated.

How To Calculate The MCGM Property Tax On Flat

In India, different property tax calculation methods. The commonly used property tax calculation methods in India are the Capital value System, Unit Area Value System, and Rental Value System.

In Mumbai, MCGM property tax is calculated based on the capital value system.

In the capital value system, the property tax is calculated based on the market value of the property.

The ready reckoner rates become the base for the MCGM property tax calculation. The municipal corporation releases the ready reckoner rates every year.

You can check the ready reckoner rates published by the Department of Registration of Stamps Online at www.igrmaharashtra.gov.in/eASR

Here is how MCGM Property Tax is calculated based on the Unit Capital Value System.

Property Tax = Capital Value X Property Tax Rate

Here the capital value for the residential properties is calculated by using the formula –

Capital Value (CV) = BV x UC x NTB x AF x FF x CA

Where,

BV = Base Value As per Ready Reckoner Rate

UC = User Category

NTD= Nature and Type of Building

AF= Age of the Building

FF= Floor Factor

CA= Carpet Area

The values for the above-mentioned terms are provided by the municipal corporations of Mumbai.

Here is an example for calculating the MCGM property tax for the residential properties in Mumbai. The percentage of the

Ready Reckoner Rate = Rs 40,000/ Sq mt

User Category = Residential Property (0.5)

NTB = 1 For RCC building

AF = 0.95 Age Factor 9-10 years Old Building

FF = 1.0 (1-4 Floors)

Carpet Area = 200 Sq mt

Tax Rate for Residential Properties in Mumbai = 0.755%

so the capital value will be-

Capital Value (CV) = BV x UC x NTB x AF x FF x CA

= 40,000 X 0.5 X 1 x 0.95 X 1 X 200

= Rs 38,00,000

Total Property Tax = 0.755% of 23,75,000

= Rs 28,690

How To Calculate The MCGM Property Tax Rates in Mumbai Online

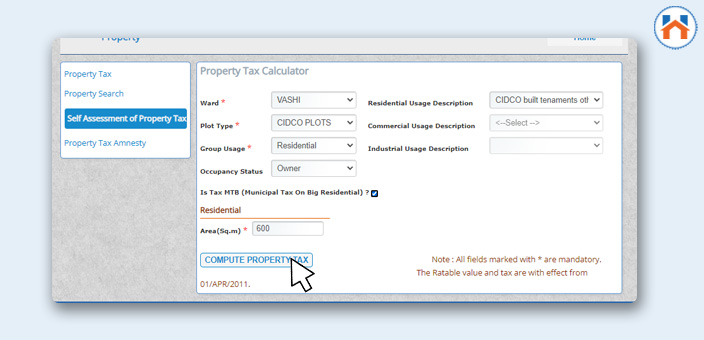

Here is the stepwise process for calculating the PCMC property tax rates.

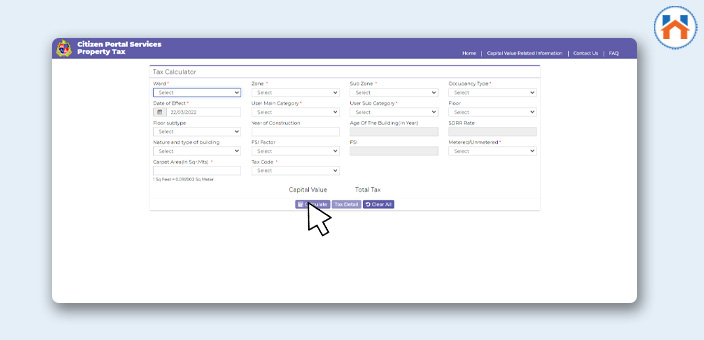

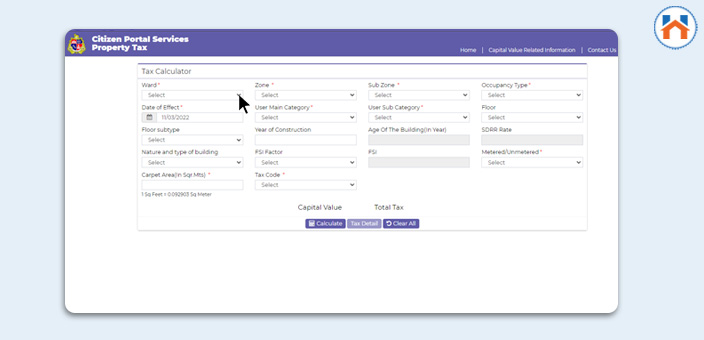

Step 1: Visit the Citizen Portal Services Property Tax

Step 2: Then click on the Tax Calculator Option

Step 3: Then fill in the important details such as Ward, Zone, Sub Zone, Occupancy, Year of Construction, Carpet Area, and the Tax Code.

Step 4: The Click On The Calculate Button.

Step 5: Then the Capital Value and the Total Tax values will be displayed.

How To Pay The MCGM Property Tax Online

You can pay the MCGM Property Tax Online by following simple steps.

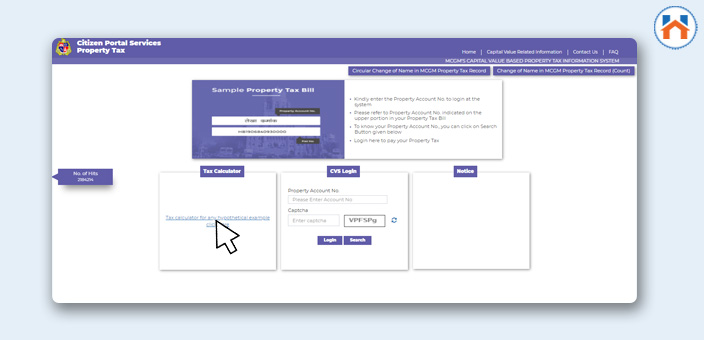

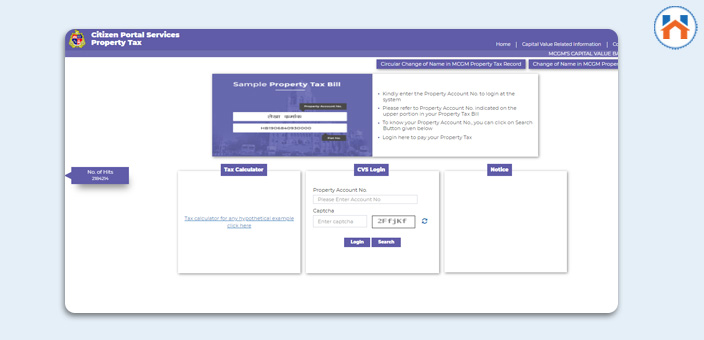

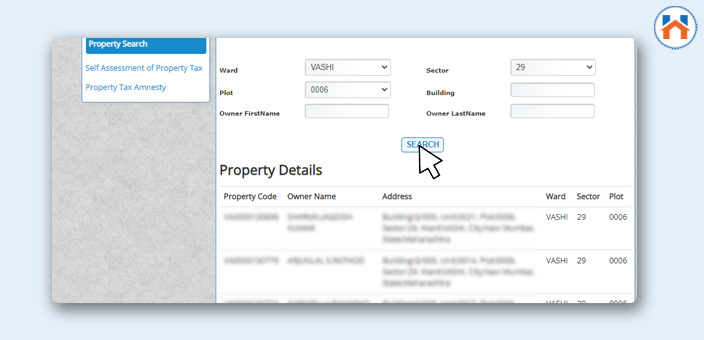

Step 1: Visit the Citizen Portal Services Property Tax Portal

Step 2: Then Enter the Property Account Number and Captcha Code, Then Click On Login

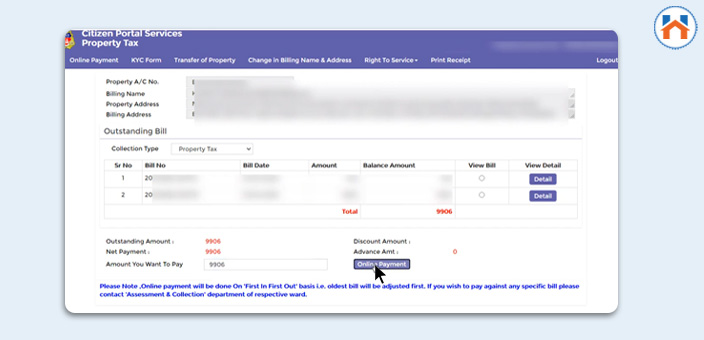

Step 3: Then the Applicable property tax Bill Amount will be displayed.

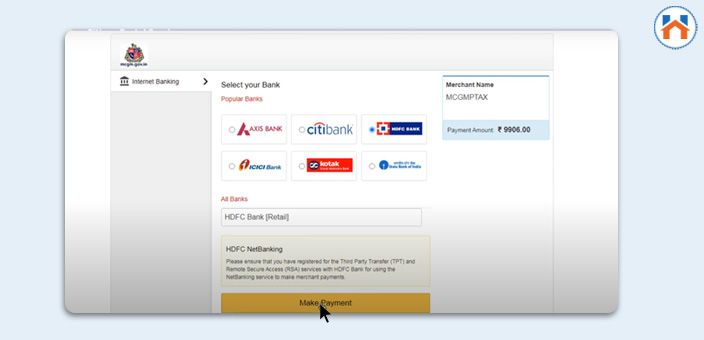

Step 4: Then Click on the Online Payment Option

Step 5: Then select the appropriate payment option.

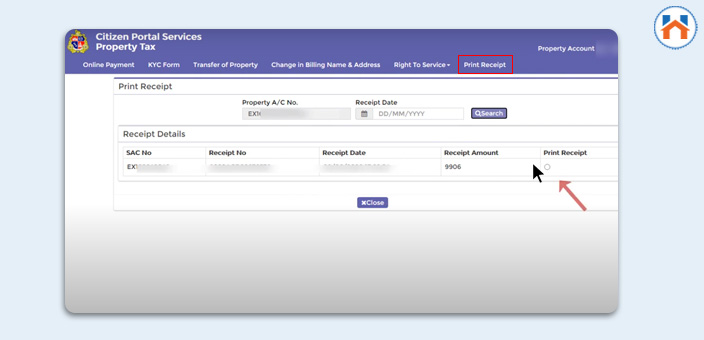

Step6: Make The Payment and download The MCGM property tax online.

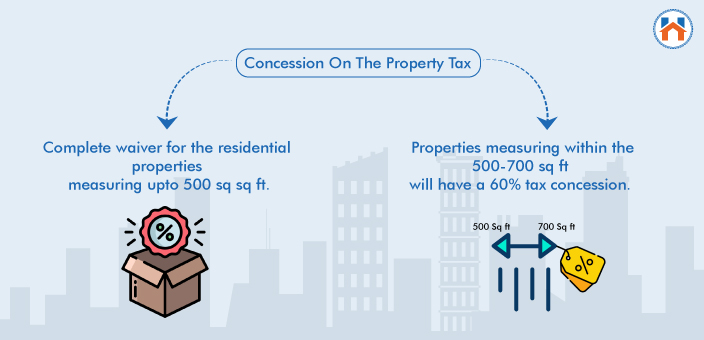

Concession On The Property Tax in Mumbai

Recently, the government of Maharastra has announced the complete waiver for the residential properties measuring upto 500 sq sq ft.

This waiver is applicable from the 1st of April 2022. The Government of Maharastra will be making the necessary amendments to The Municipal Act 1888.

There will also be no cesses applicable for the properties measuring below 500 sq ft.

The concession on the MCGM property tax will provide a significant relaxation to the property buyers. The waiver will benefit more than 16 Lakh properties with less than 500 sq ft.

Also, the properties measuring within the 500-700 sq ft will have a 60% tax concession.

FAQs

| On what factors does MCGM Property Tax Rate Depend?

The MCGM property Tax rates depend on the type of the property, the total value of the property, and the location among the other factors. |

| How to Pay The MCGM property Tax Online?

You can pay the MCGM property tax online by visiting the Citizen Portal Services Property Tax. |

| How to calculate the property tax Online?

To calculate the property tax online, visit the Citizen Portal Services at ptaxportal.mcgm.gov.in and click on the Tax Calculator options. |

| What are the concessions on the MCGM Property Tax?

The Maharashtra government has recently announced a complete waiver to the MCGM property tax for properties measuring upto 500 sq ft. |

| When to Pay MCGM Property Tax in Mumbai?

The MCGM property Tax in Mumbai needs to be paid annually in the month of June. |