Page Contents

Significant Difference Between A Land Loan VS Home Loan

| Home Loan | Land Loan | |

| Meaning | It is applied to buy or construct a home | It is applied to purchase land |

| Purpose | Used when the home is in the building process | Used when the home will be constructed later |

| Intend | It is used to purchase a developed or under-construction property | It is used to buy land to construct a building on it |

| Used | The home loan can be used to build a home for residential or commercial purposes | The land loan is used only for residential purpose |

| Loan Value | Around 75-90% value of the house can be received as loan | Around 75-80% of the land value can be received |

| Interest Rate | 7.50% on average | 7.15% on average |

| Loan Tenure | Up to 30 years | Up to 15 years |

What Is Home Loan?

A home loan is an amount borrowed from a lender or a financial institution to purchase a house. Around 80% to 90% of the current value of the property is offered after evaluating the eligibility for a loan of that borrower. It is a secured loan that is paid as EMI.

The lender will, however, hold the house until the whole amount is paid. When the principal and interest amount are repaid, the property’s title is transferred to the owner.

The lender will possess the property’s title to recover the outstanding loan amount if the borrower cannot pay the dues.

You can avail of tax benefits on home loans and land loans under sections 24 and 80C. Avail deduction on EMI with a maximum of 2 lakhs u/s 24 and deduction on the principal amount with a maximum of 1.5 lakhs deduction u/s 80C.

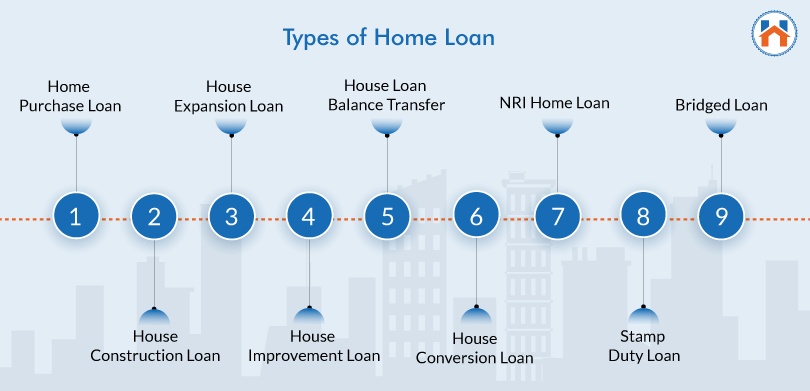

Types Of Home Loan

There are different types of home loans offered to a borrower by a bank apart from purchasing a residence.

Home Purchase Loan

A home purchase loan is one of the standard loans which is offered by the bank to the borrower to buy a residence. These properties can be a bungalows, flats, or row homes.

Banks will provide only 80-90% of the total current value of the property after considering the eligibility of the borrower to repay the loan amount.

House Construction Loan

The bank or lender will evaluate the land you own at first where you want to build your home. To receive the loan amount, you need to provide the following details to the bank:

- The land to build the home was acquired within a year

- The borrower will have to provide a rough pre-estimated cost for building the house to the bank

- The borrower can consider both the cost of the land and the estimated cost of the house or only the estimated cost of the house

Depending on all the above points, the bank will offer a specific amount to the borrower.

House Expansion Loan

The borrower can apply for a home loan if they wish to extend the space of their house. Both the existing as well as new customers can avail this type of loan. Generally floating interest rate is provided by the lender on this loan.

The interest rate for this type of loan is similar to the regular home loan. The credit score occupation profile and income status are evaluated by the lender before offering the loan.

House Improvement Loan

If you are planning to renovate your house, then you can avail a house improvement loan. This home loan will not only cover the repairs and renovations of the existing house but also for furniture, fixings, and furnishings.

This type of home loan would require minimal documentation compared to the standard home loan process.

House Loan Balance Transfer

An individual can avail of the benefits of a lower interest rate on a home loan from another bank and transfer the amount to their existing bank. This is also considered a top-up loan.

The new bank will provide a home loan to the borrower and transfer the outstanding amount to the existing bank account. However, the borrower will have to repay the loan amount to the new bank only at their interest rate.

House Conversion Loan

When you have already applied for a home loan but currently want to convert it into another type of home loan then you have to pay a conversion fee. You can move to a new home loan depending on your requirement for an affordable and competitive loan.

NRI Home Loan

The NRIs can apply for this home loan to construct or renovate their house. The process and the application of this loan are different from the standard process of a home loan.

Stamp Duty Loan

This type of loan is not widely popular among borrowers. This loan is taken to pay for the stamp duty during the time of purchasing a home.

Bridged Loan

This type of loan is used to benefit the borrower to buy a new property until the time they find a buyer for their existing home. This loan is designed for the existing homeowners to buy a new property.

The banks will keep the mortgage of the new property from the homeowner. The loan repayment can be extended for a minimum of 2 years. Very few banks offer this type of loan to their customers.

Home Loan Interest Rates

Different banks offer different interest rates on home loans apart from providing any other assistance. Currently, the loan interest rates for different loan amounts along with the processing fee are below

| Up to 30 lakhs (On An Average) | Above 30 lakhs to 75 lakhs (On An Average) | Above 75 lakhs (On An Average) | Processing Fee (On An Average) | |

| Public Sector Banks | 7.55% – 8.55% | 7.55% – 8.45% | 7.55% – 8.45% | 0.35% onwards |

| Private Sector Banks | 7.60% – 8.20% | 7.60% – 8.35% | 7.60% – 8.45% | 0.50% onwards |

There are different types of loan interest calculations which are followed by banks.

- Fixed Interest Rate: When you are paying a fixed amount of money for your installments during the total loan repayment period. The number of installments and the amount will be similar when the interest rate is calculated on a fixed interest rate. The borrower will benefit from this interest rate during the time of market fluctuation and the market rate is higher. However, the fixed interest rate is always 1-2.5% higher compared to the floating interest rate in every market situation.

- Floating Interest Rate: The interest rate changes as per the market condition. Hence, it always depends on the base rate of the loan amount. Any change in the base rate can cause a change in the interest rate every time. Banks are currently offering attractive floating interest rates to homebuyers. One of the main benefits of a floating interest rate is that it is always lower than a fixed interest rate by 1-2.5%.

How To Get Loan For Building A Home?

There are a few factors that are required to be noted before applying for a home loan like calculating the EMI, interest rate, and choosing the right institution to apply for the loan.

There are basically three stages to receiving a loan amount for building a home and the stages are:

- Apply for the loan: The initial step of getting a loan is to apply loan by filling up a form and providing the required documents to the lender.

- Evaluating Margin amount: The bank will now evaluate the applied loan amount and the eligibility loan amount. The documents provided will also be verified properly. The bank will then provide a loan sanction letter to the borrower.

- Disbursement of loan: The eligible amount will then be disbursed and deposited into the borrower’s account as a loan. Monthly installments of loan interest will be imposed accordingly.

What Is A Land/Plot Loan?

A customer can avail of the land or plot loan for the purpose of purchasing a plot for residential purposes. These types of loans are provided at a very affordable rate and it is easier to pay the EMIs as well.

The maximum tenure period for land or plot loans can be extended to 25 years. You can apply for a plot loan if you want to purchase the land now and construct your residence later after 1 year.

Types Of Land/Plot Loan

Raw Land Loan

Any land which does not have access to electricity, road, or sewage. It might be a little tricky to apply for raw land hence, you need to keep your plan for the plot ready.

You need to ensure that you are committed to the project, and the lender is impressed with your plan. Your plan should not be planned at a higher risk.

If you have a good credit score and make 20% or more of the down payment on time, there is a higher chance of loan approval. This type of loan has higher interest rates compared to other loans.

Unimproved Land Loan

The unimproved land is similar to raw land but a little more developed to it. There are some amenities available on that land but not necessarily electricity, gas connection, or phone box.

This type of land loan is also quite difficult to apply for, however, a proper plan of the project and a large down payment can make the process easier.

Improved Land Loan

Improved land has access to the proper electric supply, roads, water, and other amenities. Hence, the purchase rate of this land is higher compared to other lands.

However, the interest rate of this land loan is lesser comparatively. The borrower still has to make a good down payment and keep the credit score at a better level.

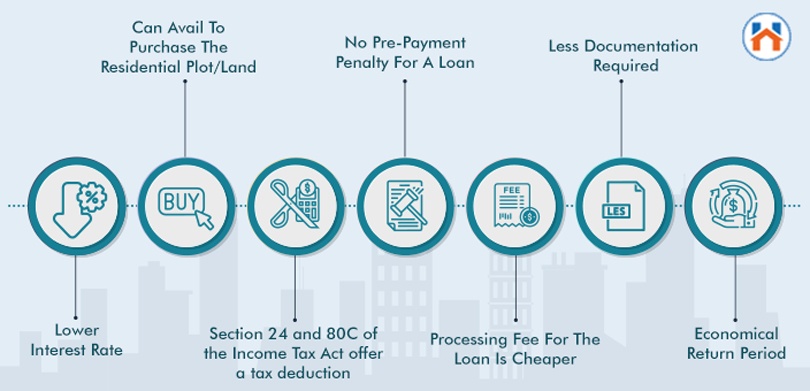

Benefits Of Land/Plot Loan

You can avail yourself the following benefits when applying for a land/plot loan:

- Can avail to purchase the residential plot/land

- Lower interest rate

- Economical return period

- There is no pre-payment penalty for a loan

- The processing fee for the loan is cheaper

- Less documentation required

- Section 24 and 80C of the Income Tax Act offer a tax deduction on this loan

Land Loan Interest Rates

The current land loan interest rate, processing fee, and loan tenure in the market can fluctuate from bank to bank or it can be similar depending on the demand.

| The current rate of interest | 7.15% |

| Processing fee | Rs 10,000 or 0.5% of the loan amount |

| Maximum amount of loan | 90% of the property value |

| Maximum loan repayment period | 30 Years |

| Minimum EMI amount over every lakh | Rs 675 |

In the Land loan process, the banks usually calculate the interest rate based on fluctuating rate considering the market.

How To Get A Loan For Buying Land?

The procedure of getting a land loan is similar to a home loan. The key requirements of the documents are also similar to the home loan requirements.

At first, you need to apply for the same at the bank and provide the required documents. The bank will then verify your credit score and documents along with evaluating the land.

After the verification is done, you will receive a loan sanction letter and the loan amount in your bank account.

FAQs

| Q: What is the difference between a home loan and a plot loan?

Ans: The major difference between a home loan and a plot loan is that a home loan is taken for a developed or under-construction house, and a plot loan is taken to buy land and construct a home later. |

| Q: Is it better to apply for a land loan to buy a plot?

Ans: You can apply for a land loan to buy a plot. The land developers on the other hand state that it is beneficial to buy land because the price of land always appreciates with time. |

| Q: Can I avail tax benefit on a home loan?

Ans: Yes, you can avail of deductions on home loans u/s 24 and 80C. |

| Q: Can I claim tax benefit on home loan interest for 2 houses?

Ans: The government has introduced a significant amendment in FY 2019-20 where a taxpayer can avail of dual tax benefits. Hence, an individual can claim another tax deduction on their 2nd home loan apart from the 1st home loan. |

| Q: Can I and my wife separately claim tax benefit on the home loan?

Ans: As you and your wife both are equally owning the property, you both can claim for a tax deduction on home loan u/s 24 and 80C. |