Page Contents

- Elements of KDMC Property Tax

- How is KDMC Property Tax Calculated?

- KDMC Property Tax Login For Citizen

- KDMC Property Tax View Bill Online

- Process For KDMC Property Tax Online Payment

- KDMC Property Tax Payment Online via Mobile App

- KDMC Property Tax Online Payment Receipt Download

- Penalties And Refunds for KDMC Property Tax

- FAQs

Elements of KDMC Property Tax

The Kalyan Dombivli Municipal Corporation was founded in 1982. The KDMC’s operational area is 67 sq kilometres, and the resident population as of the 2011 census is 12.46 lakh. There are elements to the online process of KDMC property tax payment.

They are mentioned below,

- Tax in general

- Tax on water supply benefits

- Road toll/tax

- Environmental tax

- Tax on conservancy benefits

- Education tax for Kalyan MC

- charge SWM

- Interest charges

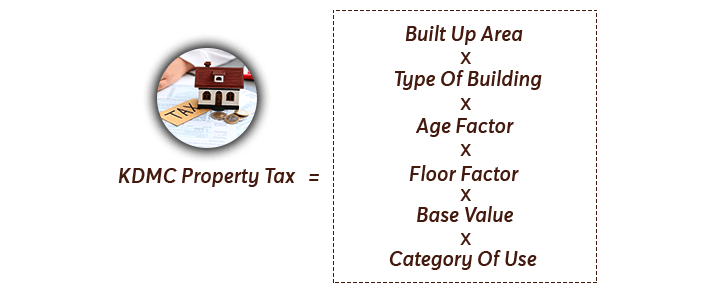

How is KDMC Property Tax Calculated?

The KDMC property tax calculation is done based on the factors given below.

- Built-up area

- Age factor

- Base value

- Floor factor

- Building type

- Category of use

The formula to calculate KDMC property tax is,

Even though KDMC property tax is governed by the property’s cost, it will alter over time. In general, the tax rates for residential are slighter expensive than the tax rate for commercial properties.

Even though KDMC property tax is governed by the property’s cost, it will alter over time. In general, the tax rates for residential are slighter expensive than the tax rate for commercial properties.

The KDMC House Tax online calculators are available through the municipal corporations’ web page and allow taxpayers to determine their outstanding taxes.

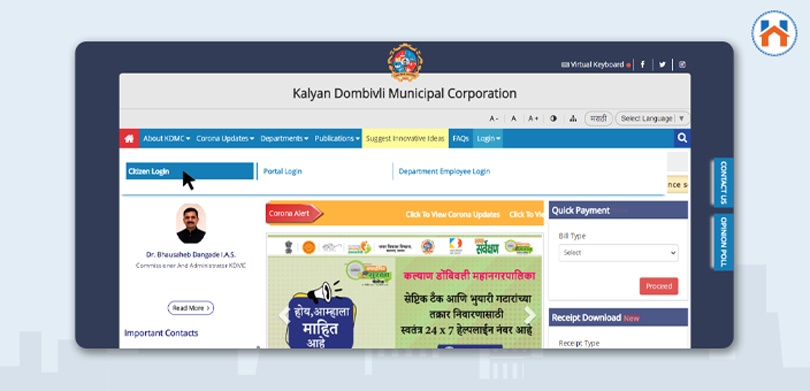

KDMC Property Tax Login For Citizen

If you are a resident of Kalyan Dombivli then you can use the e-services offered by the municipal corporation of KDMC. This includes online tax payments, online bill views, online name changes, online property transfer requests etc. To avail of this, you need to log in or register to the official portal of KDMC.

If you are a resident of Kalyan Dombivli then you can use the e-services offered by the municipal corporation of KDMC. This includes online tax payments, online bill views, online name changes, online property transfer requests etc. To avail of this, you need to log in or register to the official portal of KDMC.

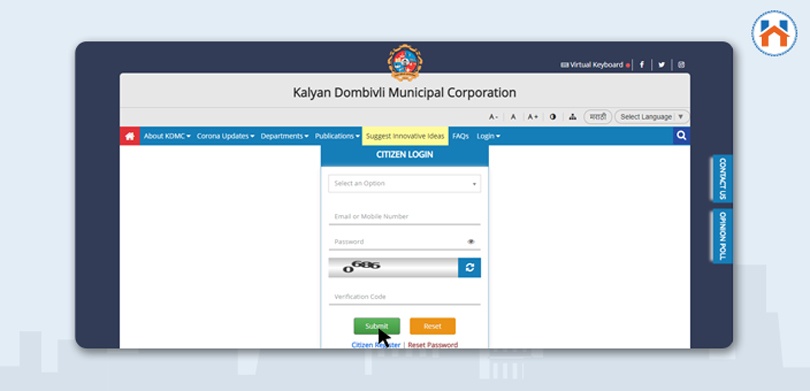

To login into the citizen login service, Enter your user ID i.e. email ID or mobile number and password.

After that, a verification code is below it.

If you are new then register yourself on the official website. visit the citizen login tab, and on that page click on citizen register.

If you are new then register yourself on the official website. visit the citizen login tab, and on that page click on citizen register.

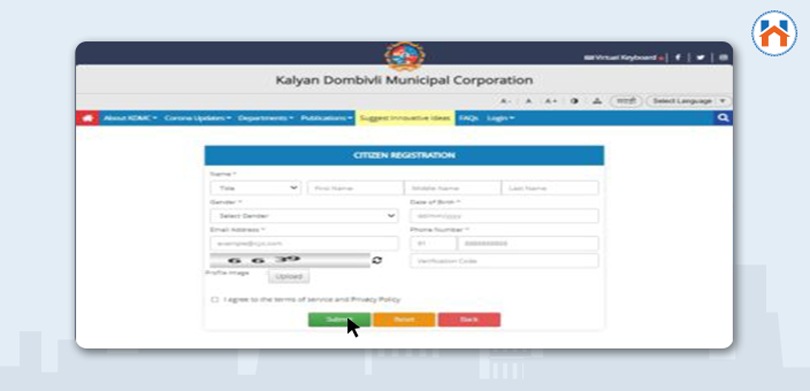

Now fill out the form with all your required information and submit it. You will receive an acknowledgement for registration by KDMC.

Now you can log in with the help of a web portal and avail of all the e-services.

KDMC Property Tax View Bill Online

Citizens from Kalyan-Dombivli can view their property tax bill online on the official website or the mobile application of KDMC.

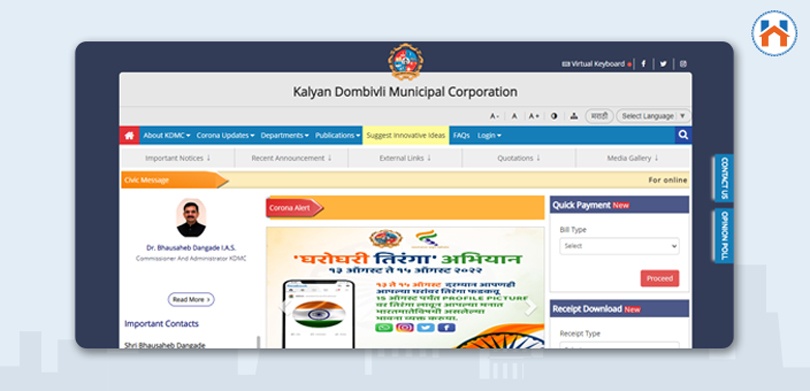

Step 1: For KDMC property tax view bill online visit the Official portal and click on ‘Quick Payment’.

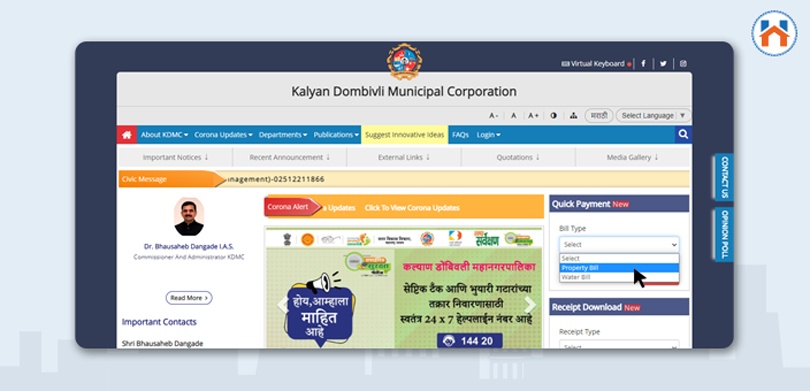

Step 2: Select the bill type from the dropdown. And select property type.

Step 2: Select the bill type from the dropdown. And select property type.

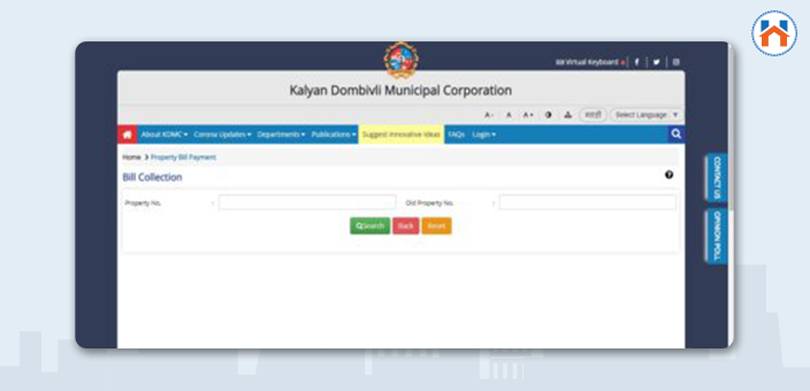

Step 3: Now enter your property number with the old property number and click on the search option for KDMC property tax bill view.

Step 3: Now enter your property number with the old property number and click on the search option for KDMC property tax bill view.

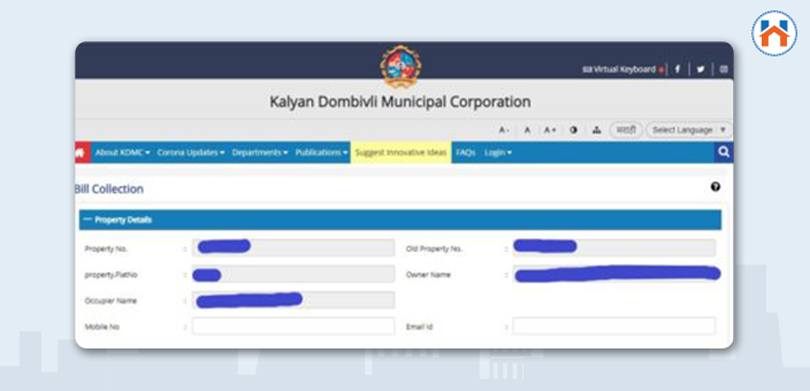

Step 4: On the next page you will see property details like the owner’s name, property number, and mobile number.

Step 4: On the next page you will see property details like the owner’s name, property number, and mobile number.

Step 5: Under property, address details property location, and Pincode will be viewed.

Step 5: Under property, address details property location, and Pincode will be viewed.

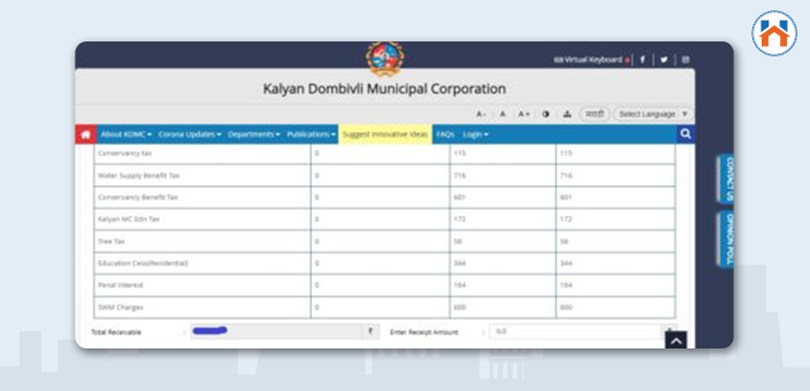

Step 6: Under receipt amount detail you can view the current tax, tax description, total balance and overall total tax balance needed to pay.

Process For KDMC Property Tax Online Payment

KDMC property tax payment can be done online via the Municipal Corporation’s official website.

Follow the process given below for KDMC property tax online payment.

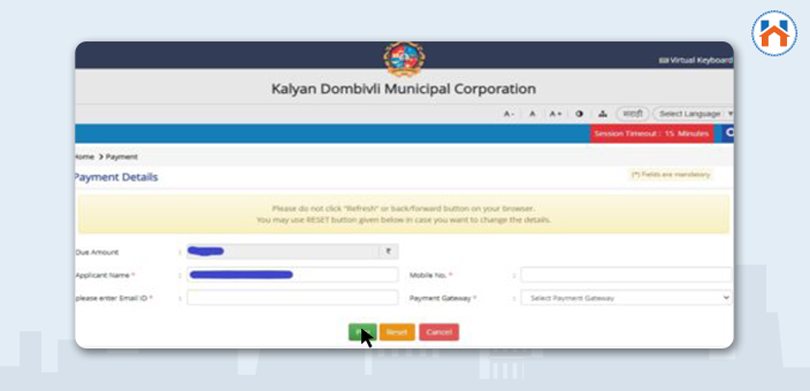

Step 1: Once you view the bill from the above process of KDMC property tax view bill through the official website of KDMC, you will see the gateway for the payment option, click on the ‘Pay’ option to make the payment of KDMC property tax.

Step 2: You will be taken to the payment page where you can see the total amount and reference number of your bill.

Step 3: Now you will see payment modes like debit/credit card, Gpay, Phonepay, and Net banking. Choose the mode of payment for KDMC property tax payment. Click on ‘Pay Now’ and proceed.

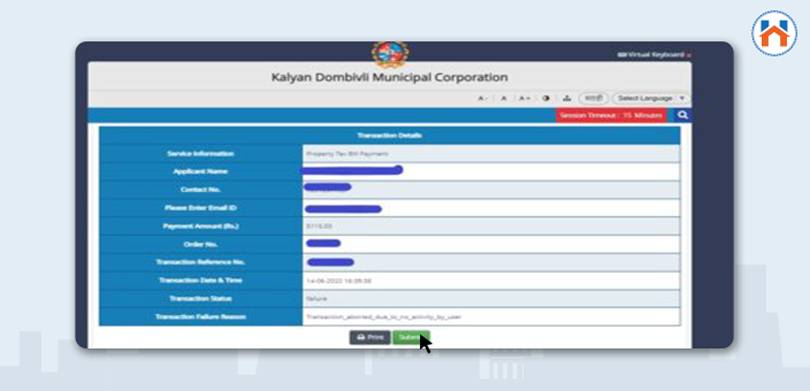

Step 4: Once the payment process is complete you will see transaction detail. Save it or print it for further reference.

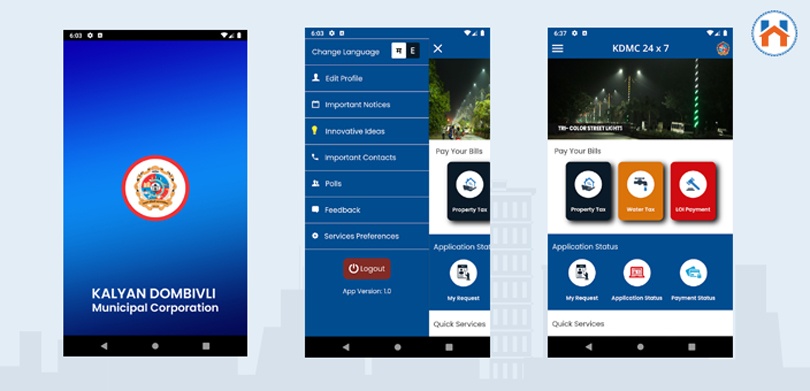

KDMC Property Tax Payment Online via Mobile App

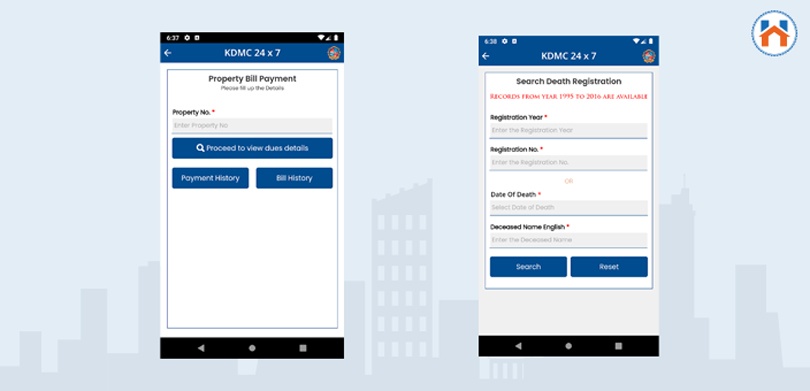

Now Kalyan Dombivli property owners can pay KDMC property tax payments online via the Mobile application on their smartphones. You can access the app on devices like Android or IOS.

KDMC app Download for Android

KDMC app Download for IOS

Once you download the app and installed it you can follow the process given below to pay KDMC property tax payment online.

Step 1: Register yourself with all your details like name, address, mobile no. email ID and property details.

Step 2: Click on the Submit option. OTP will be received on your registered mobile number. Now create your password.

Step 3: Once done with the initial process now log in with your mobile number and password.

Step 4: Now click on the property tax option. On the next page enter all required details and click on the payment option to make the payment for KDMC property tax.

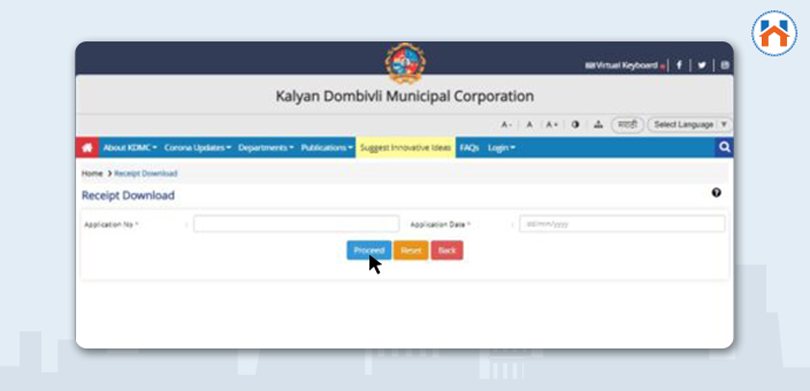

KDMC Property Tax Online Payment Receipt Download

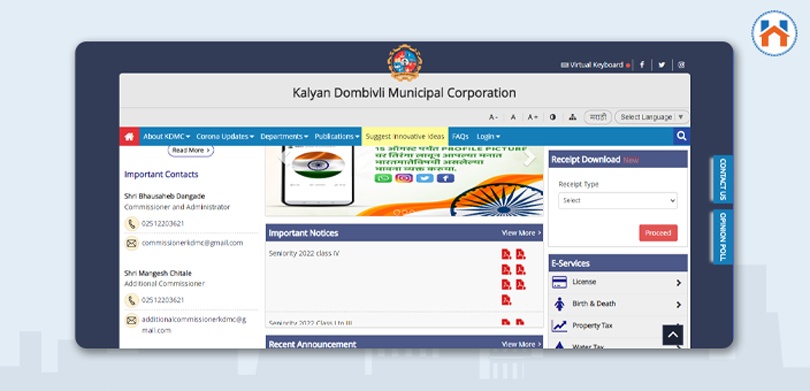

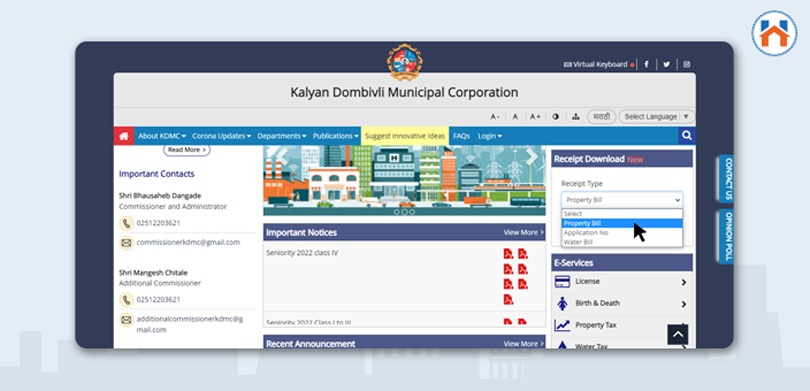

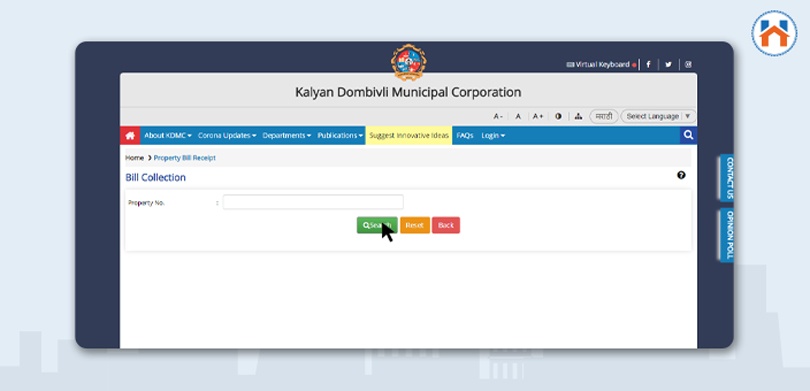

KDMC property tax receipts can be downloaded on the official website of KDMC. Follow the process to download KDMC property tax online payment receipt.

Step 1: Click on Receipt download on the Official Portal of KDMC.

Step 2: Here Select the property bill from the dropdown, it will take you to the next page where you need to enter the property number and date of the receipt and click on proceed.

Step 3: If you have selected the application number it will take you to the page where you can submit the application number and date and finally click on submit.

You will get the option to download the KDMC property tax receipt.

Penalties And Refunds for KDMC Property Tax

A discount upon KDMC property tax is provided under specific conditions. On the other hand, you endanger paying interest at a rate of 5-20% if you don’t make the KDMC property tax payment on time.

Also, read TMC Property Tax Online Payment.

MBMC Property Tax– Online Payment & Bill Download Process

Vasai Virar Property Tax: Online Payment And Bill Download

MCD Property Tax 2025 – Online Payment Process & Payment Receipt

BBMP Property Tax: Online Payment Process

FAQs

| How can I get the KDMC property number?

To receive the property number, contact the KDMC’s TDP Department. The property number can be found on any printed bill, and you can ask your lender if your mortgage is used to pay property taxes. In this situation, request a copy of the invoice from your lenders. |

| How can I change my name in KDMC property tax online?

The applicant must log in to the website and register. Using the credentials, the candidate can log in and complete the form as directed. The candidate can complete the online “Change of Name” application form inside the citizen’s login section: Application. Send in your application. |

| How do I check if my property is KDMC approved?

You can verify the specifics of both commercial and residential properties by using the toll-free number 1800-233-7125. To learn more about the properties, potential purchasers can also get in touch with KDMC’s TDP department, an official added. |

| Is Palava under KDMC?

After years of paying double property taxes, KDMC has eventually decided to give residents of Palava City, the state’s first integrated township project, a 66% property tax rebate. |

| How much is the property tax in KDMC?

Residential properties, including water supply, general, educational, transportation, sewage, and sewage utilities, are subject to a 71.5% property tax levied by KDMC. Property taxes on commercial premises are 83%. |