Page Contents

What is an Indemnity Bond For Property?

Legal documentation is an indemnity bond that gives you the authority to demand payment from the legal principal in the event of a stated circumstance.

Legal documentation is an indemnity bond that gives you the authority to demand payment from the legal principal in the event of a stated circumstance.

An indemnity bond for the property is equivalent to a contract where one party promises to make up for any losses or damages the other side is involved financially. These bonds make up a significant portion of surety bonds.

When a real estate transaction is completed, a surety business signs an indemnity bond. It may also be interpreted as a guarantee of payment in the event of fraud.

For example, if the bonded company contractor fails to complete the project on time, then the company has to get another contractor to complete the job.

An indemnity bond meaning in Marathi is क्षतिपूर्ती बंधपत्र and meaning in Hindi is क्षतिपूर्ति बॉन्ड.

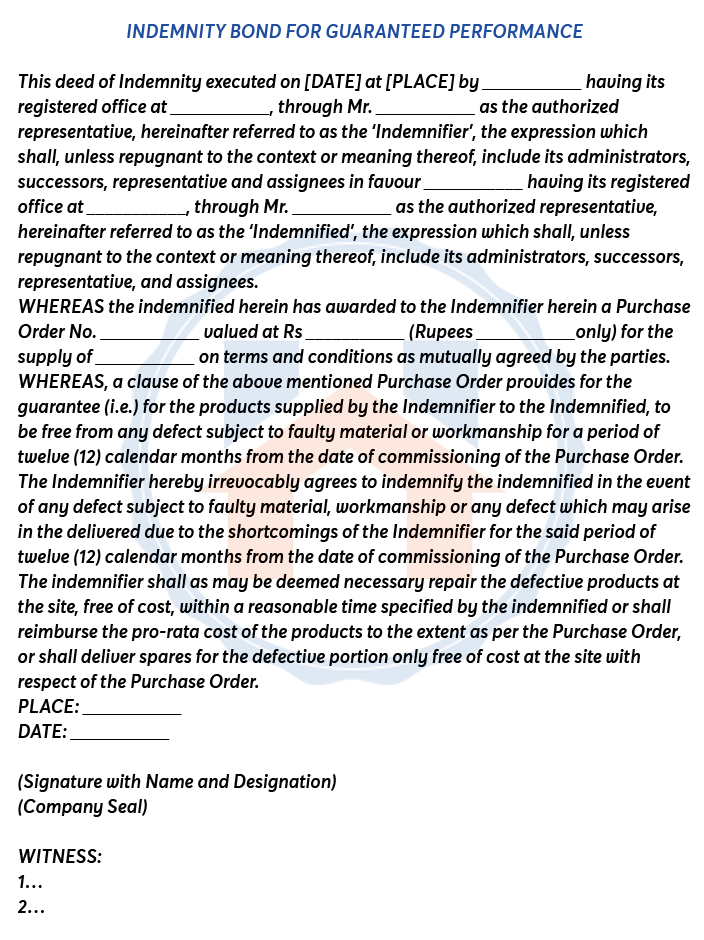

How To Draft an Indemnity Bond?

The following format can be used to draft an indemnity bond, which must be notarized on stamp paper with a value that varies by every state.

Why is an Indemnity Bond Required?

The indemnity bond is required in various circumstances. For instance, in the building sector, while purchasing a home, business, or shares, or when working with government indemnification programmes.

The indemnity bond is required in various circumstances. For instance, in the building sector, while purchasing a home, business, or shares, or when working with government indemnification programmes.

An indemnification bond facilitates the professional and moral advancement of initiatives.

An indemnity bond is needed for large sums so that in the future (after the transmission is complete) if there is a disagreement and the court rules in anticipation of the current applicant, the indemnity bond guarantees that the original unit claimant will make up the fund house’s loss because the former will be accountable for transmitting the components to the new claimant.

The most frequent justifications for indemnity bonds’ necessity are financial borrowing and property transfers.

- The indemnity bond is required for obtaining credit from the bank.

- The indemnity bond is used to Give property to legitimate successors.

- When a death claim occurs the indemnity bond is required.

- To release payment, an indemnity bond is required.

Indemnity Bond Registration

For the registration of an Indemnity bond, Stamp paper is required. The cost of stamp duty is different for every state. The cost is Rs. 100 in Maharashtra for a simple indemnity bond.

If an agreement is included with the indemnity bond, the minimum value increases to Rs. 300. Some fund companies require stamp papers to be worth Rs. 100, while others will take even one that costs Rs. 20.

- First, you need to draft the indemnity bond with the help of a legal expert.

- Second, to execute the indemnity bond stamp paper is required.

- After fixing a date at the sub-registrar’s office for bond registration.

- Pay government registration fees

- Both the involved parties with two witnesses are required to be present at the sub-registrar’s office on the fixed date.

- After a week registered indemnity bond can be collected.

Indemnity Bond Format Pdf

An indemnity bond is a legal document prepared in various circumstances. You can refer given indemnity bond format pdf for your reference.

Indemnity Bond Format For Bank

Following is the indemnity bond format for a bank for your reference.

Indemnity Bond Format For Release of Payment

Here the indemnity bond format for release of payment is given below for your reference.

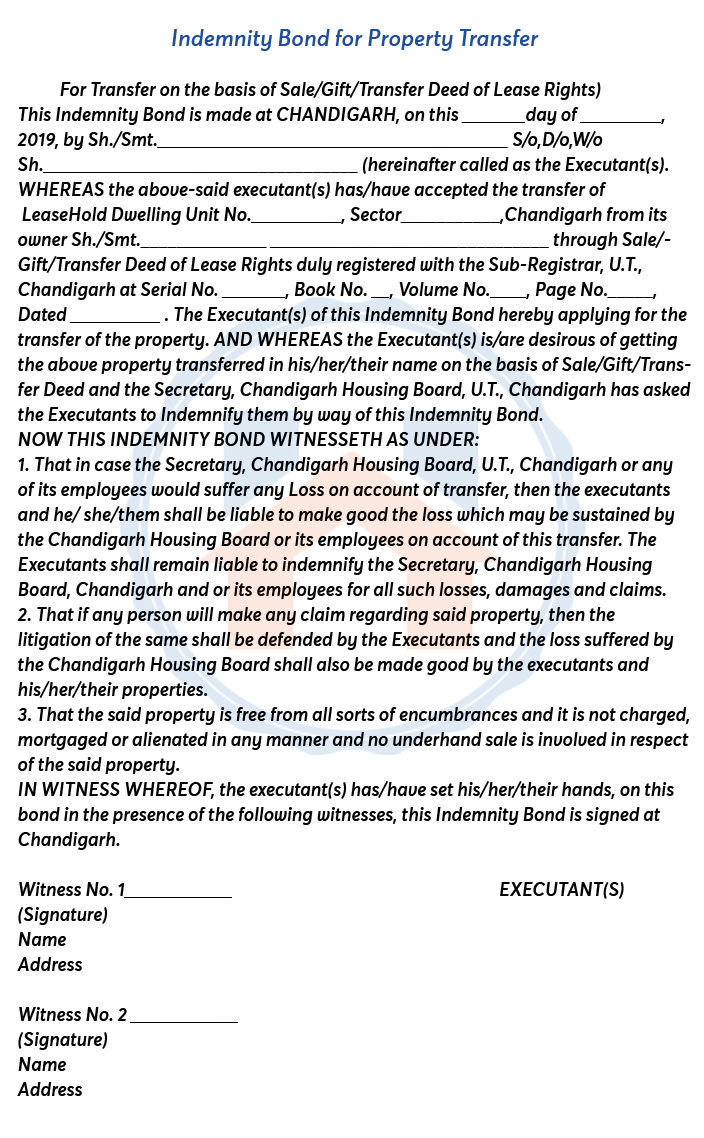

Indemnity Bond for Property Transfer Format

You can refer to the following format of Indemnity bond for property transfer.

Also, Read about the Rectification Deed and its format.

FAQs

| What is the cost of an indemnity bond?

The stamp duty charges are required to be paid which is Rs.100 and 3% of the security value is required to pay. |

| Is indemnity bond legal in India?

A legal release from the fines or obligations associated with any method of action is known as indemnity. In other words, if specific costs specified in the agreement of indemnification are obtained by another party, one party is required to compensate the other. |

| What is the purpose of an indemnity bond?

For the bondholder, an indemnity bond functions like security. Securing compensation, particularly in the event of a personal loss, defends the holder. |

| Who prepares indemnity bonds?

The indemnity bonds are prepared by third-party organisations, such as banks or insurers, who consents to pay compensation to either party if the other party breaches the terms of the agreement. |

| Who is protected by an indemnity bond?

An indemnity bond is a contract that guards against loss for the lender in the event of a borrower defaulting on a binding loan. The principal pays up to the entire bonded amount if the principal breaches the functionalities (as agreed upon between the agreed amount and the principal) (including legal costs). |