Page Contents

- How Much Tax Save on a Home Loan

- 5 Income Tax Benefits on Home Loan

- Income Tax Rebate on Home Loan for Interest Paid

- Income Tax Rebate for Interest Paid on Loan During the Initial Phase

- Home Loan Deduction Under Section 80C

- Income Tax Rebate on Home Loan for Stamp Duty and Registration Charges

- Rebate on Home Loan As Per Section 80EE and 80 EEA

- Rebate on House loan for Jointly Own Property

- Latest Update According to Budget 2024

- FAQs

How Much Tax Save on a Home Loan

The Indian government constantly demonstrated a solid willingness to motivate people to invest in homes.

By aiming to address the distress of accessibility as well as affordability, numerous schemes like the PMJDY ( Pradhan Mantri’s Jan Dhan Yojana) are shining brightness on our country’s property market.

There are numerous Income tax rebate on home loan that come with home loans when you purchase a property and drastically lower your tax bill. Both Interest payments and principal are part of a loan.

Following the Tax rebate, you can avail of a home loan.

5 Income Tax Benefits on Home Loan

While a housing loan can assist you in purchasing a home for yourself, it can also prove to be a costly endeavour. However, the numerous tax advantages that are associated with such home loans enable you to make annual financial savings.

Income Tax Rebate on Home Loan for Interest Paid

In order to buy or build a property, you must take out a mortgage. If the loan is being used to construct a home, it must be finished within five years of the end of the financial year during which the home loan was obtained.

There are two parts to the EMI for repaying a housing loan.

- Principal payment

- Interest payment

As per Section 24, a person can deduct amounts up to Rs 2 lakh an income tax rebate on a home loan from their overall revenue for the interest element of an EMI they paid throughout the year.

Income Tax Rebate for Interest Paid on Loan During the Initial Phase

When you buy a house which is under construction and not living in it yet. But you have started paying EMIs for your house loan.

If this is the case, you won’t be qualified to reduce interest on a housing loan until the property construction is done or when you buy a house that is been constructed already.

As per the Indian Income Tax law, this kind of interest, known as the pre-construction interest, is allowed to be deducted.

With the reduction you are entitled to claim on your home property income, a reduction in 5 equal monthly instalments starting with the year the house construction is done or acquired is authorised.

Home Loan Deduction Under Section 80C

Section 80C permits a reduction for the principal element of an EMI payable during the year.

Furthermore, the property cannot be sold during 5 years of residency in order to permit this rebate. If not, the prior deduction will be taken out from your earnings during the year of sales.

Income Tax Rebate on Home Loan for Stamp Duty and Registration Charges

Apart from the rebate on principal repayment per Section 80C, a reduction for custom duties and fees of registration can also be done in inclusion to the reduction for principal compensation, but up to total of Rs 1.5 lakh.

This can only be claimed during the year these charges are incurred.

Rebate on Home Loan As Per Section 80EE and 80 EEA

Home buyers are allowed an extra deduction according to Section 80EE up to a threshold of Rs 50,000.

There are a few conditions to claiming this rebate such as

- The value of the house should be under Rs. 50 lakhs and the taken loan amount should be up to Rs 35 Lakhs or less.

- The loan had to be agreed on between April 2016 to March 2017.

- The person must be a first-time home buyer.

The reinstated Section 80EE is only applicable to loans approved up until the end of March 2017.

In 2019, another additional rebate was introduced according to section 80EEA in favour of home buyers.

For this, there are some conditions to meet for availing of this rebate.

- The property’s stamp charges should not be higher than Rs 45 lakh.

- The loan should be approved in between 1st April 2019 – 31st March 2022.

- The house buyer must be a first house buyer.

- If the person requests a reduction under Section 80EEA, they should not be allowed to claim for Section 80EE.

Rebate on House loan for Jointly Own Property

If the home loan is taken out jointly, individual loan holders may deduct housing loan interest up to a total of Rs. 2 L from their taxable income, as well as principal payments per Section 80C until a total of Rs. 1.5 L.

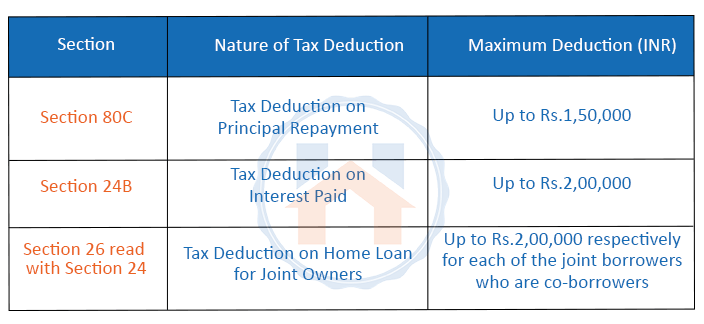

Here is the complete section’s guide for the understanding of benefits on home loan.

Latest Update According to Budget 2024

In 2024, the anticipated sustained increase in demand is likely to persist, albeit at a potentially decelerated rate. This is fueled by the nation’s robust economic growth and the expectation of a decline in interest rates for home loans.

Sharing the views on Budget 2024, Homebazaar.com VP Nikhil Naikhare said,” The real estate sector consistently submits an ambitious wish list to the Finance Ministry every year ahead of the annual Union Budget. Common requests include industry status for housing and streamlined approval processes for housing projects, and these continue to be on the agenda this year. Due to the typically sluggish resolution of challenges faced by the real estate sector, expectations remain largely unchanged, despite their continued urgency. However, it is important to maintain realistic expectations for the interim budget preceding the general elections.”

Raising the tax rebate on home loan interest rates from Rs 2 lakh to a minimum of Rs 5 lakh under Section 24 of the Income Tax Act is imperative.

This adjustment has the potential to invigorate the housing market, especially in the affordable homes category, which has witnessed a dip in demand post the pandemic.

Also, Read What is TDS applicable to rent.

FAQs

| Is taking a home loan a good idea for tax exemption?

There are many benefits which you can avail of on a home loan which includes tax deduction as per the income tax section. |

| Is the home loan principal part of 80C?

The highest deduction permitted for the settlement of a home loan’s principal amount is Rs. 1.5 lakh per section 80C of the Tax Act. |

| Can I claim both HRA and home loans?

You cannot claim the HRA tax benefit since you live in the home, have a housing loan, and employ in the same city. However, since you now own the property, you can deduct principal as well as interest payments made on your mortgage from your income taxes. |

| Can I claim both 24B and 80EE?

If a person can meet both section conditions simultaneously, he is eligible to claim both sections. |