Disclaimer:

With 11+ years of experience & expertise in the real estate industry, Homebazaar provides end-to-end property-buying solutions. Hundreds of 100% verified RERA-registered residential & commercial properties are listed on our website. We provide facilities like Zero brokerage, 360° virtual street view, effortless site visit services, end-to-end property buying agreements & documentation guidance, and low-interest home loan assistance. This helped us gain the trust of 55,000+ clients across India & sold 6,500+ homes of top reputed developers.

Page Contents

- Major Difference Between Home Loan Sanction Letter, In-Principle Sanction Letter, and Disbursement Letter

- Home Loan Sanction Letter, In-Principle Sanction, And Disbursement Letter in Home Loan Process

- In-Principle Sanction Letter Meaning

- Home Loan Sanction Letter Meaning

- Disbursement Letter Meaning

- FAQs:

Major Difference Between Home Loan Sanction Letter, In-Principle Sanction Letter, and Disbursement Letter

| Home Loan Sanction Letter | In-Principle Sanction Letter | Disbursement Letter |

| A home loan sanction letter is provided by the bank after the home loan eligibility and property authentication is verified to proceed with the home loan agreement. | In-principle sanction letter includes the final approved in-principle amount along with the eligibility of the borrower. | The disbursement letter includes the details of the documents, which mention the amount disbursement from the bank. |

| In the initial stage of the home loan procedure, an In-principle sanction letter is provided after analyzing the financial status of the borrower. | The home loan sanction process starts after the In-principle sanction letter is issued. | After the loan is sanctioned, the borrower will be provided with a disbursement letter |

| Here the borrower does not have to sign any document | The borrower is required to sign the letter and submit it to agree with the terms and conditions of the lender. | The borrower will have to provide a disbursement request before receiving the disbursement letter |

| It takes 3 to 4 weeks to issue an In-principle sanction letter | It takes 3 to 4 weeks to sanction a home loan | A home loan disbursement may take two to three business days, depending on the type of property |

Home Loan Sanction Letter, In-Principle Sanction, And Disbursement Letter in Home Loan Process

After applying for a home loan, the bank will issue different documents or letters to the borrower. The approval of a loan can be a lengthy process that includes different sanctioned letters from the lender.

In this process, a home loan sanction letter, an in-principle sanction letter, and one disbursement letter will be issued, which are different from each other.

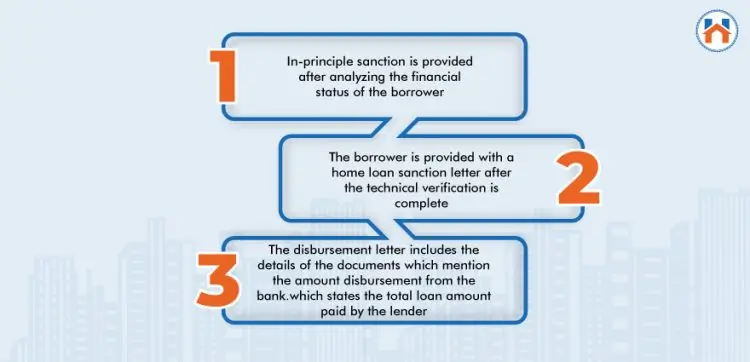

- In-principle sanction is provided after analyzing the financial status of the borrower. Hence, when a home loan is applied by any applicant, the lenders will evaluate all the provided details of the borrower and then issue an In-principle sanction letter which will mention the eligible loan amount and approve that the documents are verified. For pre-approved loans as well, the In-principle sanction letter is provided for which an extra fee is charged. However, the amount is adjusted with the total loan processing charge, and the validity of the In-principle sanction letter varies from 3 to 6 months.

- A home loan sanction process starts after the In-principle sanction letter is issued. Here the lender will verify all the documents for its authentication. Technical verification is done to check the authenticity of the property and legal verification is done for the documents provided. The borrower is provided with a home loan sanction letter after the verification is complete. The borrower is required to sign the letter and submit it to agree with the terms and conditions of the lender. However, the agreement will be valid till the specified date.

- The disbursement letter includes the details of the documents which mention the amount disbursement from the bank. The disbursement letter acts as the instructional letter for the bank which is required to be executed. The loan will be issued following the submission of the home loan sanction letter. During the process of loan disbursement, a disbursement letter is issued which states the total loan amount paid by the lender.

Note:

Homebazaar serves homebuyers searching for flats in India with end-to-end services like site visits, and lower-interest home loans to property registration guidance. We provide the best price options & offers for 1 to 4 BHK RERA-registered flats, villas & penthouse properties in India. To begin a smooth homebuying journey with us, fill out the form mentioned below or on the right side.

In-Principle Sanction Letter Meaning

When the borrower applies for a loan, the lender verifies the financial status and other detail. After the verification, a letter is issued known as In-Principle Sanction Letter. This letter explains that the lender will provide the loan when required and all the given documents by the borrower are verified.

Majorly three documents are followed to understand the repayment capacity of the borrower like their salary slip, bank account statement for a specific period of time, and income tax returns/ Form 16.

The In-Principle Sanction Letter specifies the maximum eligible loan amount for the borrower. Generally for pre-approved home loan products, the In-Principle Sanction Letter is issued.

A certain processing fee is charged, and it gets adjusted with the total processing fee of the loan. Generally, the validity of the sanction letter is for 3 to 6 months, which varies for different banks.

When the maximum eligible amount is specified in the sanction letter, it is convenient for the borrower to choose or buy a property as per their financial capability.

The Process Toward In-Principle Sanction Letter

The following steps are followed for In-Principle Sanction Letter when applied online:

- Filling up the details: The borrower should fill up a form with personal details like name, mobile number, the loan required and etc. After submitting the details, the borrower will receive a msg on their registered number and email regarding the order number.

- Login: The borrower will have to log in to their account by providing the login details in the message or email.

- Upload documents: The borrower will submit the relevant documents, which are related to the home loan application.

- Income Tax validation: The borrower then will be redirected to a new page of the income tax website where the income and employer validation will be provided. The lender will verify all the details and provide an In-Principle Sanction Letter to the borrower after the In-Principle approval.

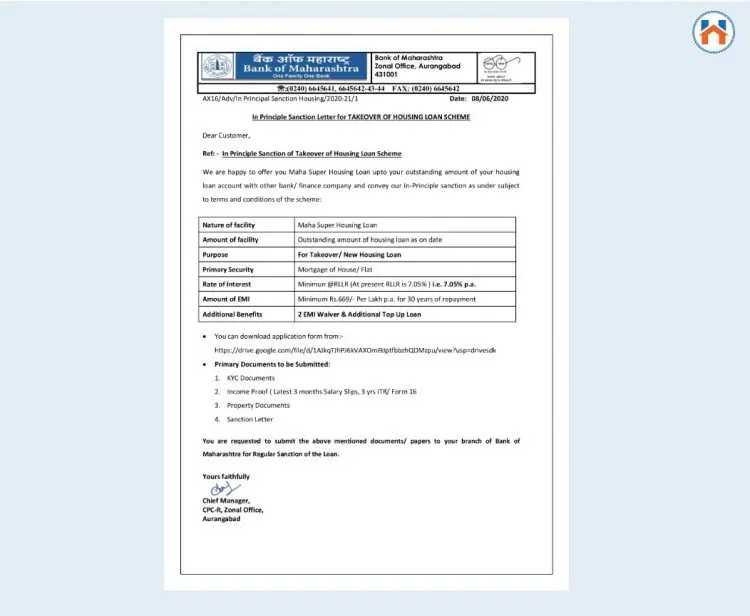

Basic In-Principle Sanction Letter Format

Download Pdf format of In-Principle Sanction Letter

Home Loan Sanction Letter Meaning

The bank or the lender issues a home loan sanction letter which is used for the further process of the loan agreement. This document states that the loan is approved after validating the details like credit history, the capacity of repayment, and the income of the borrower.

It is suggested that after receiving the home loan sanction letter, the borrower should read all the terms and conditions thoroughly. When agreed with the conditions, a signed copy should be submitted to the lender stating that you are agreeing to the terms.

The home loan sanction process starts after the In-Principle amount is validated by the lender. Here the lender will check for the following further details:

- CIBIL Score of the borrower

- Type and Location of the property

- The guarantor of the document

- Value of the property

- Legal documents

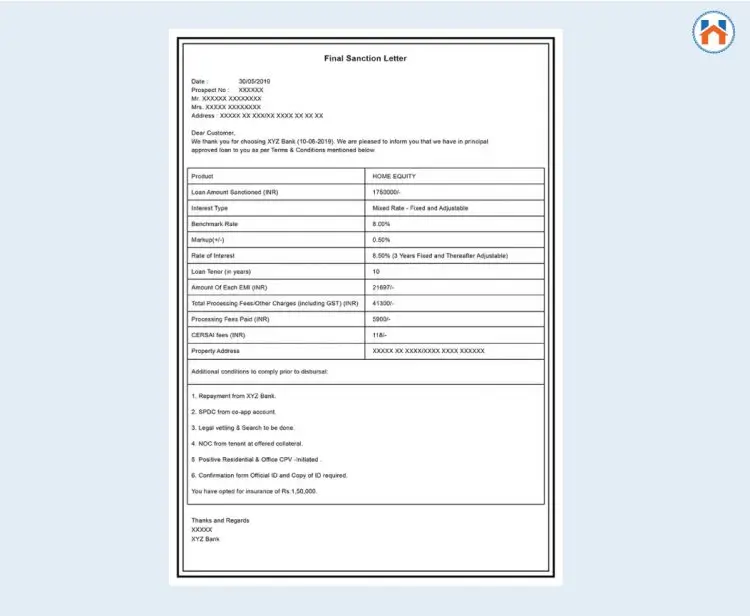

Details Provided In The Home Loan Sanction Letter

The following details are provided to the lender and the borrower for relevant information in a home loan sanction letter.

- Loan possession

- EMI payable to the borrower

- Validity of the home loan sanction letter

- Interest rate and its type

- The final amount of the sanctioned loan

- Conditions required to fulfill before disbursement of the loan

- Other terms and conditions

Basic Home Loan Sanction Letter Format

Download Pdf format of Home Loan Sanction Letter

Disbursement Letter Meaning

After the loan is sanctioned, the loan amount will be disbursed or provided to the borrower by the lender within one or more installments. A home loan disbursement letter may take 2 to 3 business days to be issued, depending on the type of property.

Following are the stages that are followed for the final disbursement of the loan:

- Filling out the home loan application form

- Submission of relevant and supportive documents

- Payment of processing fee for the loan

- Terms discussed with the lender

- Collection and verification of related documents

- Home loan sanction letter

- Property verification and legal checks

- Home loan disbursement

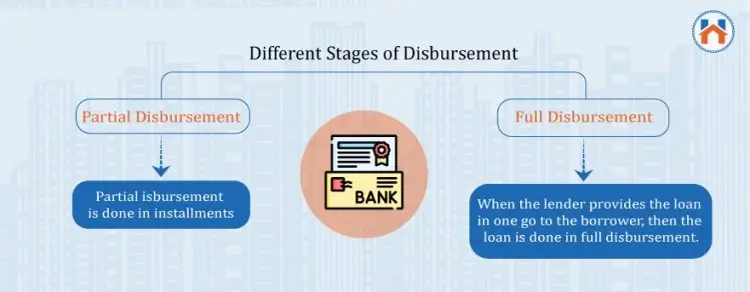

There are different Stages of Disbursement, which include the time and frequency of the loan disbursement from lenders.

- Partial Disbursement: Partial disbursement is done in installments. When the borrower is taking a loan for an under-construction apartment, the disbursement amount will be provided according to the stages completed by the construction.

- Full disbursement: When the lender provides the loan in one go to the borrower, then the loan is done in full disbursement. When any home buyer wants to take a home loan, they will be provided the loan amount at one time.

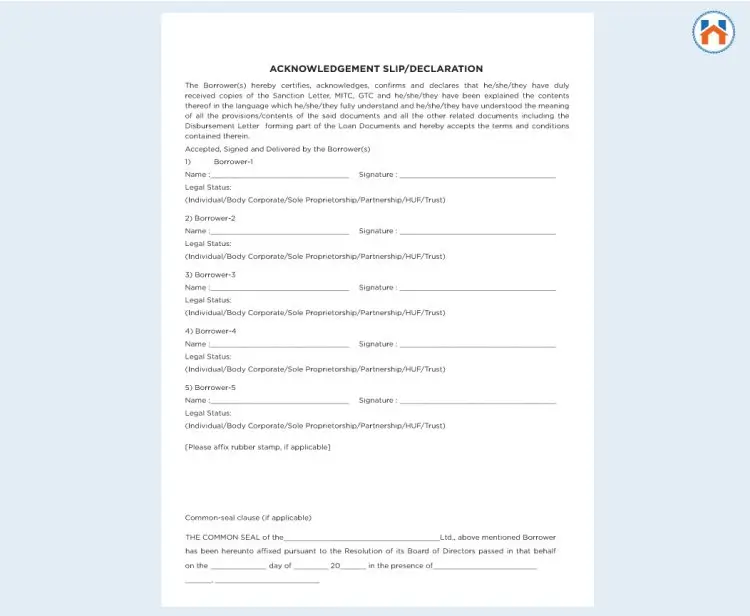

Basic Disbursement Letter Format

Download Pdf format of Disbursement Letter

FAQs:

| Q1: For how many days the home loan sanction letter is valid?

Ans: The home loan sanction letter is valid for 3 to 6 months. If the borrower does not avail of the loan amount till the date, then the sanction letter will be held invalid and the application process will start over again. |

| Q2: How much time does the final approval take?

Ans: Generally the final approval takes two weeks of time. However, it is not fixed for every lender because the time period depends on the type and stage of the property. |

| Q3: Which documents are required for a home loan?

Ans: The list of documents that are required for a home loan is following:

If the applicant is self-employed then they should provide the following:

|

| Q4: How much does it take to disburse the loan amount?

Ans: Generally the disbursement of the loan amount takes around 1 to 4 weeks. However, it is not fixed for the home loan disbursement. |