Page Contents

- About SBI Home Loan and HDFC Home Loan

- HDFC vs SBI Home Loan: Rate of Interest

- Home Loan HDFC vs SBI: Eligibility

- Processing Fees for Home Loan HDFC vs SBI

- Maximum Loan Amount for Home Loan

- Pros and Cons of SBI vs HDFC Home Loan

- Benefits and Features of SBI Home Loan vs HDFC Home Loan

- SBI Home Loan vs HDFC Home Loan

- FAQs

About SBI Home Loan and HDFC Home Loan

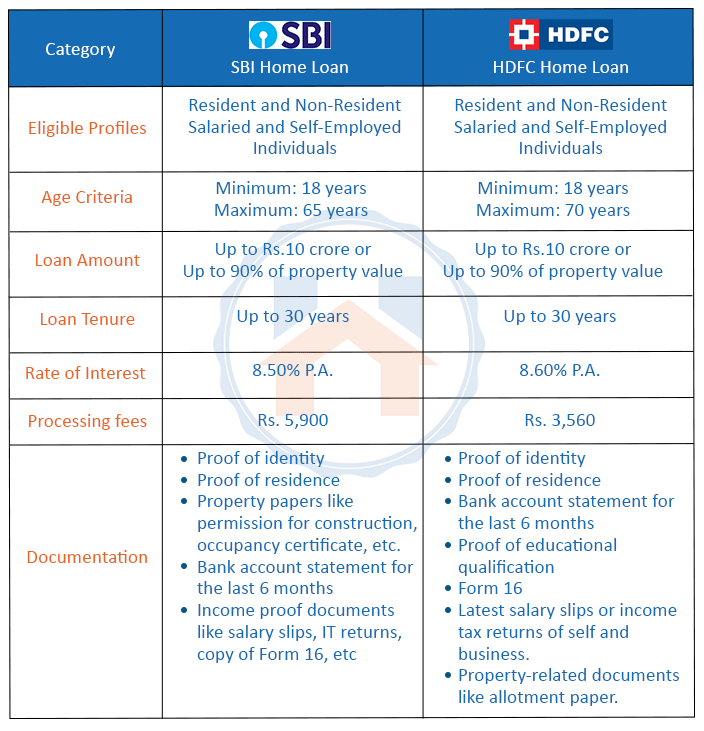

The distinctive features given below will let you know which is the best between HDFC vs SBI.

SBI Home Loan

The purpose of an SBI home loan is for both salaried employees and independent employees who can apply for SBI house loans.

The properties that are already built and those that are still under development are eligible for the loan.

SBI house loans can be utilised for home remodelling as well.

HDFC Home Loan

The goal of an HDFC Home Loan is to enable people from all aspects of life to purchase or build a home.

The loan can be avail for purchasing a new apartment or ready-to-move flat or even for plot purchase from DDA or MHADA.

HDFC offers special loans for farmers, agricultural workers, and others. Home loans are also available from HDFC to salaried and independent workers.

Note:

Homebazaar serves homebuyers searching for flats in India with end-to-end services like site visits, and lower-interest home loans to property registration guidance. We provide the best price options & offers for 1 to 4 BHK RERA-registered flats, villas & penthouse properties in India. To begin a smooth homebuying journey with us, fill out the form mentioned below or on the right side.

HDFC vs SBI Home Loan: Rate of Interest

Housing loans are long-term agreements, so it’s crucial to understand your whole interest liability at the outset.

You may easily use an EMI calculator to figure out the interest rate that will be charged on your home loan.

- The current rate of interest for HDFC Bank for a home loan is 8.60% P. A

- The current interest rate for an SBI home loan is 8.50% P.A

Home Loan HDFC vs SBI: Eligibility

Eligibility for HDFC Home Loan

- The person who is applying for a home loan must be younger than 65 years of age and at a minimum of 18 years old.

- Applicants must be employed and self-employed professionals who are residents or salaried non-residents.

Eligibility for SBI Home Loan

- A candidate needs to be at least 18 years old and not older than 70.

- A person applying for a home loan must be an employed or self-employed professional who is a resident or salaried non-resident of the country.

Processing Fees for Home Loan HDFC vs SBI

The processing fees are the charges applicable to home loans for handling documents, sanctioning and verification processes. This charge varies depending on the financial institution.

The HDFC home loan processing fee is a minimum of 0.5% i.e Rs. 3,560

The SBI home loan processing fee is a minimum of 0.1% i.e Rs. 5,900

Also other charges can be paid on the government’s official portal.

Maximum Loan Amount for Home Loan

The loan amount for SBI home loans and HDFC home loans is up to Rs. 10 CR or up to 90% of the value of the property.

Pros and Cons of SBI vs HDFC Home Loan

Both SBI and HDFC home loans have some pros and cons. Here is the list of it.

Pros of SBI Home Loans

- Affordable interest rates

- There are no upfront fees.

- Long-term repayment

- Special consideration is given to female applicants

- You can use your home loan as an overdraft.

Cons of SBI Home Loans

Compared to HDFC Bank, the maximum loan amount is less.

Pros of HDFC Home Loans

- Low rates of interest

- Reduce EMIs for women as part of a specific marketing initiative

- Long-term for repayment

- Loan approval prior to choosing a property with no additional fees

Cons of HDFC Home Loans

Compared to the State Bank of India, there is a higher rate of interest.

Benefits and Features of SBI Home Loan vs HDFC Home Loan

With the option to research a wide variety of house loan offers available in the market, top lenders like SBI and HDFC provide many benefits and features with home loans to the applicants.

SBI Home Loan Benefits and Features

- 5 basis points off of SBI’s house loan rates for female customers

- There is no penalty for prepaying floating-rate home loans

- There are overdraft, top-up, and balance transfer options available.

- There are also no hidden fees

- Appealing tax benefits

- Interest is charged on the daily falling balance.

HDFC Home Loan Benefits and Features

- Women’s borrowers are given lower interest rates.

- Available overdraft, top-up, and transfer of balance facilities

- Many loan repayment choices to suit individuals’ needs

- A simple and quick documentation process

- No hidden fees

- Competitive tax benefits.

SBI Home Loan vs HDFC Home Loan

Here is a brief comparison between SBI home loan vs HDFC home loan.

Also, Read What is Home Loan Insurance and its Importance.

FAQs

| Which bank is better for home loans private or government?

A public service bank will give you a house loan at a lower interest rate than the private operators while a private sector institution will complete the transaction more quickly. |

| Which government bank is better?

SBI is the biggest public sector institution in India and number one on the list of finest banks in India, this bank has 23% of the overall market assets in India. |

| Can I trust HDFC Bank?

For decades, HDFC Bank has offered the highest-quality banking and financial solutions and services, earning it the title of the most trusted bank in India today. |

| Is SBI Bank good for home loans?

SBI is the chosen bank for house loans for more than 40 lakh families. Along with traditional house loans, SBI also offers Top-Up loans with incredibly low interest rates ranging at only 8.60% p.a. |