A gift deed is an agreement that is used to transfer the ownership of one’s property to another immediately. A registration charge has to be paid to register or make the gift deed legally valid. In India, the transfer of ownership is governed by the Transfer of Property Act, 1882. This article has covered all the information on Gift Deed, format, and registration process of Gift Deed.

Page Contents

Gift Deed Meaning

Voluntarily Gifting movable or immovable property ownership through a document is known as a Gift Deed. It is a registered agreement that allows any person to transfer ownership without paying any money.

A gift deed can be done for movable as well as for immovable property. Anything or property that is attached to the land is stated as immovable property.

The properties which do not fall under the category of immovable property are stated ad movable property.

A gift deed is an agreement that is used when someone wishes to gift their property to someone. Transfer of ownership of the property from one person to another is done through a registered agreement.

The person who is giving their property as a gift is known as a donor, and the person who is receiving the gift is known as a donee.

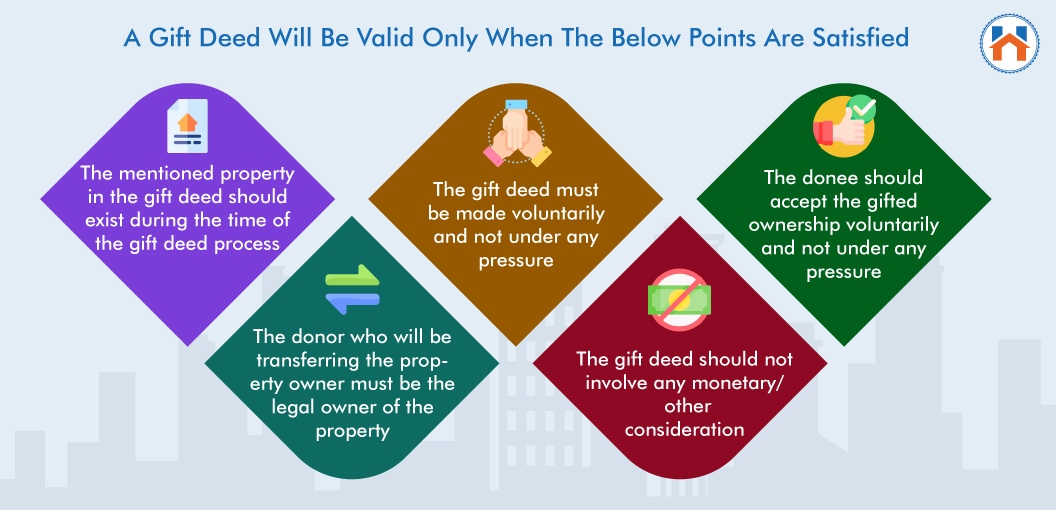

A gift deed will be valid only when the below points are satisfied:

- The mentioned property in the gift deed should exist during the time of the gift deed process

- The donor who will be transferring the property owner must be the legal owner of the property

- The gift deed must be made voluntarily and not under any pressure

- The gift deed should not involve any monetary/other consideration

- The donee should accept the gifted ownership voluntarily and not under any pressure

A registered gift deed is proof in and of itself. It also transfers the property immediately, unlike the will. The owner is not required to visit the court for any execution of the gift deed, and this also saves a lot of time.

A gift deed is the best option for receiving immediate benefits from the transfer of property ownership.

Gift Deed Registration

Only a registered gift deed or delivery of the property to the donee is valid under Section 17 of the Registration Act. 1908 and Section 123 of the Transfer of Property Act 1882.

As per Section 17 of the Registration Act of 1908, the donor should validate the gift deed through the proper registration process with the registrar or sub-registrar. According to Section 123 of the Act, any unregistered gift deed will be held invalid.

It is important that a moveable property or immovable property or the existing property which can be transferred to the donee should have a registered gift deed.

A registered gift deed would help to avoid any kind of future litigation.

The Procedure Of Gift Deed Registration

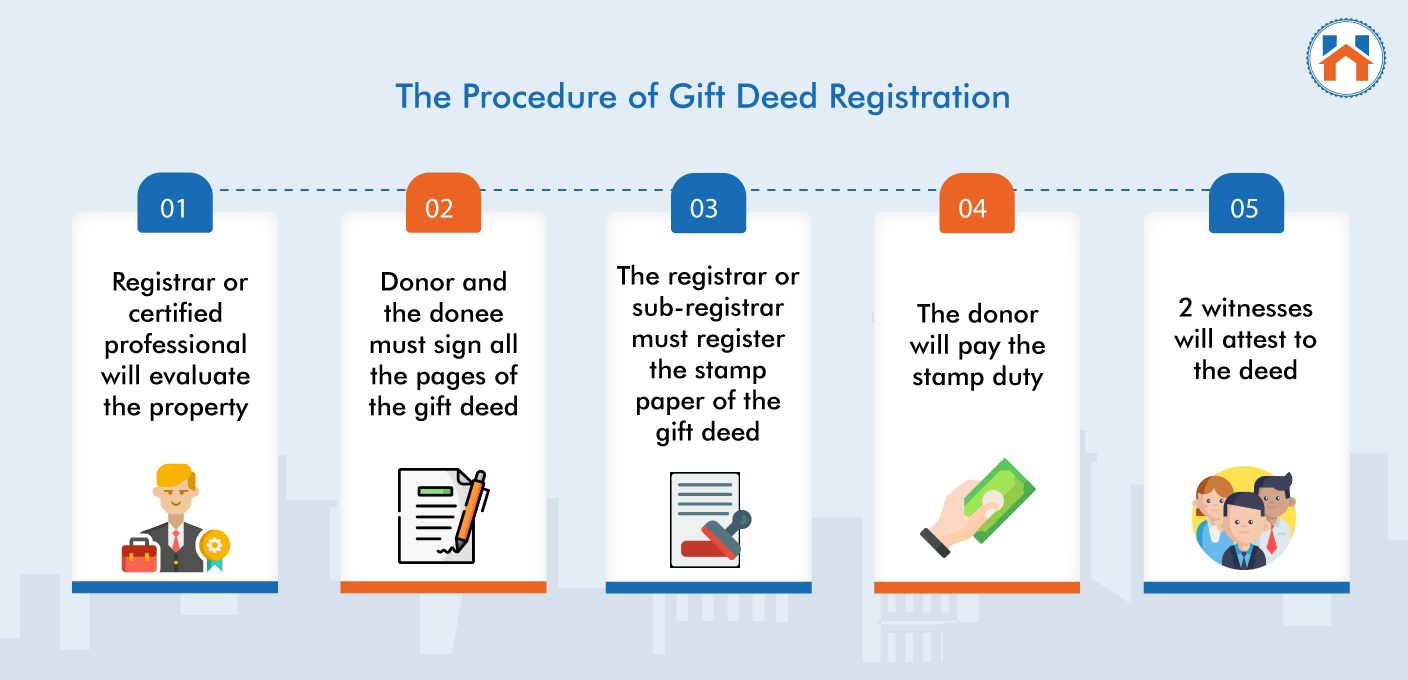

There is a procedure that is required to be maintained for a valid gift deed.

- The Registrar or certified professional will evaluate the property whether it is valid or not

- The donor and the donee must sign all the pages of the gift deed, and that must be attested by at least two witnesses.

- As per the Transfer of Property Act, the Gift Deed will become effective only when it is registered with the registrar or sub-registrar’s at their office. After that, the transfer of property will be instantly valid.

- The registrar or sub-registrar within whose jurisdiction the property to be transferred is located must register the stamp paper of the gift deed.

- If the property is moveable, then the Registrar or Sub-office Registrar should have jurisdiction over where the donor resides.

- The donor will pay the stamp duty

- 2 witnesses will attest to the deed

Format For A Gift Deed

This can be used to gift any movable or immovable property. The sender can also gift an already existing property that is easily transferable.

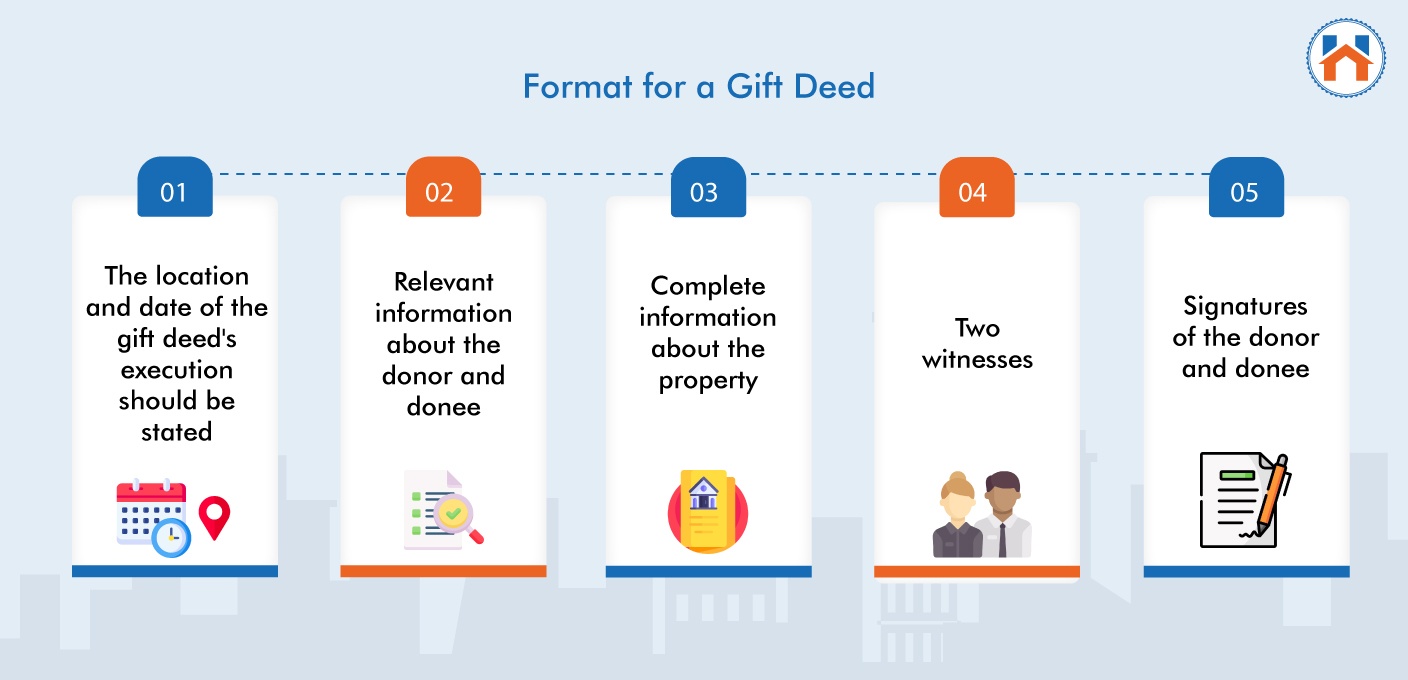

To avoid any kind of future litigation, it is better to register the gift deed. To register the gift deed, it is important that all the clauses discussed in the below points are drafted on the stamp paper properly:

- The location and date of the gift deed’s execution should be stated.

- On the gift deed, relevant information about the donor and donee, such as their names, and addresses, relationships, dates of birth, and signatures, is important to state.

- Complete information about the property you’re drafting a gift deed for is also important to declare.

- Two witnesses who will be present at the moment of registration of the gift deed

- Signatures of the donor and donee along with the witnesses

It is important to bring two witnesses who are required to testify about the gift deed as well as provide their signatures.

Gift Deed Sample

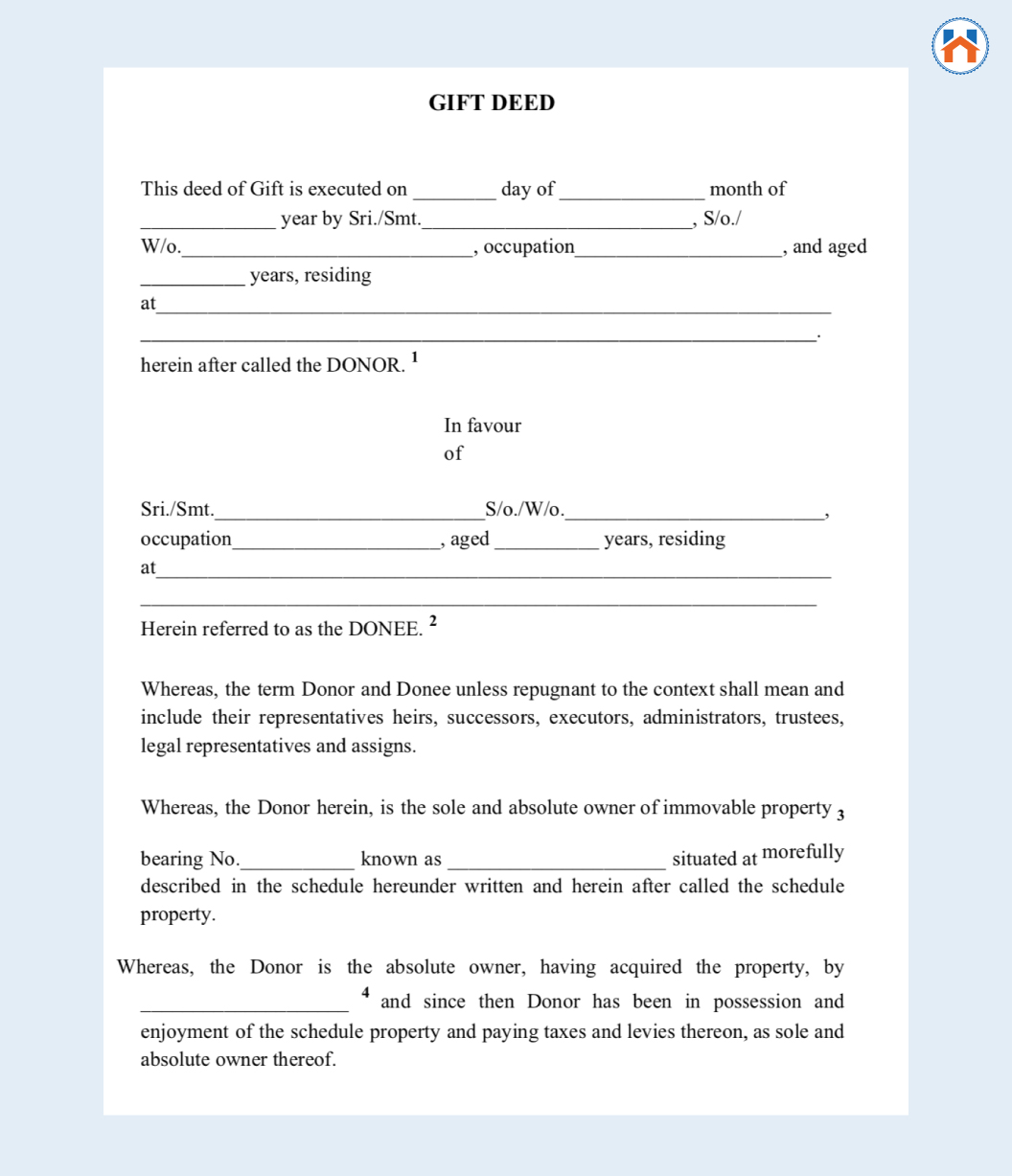

A sample format of a gift deed is provided below, which can be followed to understand and develop a proper gift deed.

Gift Deed Registration Charges

The donor will have to pay a certain amount as stamp duty for the registration fee.

However, if the gift deed is signed between certain close relatives, then there will be a stamp duty discount.

There are different registration charges for the gift deed in different states, which are provided in the below table:

| States | Stamp duty for gift deed |

| Delhi | For men, it is 6%

For women, it is 4% |

| Gujarat | Depending on the market value, 4.9% is charged |

| Karnataka | For family members, Rs 1000 to Rs 5000 is charged

For non-family members, 5.6% of the land value is charged |

| Maharashtra | 3% is charged for family members.

5% is charged for other relatives. For agricultural land or residential property, Rs 200 is charged. |

| Punjab | For family members, there are no stamp duty charges

6% is charged for non-family members |

| Rajasthan | For men, 5% is charged.

For women, 4% to 3% is charged. 3% is charged for SC/ST or BPL. For a widow, there are no charges. For the wife, a 1% charge For the immediate family, 2.5% is charged |

| Tamil Nadu | 1% is charged for family members

For non-family members, 7% is charged |

| Uttar Pradesh | For men, 7% is charged

For women, 6% is charged |

| West Bengal | For family members, 0.5% is charged.

6% is charged for non-family members. There is a surcharge of 1% over and above Rs 40 lakhs. |

A Gift Deed Between Blood Relations

It is important to pay the stamp duty as well as registration charges during the transaction of providing the legal validity.

As per Article 34 of the Maharashtra Stamp Act, which was amended in 2017, the stamp duty on gift deeds is charged at 3% of the property’s value.

However, if the property is residential or agricultural, then it can be gifted without any payment to the blood relative.

If any person has decided to gift their personal property to any of their family members or friends without any exchange of money, then it is important to register the gift deed.

The gift deed will help to serve the purpose of the donor to gift their property to their close ones.

Only a stamp duty of Rs. 200 is required to be paid.

If any person has transferred the gift through a notary then it will be considered illegal. The gift deed must be registered at the registrar’s office.

Gift Deed From Father To Son

If a father wants to gift his son with ancestral property, then he has to maintain certain situations under Hindu Law. Situations under distress or pious reasons will be considered only.

It is important to register the gift deed in this case as well. In Maharashtra, Rs. 200 stamp duty was applicable till 16th May 2017.

However, now the rule has changed for specific relatives. Now, the stamp duty is applicable with 3% of the market value of the total transaction.

If a property is sold and reinvested in some other property, there will be benefits from the long-term capital gains exemption under section 54.

Cancellation Of The Registered Gift Deed

It is possible to cancel the registered gift deed by the donor by following the provision mentioned in the gift deed.

If both the parties agree or any event happens which is already mentioned in the deed, then the deed can be canceled or revoked.

A gift deed can also be canceled in case the donor has signed the deed under any undue influence or threat.

FAQs:

| Q: What is a gift deed?

Ans: A gift deed is an agreement that is used when someone wishes to gift their property to someone. Transfer of ownership of the property from one person to another is done through a registered agreement. |

| Q: Is it required to register the gift deed?

Ans: Yes, it is important to register the gift deed for the purpose of avoiding any kind of future dispute and also to receive benefits from the gift deed immediately. |

| Q: Who will pay for the stamp duty on the gift deed?

Ans: The donor is responsible to pay for the stamp duty of the gift deed. In case the donee pays the stamp duty then the gift deed may be considered void. |

| Q: Is it possible to cancel the gift deed?

Ans: Yes, it is possible to revoke or cancel the gift transaction through the above-mentioned provision or mutual understanding. |

| Q: Is it possible to make several person donees of a gift deed?

Ans: Yes, there can be more than one donee for a single gift deed. If any donee rejects the gift deed, then other donees will still be valid for the gift deed. |

| Q: What is a Transfer of Property?

Ans: The Transfer of Property is an act where a donor transfers the ownership of any property at present or in the future to one or many donees. |

| Q: Will the gift deed be valid if done an oral transfer?

Ans: No, the gift deed must be done on a registered agreement attested by two witnesses and both donor and donee. |

| Q: What are the important elements of a gift deed?

Ans: According to the Transfer of Property Act, a gift deed has the following important elements:

|