While buying a property you get two major options- you can either go for an under construction or a ready-to-move property.

If you know that the under-construction property is about waiting for some years before getting the possession. And ready to move property means a huge instant financial demand then that’s not enough.

Because every single factor that makes a distinction between the under-construction and the Ready-to move Property decides what’s best for you.

And the best way to make the distinction between under construction and ready to move property is by checking out the pros and cons.

Moreover, understanding the general process such as home loans and the taxations is important to check the suitability of both.

Therefore, this article discusses the difference between under construction and ready to move properties along with the home loan, tax scenarios, and notable trends for both.

Page Contents

- Buying Under-Construction Properties:

- Advantages Of the Under-Construction Properties:

- Disadvantages Of The Under-Construction Properties:

- Home Loan In Case Of Under Construction Properties:

- Buying Ready To Move Property:

- Advantages Of Ready to Move Property:

- Disadvantages Of Ready To Move Property

- Home Loan In case Of Ready-To-Move Properties:

- Notable Trends In Under Construction Vs Ready-To-Move Properties:

- Summary Of Comparison: Under Construction Vs Ready To Move Property

Buying Under-Construction Properties:

In under-construction properties, a buyer pays the amount to the builder in the various stages of construction. Initially, the booking charges are paid followed by the payments in multiple tranches as per the agreement with the builder or developer.

The under construction properties are the best know for their cost-effectiveness, payment flexibility, and better property price appreciation.

On the other hand, the challenges in the case of under construction properties could be waiting periods, discrepancies in the final construction, and taxes, etc. These are manageable with the careful consideration of the important factors.

Advantages Of the Under-Construction Properties:

Comparatively Lower Costs:

Generally, Under Construction property costs 10-15% less than ready-to-move-in properties. The difference between the costs for under construction and ready-to-move-in properties may go up to 30% in some cases for the same factors such as locality, project scale, and unit size, etc.

Moreover, it is easy to manage the finances as you get a considerable amount of time. Also, you get different options on the location of the unit within the building at the lower cost range.

In under-construction type properties, you are expected to pay the amount in stages reducing the overall financial load. The EMIs on the other hand remains constant over the period of time against the increased income.

Scope For Property Appreciation:

In under-construction property buying, there is a considerable timeline between the buying stage and the actual possession of the property. Because of this, there are chances of good property price appreciation.

For better property price appreciation time period is not the only parameter. Different factors such as location, growth of the regions, economic activities, infrastructure projects, etc have a collective impact on the property price appreciation of the under-construction properties.

If all the factors are fairly positive, then the property price appreciation can be around 25-35% for a minimum three-year time frame.

Flexibility on the Payments:

Buying a property in the under-construction phase allows you to pay in multiple stages. Many banks offer home loans in the disbursed form so that the interests are applied only on the amount issued in the respective stage of construction.

Generally, the stages of payment in the under-construction properties are:

| Stage | Description | Payment Breakups % of Total Amount |

|---|---|---|

| Stage 1 | Booking Charges | 10-20% |

| Stage 2 | Commencement of work | 10% |

| Stage 3 | Completion of The Plinth Level | 15% |

| Stage 4 | Completion of Floors | 3% After Each Floor |

| Stage 5 | Close To the Completion Phase | 5% |

| Stage 6 | Final Possession | 5% |

New Construction:

The age of the property is one of the chief factors that decide the ROI in the later stages. Buying under-construction properties gives you the new construction along with the other features at a reasonable cost. Also, there are no repairing and renovation costs involved saving a significant amount of money.

In the future, if you decide to resale the property the age of the property doesn’t become the pain point.

RERA Compliance:

All the under-construction projects come under the new RERA guidelines. This ensures compliance with the legal practices in the transactions.

Moreover, The advent of RERA streamlined the under-construction property buying and enforced the regulation to complete the project within the time. If the developer does fail to deliver the project on the date of possession in the agreement, the developer has to pay the amount paid along with the interests.

However, the timeframe for the possession is usually decided by the developer during the initial phase of the deal. Buyers should take the decision by considering the time frame for the possession.

Special Offers & Discounts:

Developers offer discounts and special offers to attract buyers for under-construction properties. Besides, there is always a scope for negotiating with the developers for the best deal. On the other hand, there are very few chances of getting discounts on the ready-to-move property.

The best way to explore projects with the best discount offers is to get consultations from real estate advisers.

Disadvantages Of The Under-Construction Properties:

Delay In the Project Completion:

Delays in construction were a common problem before the advent of the RERA. Now as RERA has provided strict guidelines for completing the project on time, the developers have been more responsible with the completion dates. Nevertheless, if the project is not authorized under RERA, there is no guarantee that the project will be delivered on time.

So buying an under-construction property from an authorized and well-known developer is important to avoid the complexities.

Taxes:

5% GST of the total cost of the property is applicable for the under-construction projects. For affordable housing projects ( price less than 45L) the applicable GST is 1%.

Whereas for the Ready to move flats, there is no tax applicable giving significant relief from cost additions.

However, you can still claim the tax benefit for the under-construction property applicable under sections 80C and 24B of the income tax Act. The tax benefits can be claimed after getting possession of the house.

But provided that-

- The construction gets completed within three years of loan sanctions.

- And the exempted amount is up to 2.5Lakh on the interests paid.

- If the project does not get completed with three years then the tax benefits are limited up to 30,000.

Construction Discrepancy:

During the construction process, there are chances of minor alterations in the layouts, designs, and area. Sometimes it is not possible to exactly replicate the promised features of the property.

The only drawback is you get to know this at the time of possession.

However, RERA has stringent guidelines for the discrepancies. For example, if the carpet area reduces after the completion of the project, then the developer has to reimburse the extra amount. But as a buyer, you have to compromise in the space you get at the time of possessions.

The best way to avoid the Construction discrepancy is to choose a developer who has a proven track record and a good reputation in the real estate domain.

Home Loan In Case Of Under Construction Properties:

The home loans for construction properties offload the financial burden from the buyer by giving sufficient flexibility on the various terms.

Some of the benefits of the key benefits of Home Loans for Under Construction properties are:

- Home loan for under-construction properties is disbursed in parts as per the stages of construction. And the interest will only be charged on the disbursed amount. Resulting in lower EMIs.

- Favourable repayment tenures. The maximum tenure of the loan repayment can maximum up to 30 years.

- Before getting possession of the house you only need to pay the interest rates on the disbursed loan amount called “prior period interests”

Buying Ready To Move Property:

Ready to move properties are costly, but also gives immediate possession and more transparency

Ready to Move flats gives you transparency on what you will get the deal. But the challenging part of the ready-to-move properties is to be prepared to meet the financial demands. As the home loan interests and the EMIs start instantly.

But you also save a significant amount on rents and taxes as compared to the under-construction property. So, let’s check out the advantages and disadvantages of the ready-to-move-in property.

Advantages Of Ready to Move Property:

Instant Availability:

You don’t have to wait for years to move in into the property. This is the most important advantage you get when you buy ready-to-move property. Because of instant availability, you can save a considerable amount of money which would have been spent on renting.

The only thing is to be more careful about the documentation and legalities. Moreover, the finances should be managed effectively to avoid the sudden load.

Transparency:

Unlike the under-construction properties, there are no discrepancies or changes you need to face during the possession. In ready-to-move properties it is simple, everything is before you to take the decision.

This also simplifies your task to evaluate the property by considering the various factors. And also it enables the comparative analysis with the properties in the surrounding regions since everything can be effectively examined.

No GST Applicable:

The biggest relaxation for the construction properties is that there is no GST applicable on the total cost of the property. Whereas for the under-construction properties, there is 5% GST applicable.

Reselling and Renting:

After some months or years, you can choose to resale the property. There are no complications or restrictions to resale the property. This is not possible in the case of ready-move properties as there is a construction period in between.

Because of the quick ownership in the case of ready to move properties, you have the freedom to decide to resell or rent out the property. If you have done the proper investment analysis before buying a ready to move property you can get good returns either from reselling or renting out the property.

Disadvantages Of Ready To Move Property

High Cost:

The cost of ready-to-move property is around 15-30% more than that of the under-construction property. It is also challenging to face the sudden financial demands of the ready-to-move-in property. Along with the home loans, instant EMIs the buyer has to pay the stamp duty and the registration charges.

In the case of under-construction properties, the payments are coupled with the construction phases and hence more flexible for the buyers.

Absence Of RERA Regulations:

RERA came into effect in 2016, the properties established before that have not followed the standard RERA requirements. The occupancy certificate before May 1, 2016, so not come under RERA and therefore can’t be promoted by making its information available to the public.

Age Of the Property:

The age of the property is important for deciding the returns on the property investments. It is possible that The ready move-in property may have been for sale for a long duration. Avoid buying the old property as it will reduce your chances of profitable reselling later. Ideally, Buy a property that is 1-5 years old for better future prospects. Also Check Out: Best Cities For Real Estate Investment In India 2025

Home Loan In case Of Ready-To-Move Properties:

In the case of Ready-To-Move homes, it is challenging to manage the finances as you need there are no stages involved. You need to be prepared for the downpayment, stamp duty, registration costs, etc.

However, there is a relaxation on the GST applied on the principal loan amount.

Key Benefits of the Home Loan for Ready-To-Move properties.

- The total cost to avail of the home loan is considered less than that of the home loan process for the under-construction properties.

- Tax benefits are applicable from the first EMI. Providing significant relaxation.

- The Tax deductions could be up to Rs. 1-1.5Lakh on the principal loan amount as per the section 80C and 24B of the income tax Act.

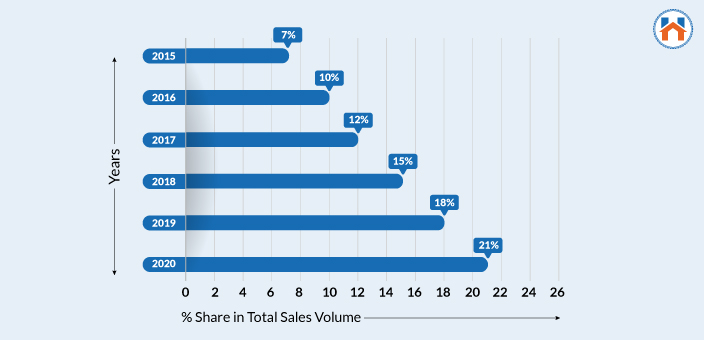

Notable Trends In Under Construction Vs Ready-To-Move Properties:

- The ready-to-move-in properties are preferred by the buyers who have the financial potential to meet the instant cash demands of ready-to-move properties.

- Buyers who are willing to wait in order to avoid the sudden financial loads preferably go for the under-construction properties.

- The shares of the Ready-to-move-in properties increased in the overall sales has been gradually increasing over the last few years.

- The price difference between the under construction and the Ready-to-move-in property is different for different cities. For Mumbai and Delhi, the price difference is 3-4%. This is because of the competitive real estate market of the region. In cities such as Pune and Hyderabad, the price difference is generally 4-5%

- There are some schemes provided by the banks to give complete security to the buyers in case of under-construction properties. For example, SBI’s RBBG Scheme through which if the developer fails to complete the project on the date of the possessions, the buyer will get his principal amount paid in the EMIs.

- RERA guidelines for the on-time completion of the project and the reimbursements have provided solid grounds for under-construction property investment.

Summary Of Comparison: Under Construction Vs Ready To Move Property

| Under-construction | Ready-To-Move Properties |

|---|---|

| For under-construction properties 5% GST is applicable on the total cost of the property. | In the case of Ready to Move Properties, the GST is not applicable. |

| The under construction property gives sufficient flexibility for the payments. The buyer is not subjected to the sudden financial burden. Downpayment is low (15-20%) | In Ready-To-Move properties the buyer is always needed to ready with the financial arrangements in a short time period. Moreover. The interest on the home loans EMIs starts instantly. |

| Under-construction properties are comparatively easy to buy. Considering the new guidelines issued by the RERA | The challenge in buying the Ready to move in properties is to manage all the financial, legal, and ownership-related activities at the same time. Making it moderately challenging. |

| In the case of under-construction properties, returns are high because of the gap between the buying and actual possession of the property. Properties can give a high appreciation of 25-35% if other conditions of the real; estate ecosystem are solid. High property appreciation. | The returns in the case of Ready to Move Properties are modest and depend on various other factors. However, there is complete freedom for the buyer to a resale or rent out the property for income. |

| Not possible to re-sell the properties during the construction period. | Possible to re-sale the property. No restrictions. |

| The Age Of the property is not the concern as the buyer gets possession of the newly constructed property. This gives solid ground for future ROI. | The age of the property can be a negative factor if the ready-to-move property was not occupied for several years. |

| There might be construction discrepancies in the under-construction properties at the tie of possession. However, the RERA has made compulsion for the developers to recalculate the amount on the new area of the property. | Ready to move in properties give clear transparency. The buyer can see the construction details and take the decisions accordingly. |

| It is mandatory for the newly launching properties to have RERA registrations. Therefore, the buyer gets the assurance on the legal compliance and fair | RERA was commenced on 1 May 2016, So the ready-to-move-in properties before this may not have the adherence to the RERA guidelines. |