Disclaimer:

With 11+ years of experience & expertise in the real estate industry, Homebazaar provides end-to-end property-buying solutions. Hundreds of 100% verified RERA-registered residential & commercial properties are listed on our website. We provide facilities like Zero brokerage, 360° virtual street view, effortless site visit services, end-to-end property buying agreements & documentation guidance, and low-interest home loan assistance. This helped us gain the trust of 55,000+ clients across India & sold 6,500+ homes of top reputed developers.

Page Contents

What is The Home Loan Processing Fee?

There are many reasons for a person to take a loan from a bank or any financial institution. One of these many reasons is that buying a house sometimes requires a home loan.

There are many reasons for a person to take a loan from a bank or any financial institution. One of these many reasons is that buying a house sometimes requires a home loan.

While processing and approving your loan, the bank incurs some administrative charges. These charges are known as Home Loan Processing Fees.

This is normally a small price, differs per bank, and generally costs between 0.5% and 2% of the overall loan amount.

Each bank establishes a threshold and the highest amount borrowers must pay for loan processing fees. These fees can either be paid up in advance or subtracted from the loan balance after it has been disbursed.

Note:

Homebazaar serves homebuyers searching for flats in India with end-to-end services like site visits, and lower-interest home loans to property registration guidance. We provide the best price options & offers for 1 to 4 BHK RERA-registered flats, villas & penthouse properties in India. To begin a smooth homebuying journey with us, fill out the form mentioned below or on the right side.

Why do Banks Charge Loan Processing Fees?

The one-time price that lenders charge borrowers for executing their housing loan applications is referred to as a processing fee. Typically, this cost is non-refundable.

The one-time price that lenders charge borrowers for executing their housing loan applications is referred to as a processing fee. Typically, this cost is non-refundable.

Because there are considerable expenses involved in processing your service request, banks impose processing fees.

For instance, the bank performs a CIBIL check when you submit a loan application, and there is a fee associated with it. Similar to that, there are additional fees.

Processing fee charges may go up to 2.50% to 3% of the loan amount, depending on the lender. Certain lenders will waive the processing cost on special events or throughout the holiday season.

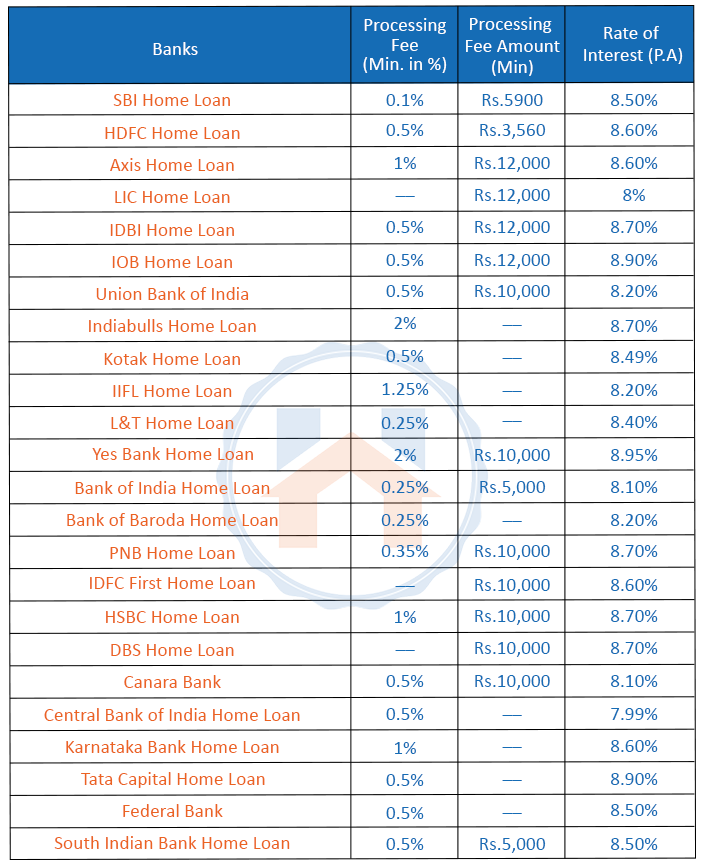

Latest Home Loan Processing Fee For Banks

Here are the latest Home loan processing fees for top banks.

How is the Processing Fee Calculated?

How is the Processing Fee Calculated?

When a housing loan request is submitted, a one-time cost known as a home mortgage processing fee is levied. The charge is payable to the processing and management of the loan.

The processing fee is decided by the amount borrowed and the lender’s credit policy.

Processing charges normally vary from 0.50% to 2.00% of the authorised loan amount.

Additionally, a GST of 18% will apply. The administrative charge portion of the processing fee includes rejected non-refundable loan applications.

Here is a Home loan Eligibility calculator to calculate your eligibility for a home loan.

Different Types of Home Loan Fees and Charges

Home loans include several additional fees, fines, and penalties in addition to the processing cost.

Home loans include several additional fees, fines, and penalties in addition to the processing cost.

It’s crucial to understand these when you request a house loan so that you’re not misled by the jargon and know the services you will be spending the institution for.

Legal and Government Fees

The cost of all legal fees associated with the preparation of mortgage loan agreements must be covered by this sum.

This could involve creating the tripartite contract between customers, the contractor, and the financial institution, as well as confirming any other necessary paperwork. The payment amount will be determined by the lawyer’s or legal advisor’s fees.

This sum usually ranges between lenders and may be in the range of Rs 3,000 to Rs 10,000.

Late Fee Payment

When you don’t pay your EMI for a home loan on time, you will be assessed this fee.

Until the repayment is paid, it typically amounts to 2% to 3% of the amount that has been late or defaulted each month.

Charges For Various Documents

There are various charges applicable to the legal documentation of the home loan process.

- Stamping charge

- Fee for Agreement Copy

- NOC Charge

- Charge for Interest Certificate

- Charge for Income Tax Certificate

- Fees for CIBIL Report

- Duplicate NOC or NDC Fees

CERSAI Charge

Central Registry of Securitization Asset Reconstruction & Security Interest of India is known as CERSAI.

Your property must be pledged with a bank and registered with CERSAI. This is necessary to prevent the same property from serving as collateral for many loans.

Depending on the home loan amount, CERSAI Fees can range from Rs. 50 – Rs. 500.

MOD Charges

The bank has received the title deeds and ownership documents for your property as security for the loan, according to the Memorandum of Deposit on Title Deed (MoD).

It verifies who owns a particular piece of land. It is typed out on non-judicial stamp paper and is also known as MODTD, MODT, or DTD.

If there is a legal issue involving your property, this document may be helpful. Varying states have different MoD fees.

MOD charges in Maharashtra are 0.3% of the cost of a home.

Prepayment Charges

Prepayment charges are applicable when a home loan borrower pays the full amount of the loan before the tenure completion. This is also called Preclosure or Foreclosure Charges.

For loans with floating rates and individual borrowers, the majority of banks don’t charge a fee for foreclosure.

This fee might be assessed and varies from 2% – 6% of the remaining balance. So, if borrowers pay the remaining sum of Rs. 12 lakh to close their loan account, they may owe the bank anything from Rs. 24,000 – Rs. 60,000.

Conversion Charges

You will be required to make a payment of a once conversion fee if you want to convert your floating interest rate loan to a fixed rate loan or vice versa.

The fee may be fixed at a set sum, such as Rs. 1,000 + GST for Housing Finance loans under Rs. 75 lakh, or it may fluctuate from 0.25% to 3% of the balance amount.

Valuation or Inspection Fees

This sum will be demanded by the bank to assess and appraise the house you are purchasing and using as collateral for the loan.

Your obligation to pay will be determined by the actual fees incurred.

Notice Of Intimation Charges

NOI Notice of Intimation is a notice that is required as a component of the registration procedure for house loans.

It is provided to let the registrar’s office know that a house loan has been disbursed.

These charges can be paid online through the Maharashtra Stamp Duty Official website.

Regardless of the loan amount, the NOI Maharashtra charges Rs 1000 when submitted online. The NOI fees or the document handling fee would be Rs 300 if the notice is filed physically by visiting the SRO office.

Top Home Loans Without Processing Fees

Sometimes, different lenders may waive your processing charge. Here is the list of banks that offer home loans without Processing Fees.

- SBI Shaurya Loan and SBI Privilege Loan

- Saraswat Bank Vastu Siddhi Home Loan of less than Rs.28 lakh

- Syndicated Kuteer scheme

- Nainital Bank Apna Ashiana

FAQs

| Is the processing fee refundable in a home loan?

Processing fees are a one-time, non-refundable payment. |

| What is the HDFC home loan processing fee?

Up to 3,000, plus any relevant taxes and 0.50% of the loan amount. 50 percent of applicable fees or Rs 3,000 plus applicable taxes, whichever is larger, is the minimum retention amount. |

| Is a loan processing fee mandatory?

Yes, once the loan is approved, you need to pay a processing fee. |

| What is the processing fee for the SBI home loan?

0.35% + GST applicable on home loan or min Rs. 2000 to max Rs 10000 plus GST. |

| Does the SBI home loan include stamp duty & registration?

Stamp duty & registration fees are typically not included in the home loan amount that the bank has approved. |