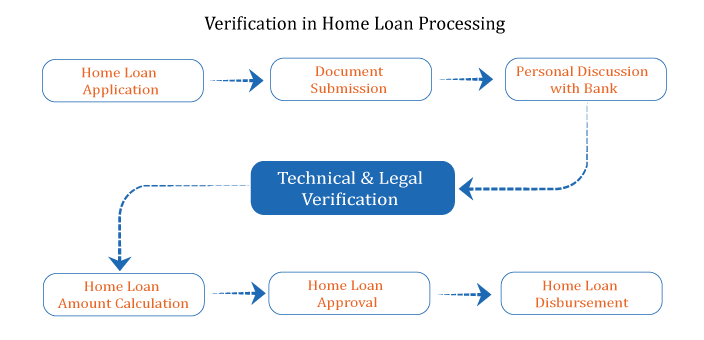

Before understanding what legal and technical verification in Home Loan processing, let’s first see at what stage during the home loan processing you need to face the home loan verification.

If we consider the entire home loan process, the verification comes after making the home loan application and subsequent profile making followed by personal discussion.

Once the bank officials duly check the home loan application details, create the profile, and understand the requirements in the personal discussion, then the process for the legal and technical verification of the property begins.

This is the general process for the home loan. However, it may vary depending on the bank’s policies and process plans.

Page Contents

- Legal and Technical Verification Process Overview

- Important Documents For Legal Verification of Property

- Home Loan Legal Verification Report

- Property Technical Verification Report

- Why Is The Legal and Technical Verification Important?

- How to Simplify the Legal and Technical Verifications in the Home Loan Process?

- FAQs

Legal and Technical Verification Process Overview

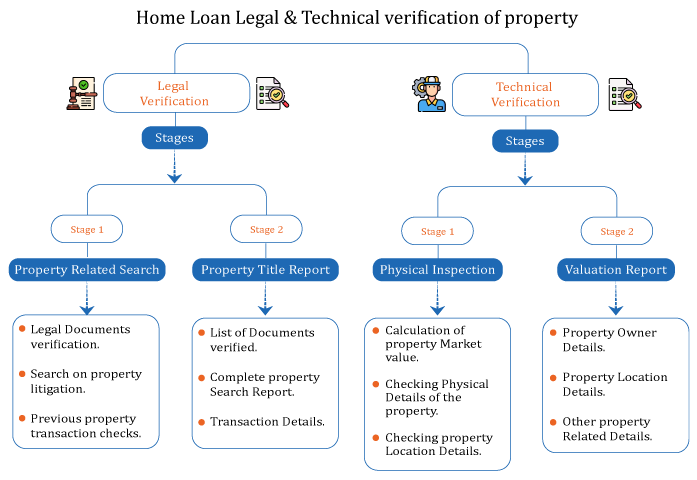

The home loan verification process is done in two stages. Both of these stages involve detailed inspection and report making.

- The Legal Verification of the Property

- The Technical Verification of the Property

What Is The Legal Verification of the Property

What Is The Legal Verification of the Property

The legal verification of the property for the home loan is done in two stages. In the first stage, the property-related search and the verification of the property-related documents are checked.

Then in the next stage, the title report is generated. In this report, all the legal and property verifications are mentioned.

Important Documents For Legal Verification of Property

The following are the important documents in the legal verification of the property.

- Sales Agreement – The conditions between the developer and property buyer are checked. Also, the amount of the agreement is checked, which becomes the base of the loan amount disbursal.

- Non-Agricultural Order – This is the document that indicates the permission for the conversion of agricultural land for non-agricultural uses.

- Copy of 7/12 Extract – The complete land specifications are checked and the details such as location, size, and ownership are verified.

- Occupancy Certificate – The occupancy certificate given by the government authorities indicates that the building or project is suitable for occupancy.

- Commencement Certificate – The commencement certificate is the legal document issued by the municipal authority of the region that indicates the permission for the construction.

- RERA Registration – The official RERA registration of the developer and the real estate projects is checked.

- Copy of Approved Plans – The copy of approved building plans issued by the municipal authority is verified.

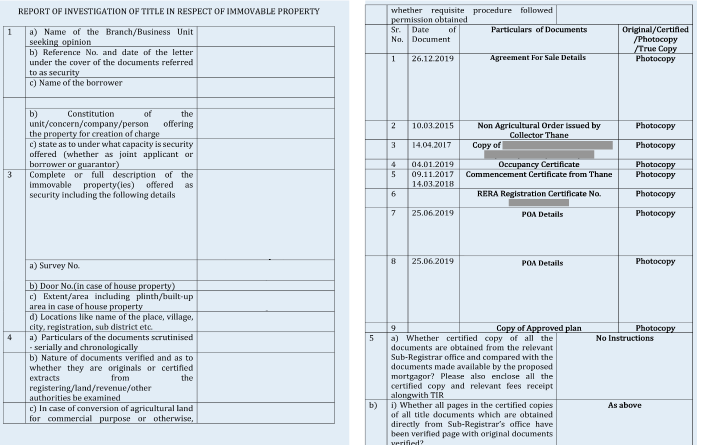

Home Loan Legal Verification Report

The important things involved in the home loan legal verification report include the following.

- Details of the Bank

- Details of the Borrower

- A complete description of the property

- Extent/area including plinth/built-up area

- Location details- village, place, sub-district, etc

- List of the documents verified

- Series of questions about the legal property checks

- Chain of title tracing the title from the oldest title deed to the latest title deed establishing the title of the property

- Property search report for the last 30 years

- Litigation status of the property

- Details of power of attorney (POA)

- Certificate of the title

- Property search report with complete transaction history

- Declaration by the search clerk

Here Is a Sample Home Loan Legal Verification Report

What Is Technical Verification in Home Loan Processing?

The technical verification of the property involves checking the physical details of the property.

The main objective of the technical verification of the property is to determine the fair market value of the property.

The technical verification of the property is conducted by a third-party chartered engineer and government-registered valuer.

After the detailed technical verification of the property, the valuer sends the report to the bank to take a further call on the home loan approval.

The technical verification of the property involves the following

- Address verification of the property

- Checking the extent of the site- Total Built-up and Carpet Area

- Latitude, Longitude, and the Coordinates of the flat

- Property location details

- Total Realizable Value

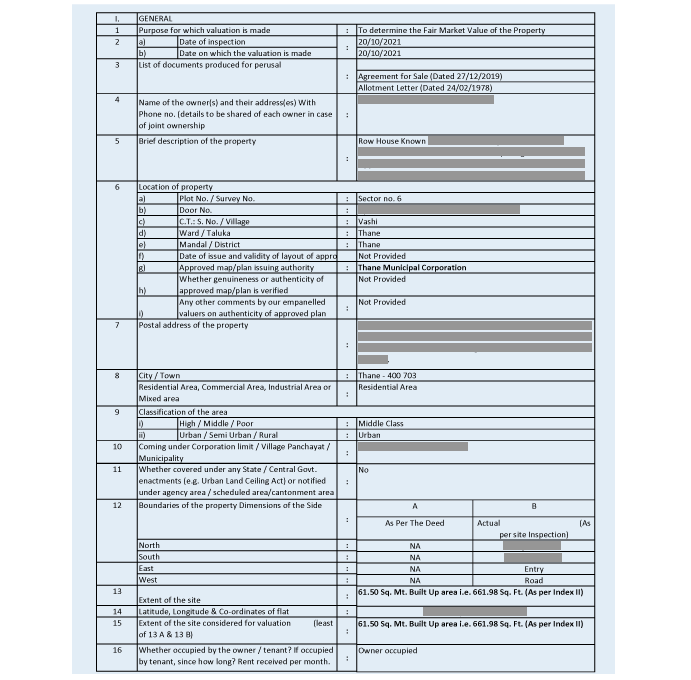

Property Technical Verification Report

The technical property verification report is prepared by the authorized chartered engineer.

After this, the property technical verification report is then sent to the bank to take the call on the home loan approval.

The property Technical verification report consists of the following

- Details of the Property Owner

- Brief Description of the Property

- Details on the Property Location

- Postal Address of the Property

- Area Classification Details

- Latitude, Longitude, and the Coordinates of the flat

Here is how the sample verification property technical verification report.

What Are The Fees For Legal and Technical Verification of the Property?

What Are The Fees For Legal and Technical Verification of the Property?

The fees for legal and technical verification of the property vary from one bank to the other.

Some banks charge for technical and legal verification. While some include the charges in the processing fees.

Generally, the legal and technical verification of the property is-

Legal Verification Charges for Home Loan = Rs 4000 – Rs 5000

Technical verification Charges for Home Loan = Rs 3000 – Rs 5000

Mostly the banks that charge for the Legal and technical verification do not apply the home loan processing fees.

The processing fee, however, is around 0.30-0.25% of the total home loan amount. The home loan processing fees keep changing depending on the various parameters set by the bank.

Few banks also offer no processing fees, especially for salaried home loan applicants.

Why Is The Legal and Technical Verification Important?

The Legal and Technical Verification is crucial for banks as well as for the applicants. For banks, it gives the assurance that the home loan application is authentic and there is no mischief involved.

On the other hand, the home loan verification is decisive in the approval of the home loan. Because the loan is approved based on the market value determined in the Legal and Technical Verification.

For example, if the total cost of the flat you are buying is 50 Lakh and if the LTV ratio of the bank is 80% then the total home loan amount sanctions will be Rs. 40 Lakh.

However, if the market value calculated during the legal and the technical verification is to be 45 Lakh then subsequently the 80% LTV will be applicable on this amount which will be lesser.

How to Simplify the Legal and Technical Verifications in the Home Loan Process?

Generally, the developers have tie-ups with the banks. If you apply for the home loan listed by the developer, the entire home loan verification process becomes simplified.

There is no legal and technical verification involved if you apply for a home loan from the bank that has tie-ups with the developer. This considerably saves time and as well as fees applicable on the legal and technical verification and saves time in the home loan process.

FAQs

| What is the Legal and technical verification in the Home Loan Process?

The legal verification of the property involves checking the property-related documents, property litigations, and previous transactions on the property. |

| Who conducts the legal verification of the property?

Banks conduct the legal verification of the property through third-party lawyers or law firms. |

| What are the legal documents checked during the legal verification of the property?

When you are buying a new property from the developer, the Sales Agreement, Non-Agricultural Order, Copy of 7/12 Extract, Occupancy Certificate, Commencement Certificate, RERA Registration, Copy of Approved Plans, etc are checked. |

| What is the technical verification of the property?

The technical verification of the property involves the physical inspection of the property to calculate the actual market value. |

| Who conducts the legal verification of the property?

Banks conduct the legal verification of the property through third-party chartered engineers who are authorized, government valuers. |

| What are the fees for legal and technical verification of the property?

The fees for legal and technical verification vary from bank to bank. Generally, the fees for the legal verification are Rs 4000-5000 whereas the Technical verification Charges for Home Loan are between Rs 3000- 5000 |