Page Contents

- What Are Stamp Duty & Registration Charges In Pune

- Importance Of Stamp Duty and Registration

- Factors That Decide the Stamp Duty and Registration Charges

- How To Calculate Stamp Duty And Registration Charges

- How To Pay Stamp Duty and Registration Charges in Pune

- How To Pay Stamp Duty and Registration Charges Online in Pune

- How To Check the Generated Challan for Stamp Duty and Registration Online

- FAQs

What Are Stamp Duty & Registration Charges In Pune

The Stamp Duty and Registration charges in Pune are payable under the Maharashtra Stamp Act 1958. The Stamp Duty and the registration charges are governed by the state government and may be subject to changes depending on various factors.

Here are the most recent Stamp Duty and Registration Charges in Pune.

| Stamp Duty Rates | Registration Charges |

|

|---|---|---|

| Male | 7% | For properties above Rs 30 lakh - Rs 30,000. For properties below Rs 30 lakh - 1% of the Agreement Value |

| Female | 6% | For properties above Rs 30 lakh - Rs 30,000. For properties below Rs 30 lakh - 1% of the Agreement value |

| Joint Male-Female | 7% | For properties above Rs 30 lakh - Rs 30,000. For properties below Rs 30 lakh - 1% of the Agreement Value |

Importance Of Stamp Duty and Registration

After buying properties in Pune, it is mandatory to pay the Stamp Duty and the registration charges. The following are the main reasons why it is important to pay the stamp duty and the registration charges.

- Paying the stamp duty makes you the legal owner of the property.

- The Stamp duty and registration receipts are considered valid for court proceedings in case of property disputes.

- The property purchase process is incomplete without registering the property.

- It protects the property title in case of fraud or discrepancies.

- Stamp Duty and registration is required to officially reflect the property transaction in the government records.

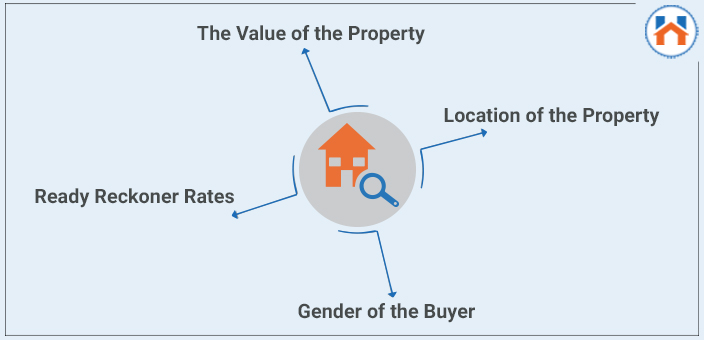

Factors That Decide the Stamp Duty and Registration Charges

There are several factors that decide the Stamp Duty and the registration charges. Here are the main factors which directly affect the stamp duty and registration charges.

The Value of the Property

Stamp Duty and the registration fees are charged as a percentage of the Market value or the agreement value of the property. So, the higher the Market or the agreement value of the property, the higher will be the applicable stamp duty and the registration charges.

Ready Reckoner Rates

Ready Reckoner Rates are used to calculate the Market value of the property. These are the standard rates decided and published by the state government authorities. The ready reckoner rate is the minimum rate for property transactions. Below the Ready Reckoner rate, no property transactions take place. The buyer and the seller of the property have to pay higher taxes if the transaction takes place below the ready reckoner rate.

Location of the Property

The stamp duty varies from one location to another. Depending on the areas of jurisdiction, the stamp duty changes. For municipal regions, the stamp duty charges are more as compared to the area under the Panchayat limits.

Also, the ready reckoner rates are decided on the basis of the locality and hence the location of the property becomes an important consideration for the stamp duty calculation.

Gender of the Property Buyer

To promote female property owners, the government has kept lower Stamp Duty charges for female property buyers. Almost all the states offer less Stamp duty for female property owners. In Pune, the stamp duty charges for women are 6% of the market value of the property. Whereas for men the stamp duty charges are 7%. The registration charges, however, are the same for the men and women property owners.

How To Calculate Stamp Duty And Registration Charges

Let’s consider the following specifications for the calculation of the stamp duty and the registration in Pune.

Location Pune

Configuration 2 BHK

Area 800 Sq ft

Rate Rs 20,000 per sq ft

The Agreement Value = 800 X 20,000 = Rs 1,60,00,000

Then the stamp duty can be calculated as

Stamp Duty = 7% of the Agreement value (For Men)

= 7 % of 1,60,00,000

= Rs 1,120,000

Stamp Duty = 6% of the Agreement value (For Women)

= 6% of 1,60,00,000

= Rs 960,000

The registration charges applicable in this case will be Rs 30,000 since the market/agreement value is more than Rs 30 Lakh.

How To Pay Stamp Duty and Registration Charges in Pune

You can pay the Stamp Duty and the Registration Charges Offline or Online.

The offline methods for paying the stamp duty and the registration charges are Physical stamp paper and franking.

Stamp Duty and Registration Payment By Physical Stamp Paper

To pay the stamp duty through the Physical Stamp Paper you need to purchase the stamp paper from the authorized stamp paper vendor. The value of the stamp paper should be equal to the applicable stamp duty. This was the most widely used method for paying stamp duty before the advent of the online method.

Stamp Duty and Registration Payment By Franking

The franking services are provided by the banks. The applicable stamp duty and the property details are mentioned in the document and submitted to the bank. The bank gives a stamp on the document by the franking machine.

How To Pay Stamp Duty and Registration Charges Online in Pune

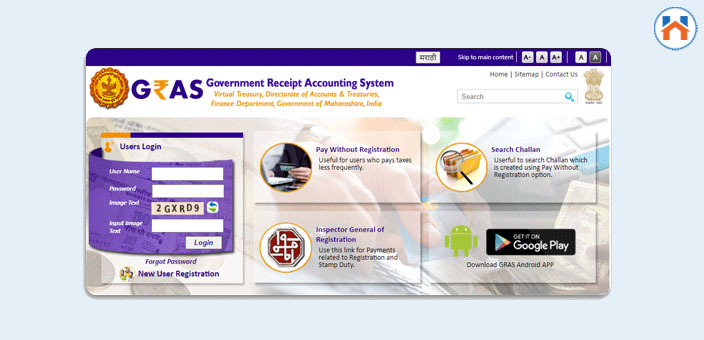

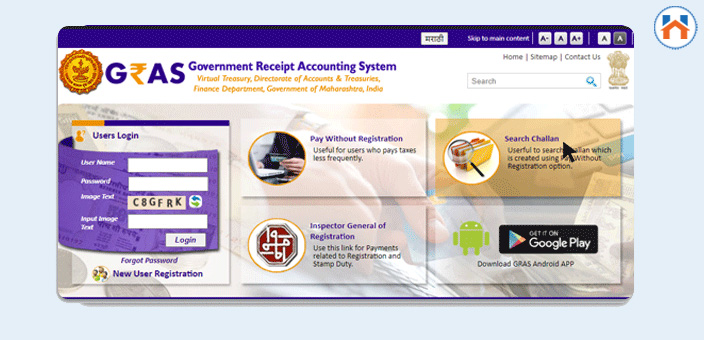

You can pay the stamp duty and registration charges in Pune online by using the Government Receipt Accounting System (GRAS). The portal allows you to digitally sign the document and pay the stamp duty and registration charges online.

Here is the complete process to check the Stamp Duty and Registration Charges Online In Pune.

Step 1: Visit The Government Receipt Accounting System (GRAS)

Step 2: Then From the Home Page select the Inspector General of Registration

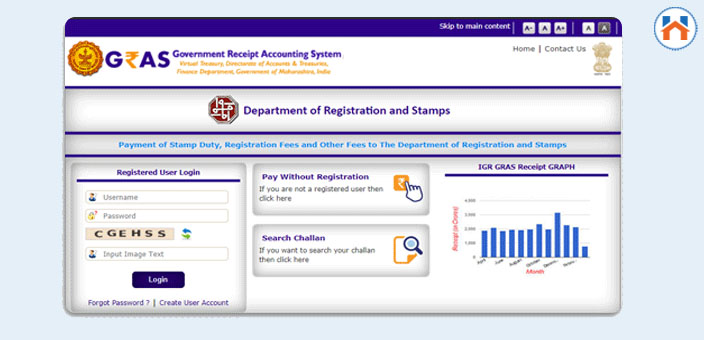

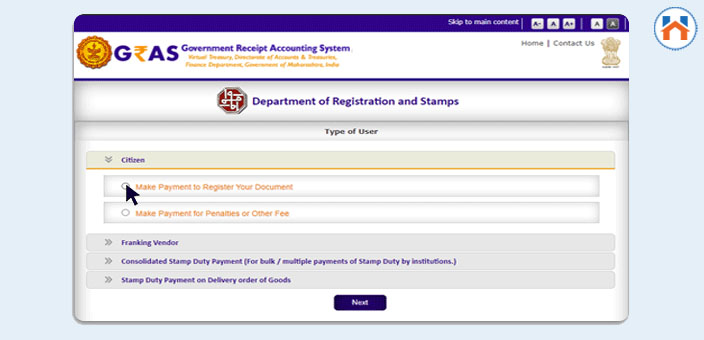

Step 3: It will redirect you to the Department of Registration and Stamps. Then click on the Pay Without Registration Option

Step 4: Now, from the Citizen tab select Make Payment to Register Your Document

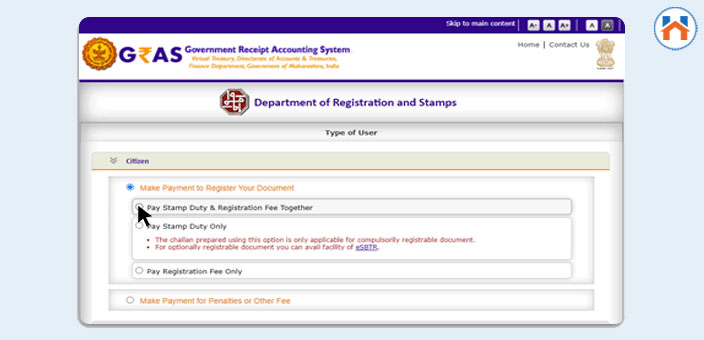

Step 5: Select the Pay Stamp Duty and the Registration Fee Together Option

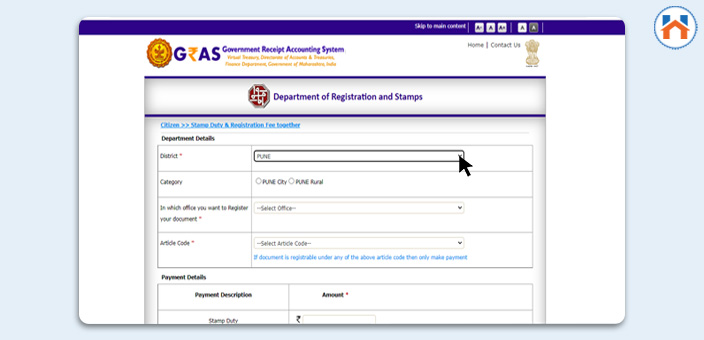

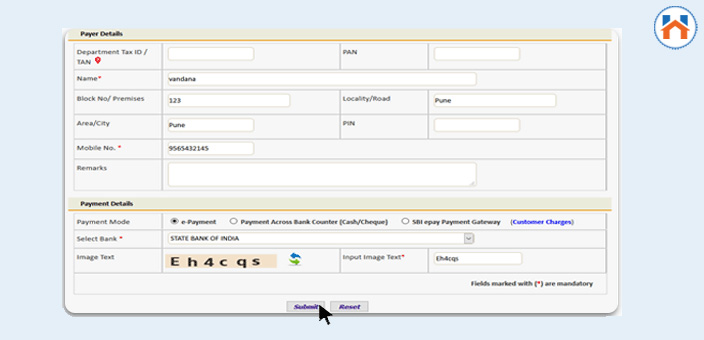

Step 6: Fill in the important details such as District, Stamp Duty Amount, and Registrar’s Office.

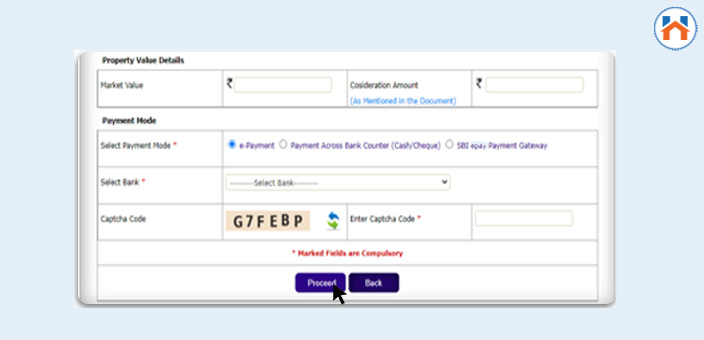

Step 7: Select the suitable Payment options and Click on proceed. If you select the payment across the bank option, you have to visit the bank and make the payment through the cheque or demand draft (DD).

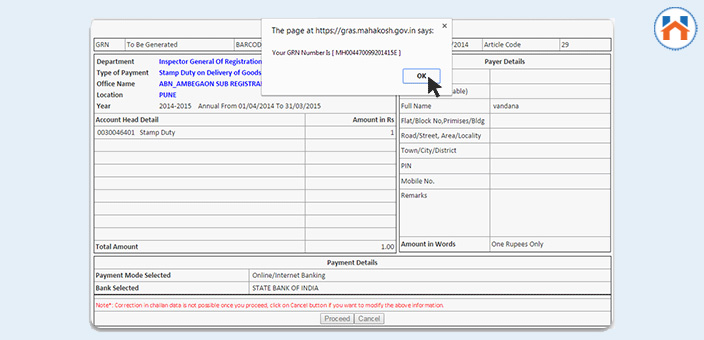

Step 8: The draft challan will be generated. Note down the GRN number Click Ok and then proceed.

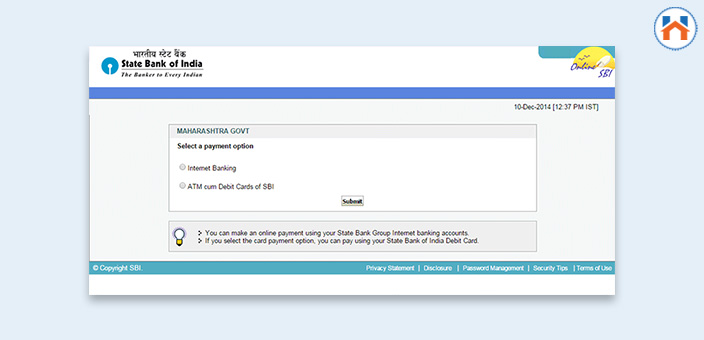

Step 9: Select the Payment Method.

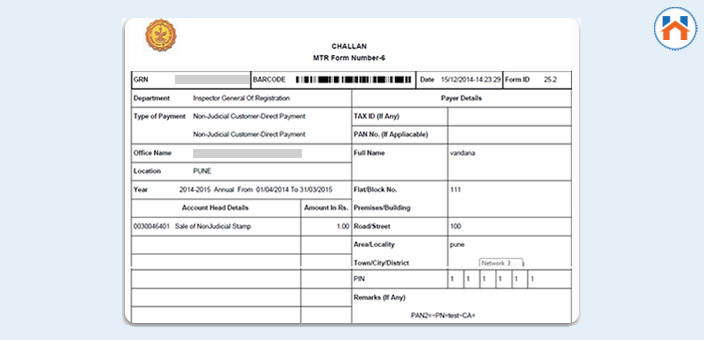

Step 10: After the payment, you will get a copy of the challan.

Once you make the payment, you can check the copy of the challan online.

How To Check the Generated Challan for Stamp Duty and Registration Online

You can take the printouts of the generated challan once you make the stamp duty and registration charge payment.

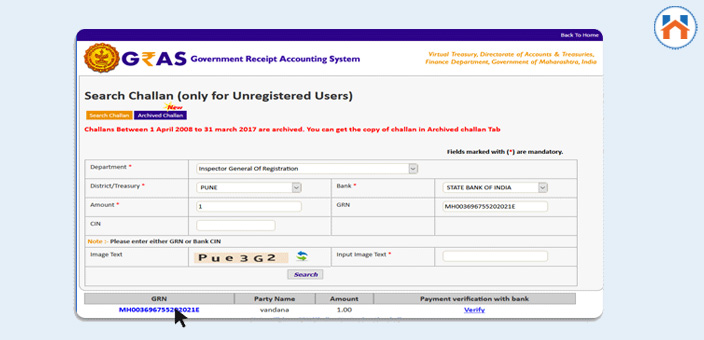

Step 1: Visit The Government Receipt Accounting System (GRAS)

Step 2: Then Select the Search Challan Tab

Step 3: Fill in the following details.

- Department

- Name

- Block Number

- Locality

- Area

- PIN

- Mobile Number

- Payment Mode

And Click on the Search button

Step 4: Click On the Challan Number to get the copy of Challan.

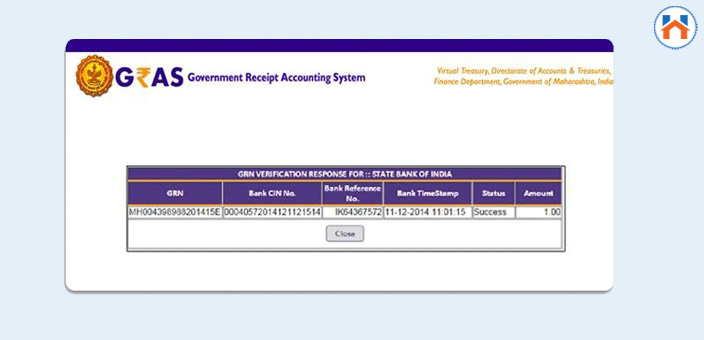

Step 5: Then Click on the Verify to get the status of the verification.

Also Check Out: How To Pay PCMC Property Tax Online

FAQs

| What are Stamp Duty and Registration Charges?

You need to pay the stamp duty and the registration charges while buying a property. It is a tax payable to the state government for registering the property sales deed at the sub-registrar office. |

| What are the factors affecting the Stamp Duty and Registration Charges?

The agreement value of the property, location, ready reckoner rates, and gender of the property buyers are the main factors that affect Stamp Duty and Registration. |

| Why Stamp Duty and Registration is important?

You become the legal owner of the property only when you register the sales deed with the applicable Stamp Duty and the registration charges at the sub registrar’s office. The property buying process is incomplete without the payment of Stamp Duty and the registration charges. |

| When to pay the Stamp Duty and the Registration Charges?

You can pay the stamp duty and the registration charges once the sales deed is processed. Usually, the stamp duty is paid before or at the time of execution of the property. |

| What are the penalties for not paying the Stamp Duty and Registration Charges?

The penalty of 2% of the applicable stamp duty is charged from the date of the execution of the document. This penalty can go up to 200% of the main Stamp Duty. |

| How to Pay the Stamp Duty and Registration Charges Online in Pune?

The stamp duty and registration charges can be paid online by visiting Government Receipt Accounting System (GRAS) portal. |