As we all know, property buying and selling is divided into some basic steps, from choosing a location to finalising the property, which we know very well. But we also need to gain further knowledge about stamp duty and registration charges. When you buy any authorised property in Thane, or anywhere across the country. The total cost of your property will go further than the developer’s quotation.

Stamp duty and registration charges in Thane are the two important components that the buyer needs to pay to the state government directly, so the property’s legal ownership will be transferred. Understanding how these charges work, what laws & authorities govern them, and what factors influence the final amount is crucial for smooth and legally secure property ownership.

Page Contents

- Stamp Duty Law in Maharashtra

- Property Registration Law

- How Stamp Duty and Registration Charges in Thane Vary by Gender

- How Stamp Duty and Registration Calculations Works

- Factors Affecting Stamp Duty and Property Registration Charges in Thane

- Process of Stamp Duty and Property Registration Charges in Thane

- Property Registration Portal in Maharashtra

- Why Understanding These Charges Is Important

- Tax Benefits Under Section 80C

- FAQs

- What is the current stamp duty in Thane?

- Do stamp duty and registration charges in Thane vary between under-construction and ready property?

- Is it possible to pay stamp duty and registration charges in Thane Online?

- What happens if stamp duty and registration charges in Thane are not paid?

- Do home loans have stamp duty and registration fees?

- Why is understanding the stamp duty & registration important when buying property in Thane?

Stamp Duty Law in Maharashtra

Stamp duty is a legal tax collected by the state government and regulated under the Maharashtra Stamp Act, introduced in 1958. This tax is payable on all property transactions, such as sales deeds, agreement deeds, agreements to sell, conveyance deeds, gift deeds and even on first-time bought property.

Stamp duty in Thane regulates and maintains records of every property transaction and property’s legal ownership transfers. For residential properties, the stamp duty is calculated through two factors: first, on the higher of the agreement value or government approved ready Reckoner rate.

The Reckoner rate helps calculate the actual market value of any property registered and published under ASR (Annual Statement Rates) by the Government of Maharashtra.

Without issuing, fulfilling and paying stamp duty, the sale deed has no legal value, which makes it impossible to establish an individual’s rightful ownership.

Property Registration Law

As stamp duty, the property registration charges also vary from state to state and are regulated under the Registration Act introduced in 1908.

First, the stamp duty is paid, and then the property must be registered at the local Sub-Registrar’s Office (SBO) to establish ownership, maintain a public record of the property and avoid any fraud.

Stamp duty and registration charges in Thane are capped, making them easy to calculate and predict. Paying both charges and completing the listing of the property under your name legally enters the property into the government property records

Property registration charges are calculated as follows:

- Properties valued above ₹30 lakh: Flat ₹30,000.

- Properties valued below ₹30 lakh: 1% of the property’s market value.

This registration charges structure applies whether you are buying a property in Thane to live in or making a property investment.

How Stamp Duty and Registration Charges in Thane Vary by Gender

The stamp duty is charged at 7% in Thane and overall across Maharashtra. But this 7% is charged to Male buyers only, and to Female buyers, the 1% concession is offered to promote property ownership among women.

This difference can translate into substantial savings, especially for stamp duty on flat purchases for higher-value properties.

In joint ownership cases, the concession usually applies if the woman is listed as a co-owner, making gender an important consideration while planning property purchasing, registration and ownership.

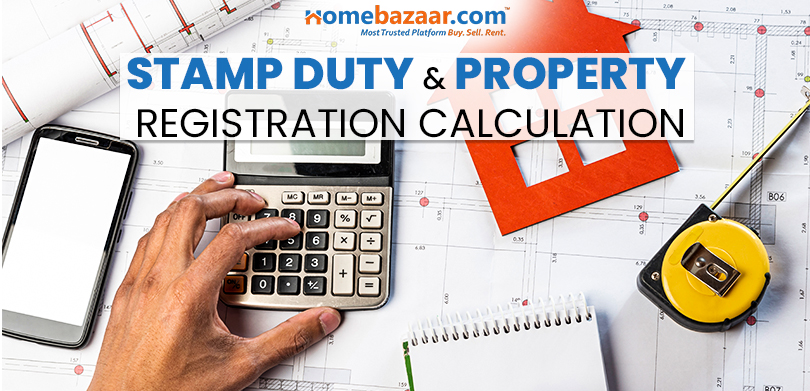

How Stamp Duty and Registration Calculations Works

As mentioned, the stamp duty and registration charges vary by gender. The calculation also differs by that 1%. Stamp duty is divided into a few components, such as stamp duty, cess and local body tax (LBT).

- For Male Buyers: Stamp duty – 5%, Cess – 1% and LBT – 1%

- For Female Buyers: Stamp duty – 4%, Cess – 1% and LBT – 1%

Let’s understand how stamp duty on flat purchase is calculated through an example where the property value is 50 lakh.

Stamp Duty Calculation

Here, we’ll assume the rate of the property is ₹50 lakh.

- Stamp duty rate (Male buyer): 7%

- Stamp duty amount: ₹50,00,000 × 7% = ₹3,50,000

For a female buyer, the stamp duty is calculated at 6%, so it will be ₹3,00,000 against a ₹50 lakh property.

Total Charges Payable

For a Male Buyer

- Stamp Duty: ₹3,50,000

- Registration Charges: ₹30,000

- Total: ₹3,80,000

For a Female Buyer

- Stamp Duty: ₹3,00,000

- Registration Charges: ₹30,000

- Total: ₹3,30,000

The Final Payment Amount Will Be

| Particular | Male Buyer | Female Buyer |

| Stamp Duty | ₹3,50,000 | ₹3,00,000 |

| Registration Charges | ₹30,000 | ₹30,000 |

| Total | ₹3,80,000 | ₹3,30,000 |

Factors Affecting Stamp Duty and Property Registration Charges in Thane

Several factors influence how much stamp duty and registration charges in Thane you will pay.

These include the property’s location, the ready reckoner rate, the declared agreement value, the buyer’s gender, and whether the property is residential or commercial. Under-construction and ready-to-move properties may also have different valuation considerations.

Being aware of these factors helps buyers accurately estimate costs and avoid unexpected expenses while purchasing property in Thane.

Process of Stamp Duty and Property Registration Charges in Thane

Individuals buying property in Thane can complete stamp duty payment and registration through online or offline processes. The payments are made online via the authorized portal by the Maharashtra Government (IGR), where e-stamping, uploading of documents and booking of appointments can be done.

Under offline registration, the buyer has to visit the sub-registrar’s office with all the necessary documents and pay the necessary charges, go through the biometric verification and sign the registered deed.

Property Registration Portal in Maharashtra

The Maharashtra government has digitised property registrations through a portal, making it faster and more transparent. The Inspector General of Registration and Controller of Stamp (IGR Maharashtra) is the dedicated portal for stamp duty registration and e-filing of your property.

Buyers are also able to complete the stamp duty, make payments, reserve a registration slot and monitor their application status online. This system has simplified transactions for those purchasing property in Thane, reducing paperwork and saving time.

Why Understanding These Charges Is Important

Stamp duty and registration fees contribute a great proportion of the total cost of owning properties. It is better to pay them appropriately to make them sure that the property belongs to them legally, avoid legal disputes, and make it obligatory to obtain home loans or resell the property in the future.

For anyone planning to invest or settle in Thane, having a clear understanding of stamp duty and registration charges in Thane leads to better financial planning and a smoother home-buying experience.

Tax Benefits Under Section 80C

You may get a deduction in terms of stamp duty and registration fees under Section 80C of the Income Tax Act of 1961 and claim an incentive, which will reduce your taxable income up to ₹ 1.5 lakh in a financial year. This benefit applies to individuals and Hindu Undivided Families (HUFs) who purchase a new residential house, but it is only available under the old tax regime. This deduction should be taken in the year of payment, and the property should be held for at least five years to continue enjoying the deduction. This provision can greatly reduce your tax outgo in a given year in which you purchase a home when put to use in the right way.

Key Benefits & Conditions:

- The maximum deduction is ₹ 1.5 lakh under Section 80C.

- This is only available under the old tax regime.

- Eligible parties include individuals and Hindu Undivided Families (HUFs) who are legal owners of the property.

- Must be applied to new residential property (not resale, land, or commercial property).

- The deduction should be taken in the same financial year in which the payment is made.

- Sale of property within five years of possession should not be done in a bid to reverse benefit.

- In the joint ownership, both the co-owners can deduct what they can claim in the kind of proportion of co-ownership they are registered in their respective limits.

How to Claim the Deduction

- Visit the Income Tax Department of India’s Website and follow the depicted steps.

- Make sure the property lies in and is eligible under section 80C.

- Retain the sale agreement and stamp duty receipts and registration payment.

- Salaried individuals are allowed to provide evidence to the employers to adjust the TDS.

- Deduct it while filling ITR under Schedule VI-A (Section 80C).

There are likelihoods of alterations in tax legislation and eligibility periods; thus, it is always advised to seek the services of a qualified Chartered Accountant or tax specialist when claiming deductions to be eligible and to fill them in correctly.

FAQs

What is the current stamp duty in Thane?

Stamp duty in Thane is 7% for male buyers and 6% for female buyers, including stamp duty, cess, and local body tax. This is the case with most of the residential property transactions.

Do stamp duty and registration charges in Thane vary between under-construction and ready property?

Rates will be the same, but the valuation base might vary in accordance with the stage of construction, the value of the agreement, and the ready reckoner rates applicable.

Is it possible to pay stamp duty and registration charges in Thane Online?

Yes. Filing the stamp duty and registration is done through the IGR Maharashtra portal that provides an opportunity to pay online and book an appointment as well as submit the documents.

What happens if stamp duty and registration charges in Thane are not paid?

Failure to pay stamp duty turns the sale deed into a worthless legal document, and therefore, no legal claim to possession will be received, which can create disputes or punishment.

Do home loans have stamp duty and registration fees?

As a rule, stamp duty and registration fees do not form a part of home loans but are paid by the buyer separately.

Why is understanding the stamp duty & registration important when buying property in Thane?

Stamp duty and registration fees constitute a major part of the overall price of property. Understanding them helps buyers plan finances better, avoid legal issues, and ensure smooth ownership transfer of property in Thane.